JPY flows: JPY firmer after Bessent/Katayama meeting

JPY firmer as Bessent suggests need for tighter BoJ policy

The USD fell back against the JPY overnight and was also slightly weaker against the EUR, although losses against the EUR came in late North American trading, with little net change in Asia. The JPY has benefitted from comments from the US treasury, reporting on Secretary Bessent’s meeting with new Japanese Finance Minister Katayama. The treasury made a statement saying Bessent “highlighted the important role of sound monetary policy formulation and communication in anchoring inflation expectations and preventing excess exchange rate volatility”. The comments were seen as Bessent making the case for faster BoJ rate hikes and a stronger JPY, and the JPY gained some ground in response, with USD/JPY hitting a low at 151.75 before bouncing in late Asian trading. The chance of a BoJ rate hike at this week’s meeting is still priced as less than 20%, but with December also seen as representing less than a 50-50 chance of a hike, there is scope for Japanese yields to rise if Ueda sounds hawkish, even if the BoJ don’t raise rates this week.

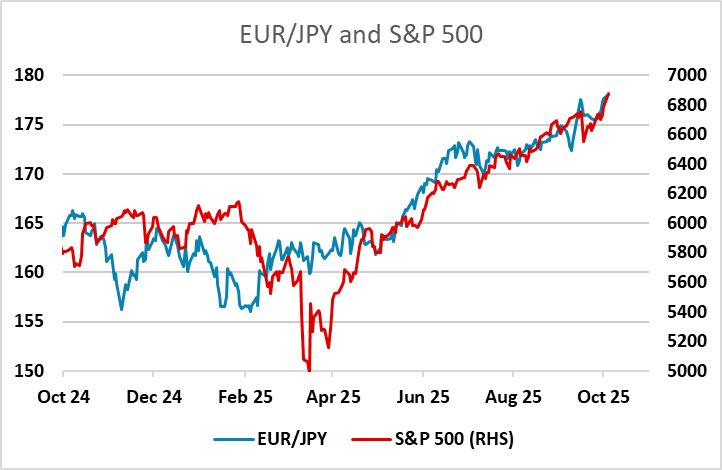

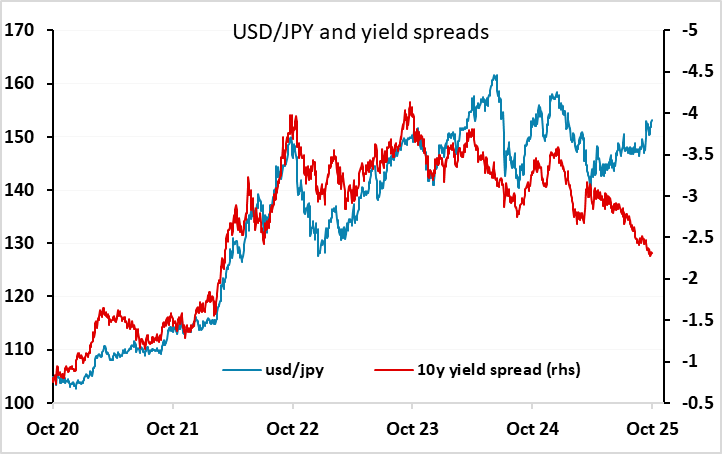

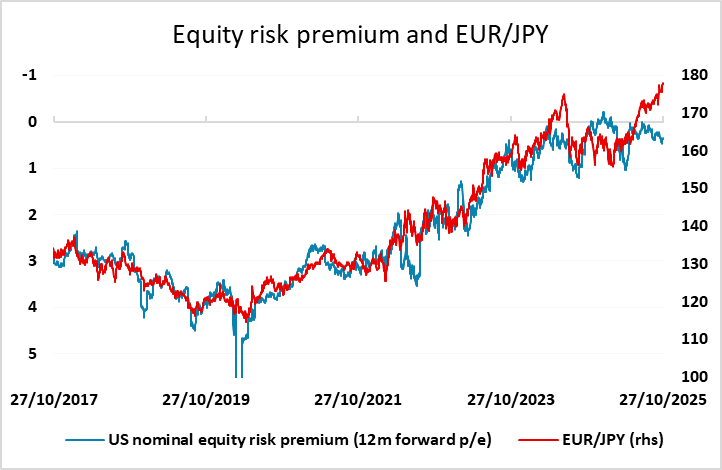

But while BoJ policy news can affect sentiment and have a short term JPY impact, the debate around Japanese monetary policy is of limited significance for the JPY, given that yield spreads have already moved significantly in the JPY’s favour in recent months due to the decline in US yields, without preventing further JPY weakness. We still see a turn in the equity market as likely to be necessary to turn the weak JPY trend, and it is certainly possible that we see a significant correction this week, as the quarterly results of five of the “magnificent seven” are due in the next couple of days, and there is an opening gap in the S&P 500 to fill from Monday morning.