Preview: Due February 18 - U.S. November and December Housing Starts and Permits - Moderately positive picture

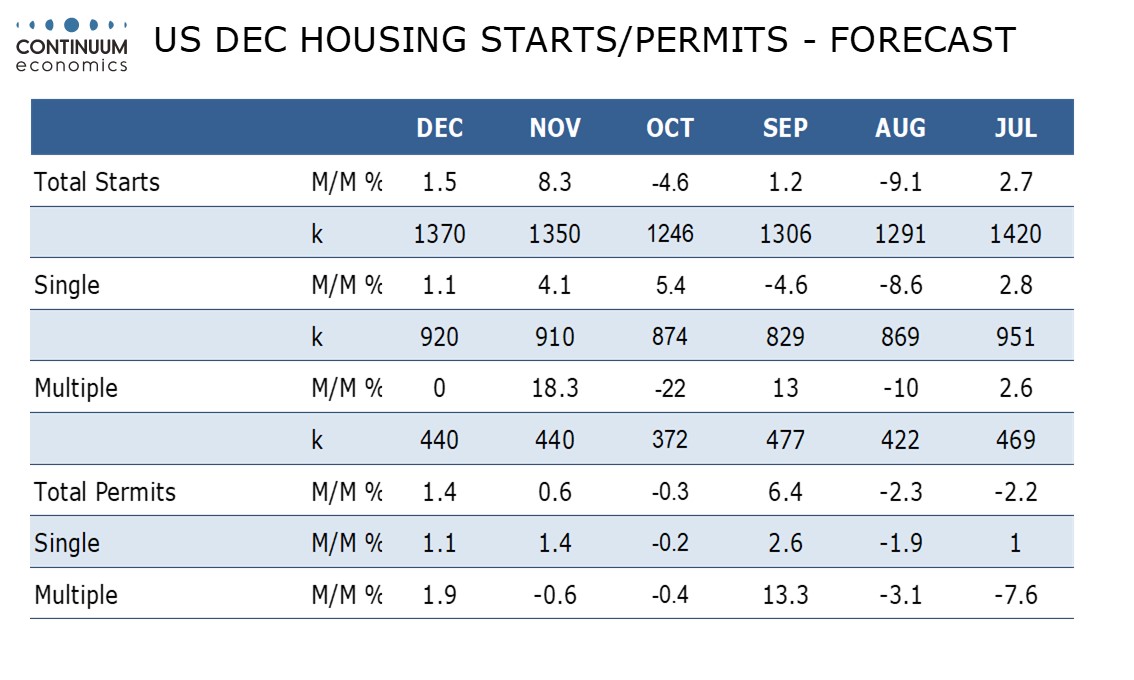

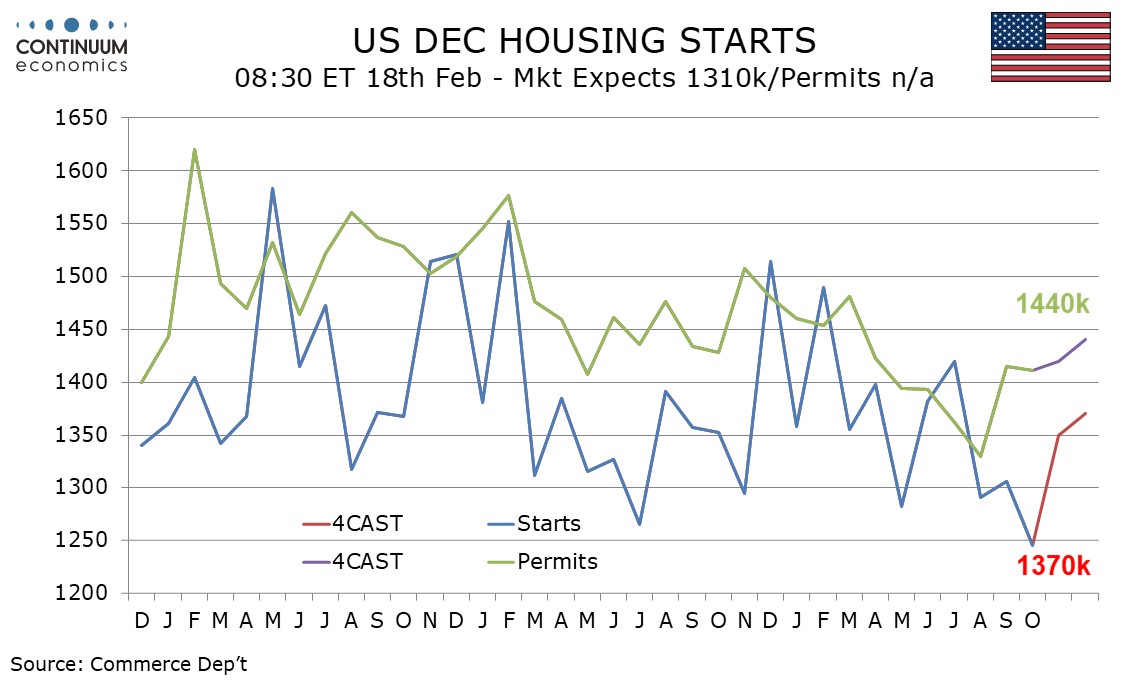

Housing starts and permits data for both November and December are due on February 18. For starts we expect a rise of 8.3% in November to 1350k to follow a decline of 4.6% in October, with a more moderate 1.5% increase to 1370k in December. For permits we expect moderate gains of 0.6% in November, to 1420k, and 1.4% in December, to 1440k.

The housing sector picture generally picked up moderately in Q4, assisted by Fed easing, though non-farm payroll details were more constructive for construction in November than December. New home sales data is available only through October, with November and December data due on February 20.

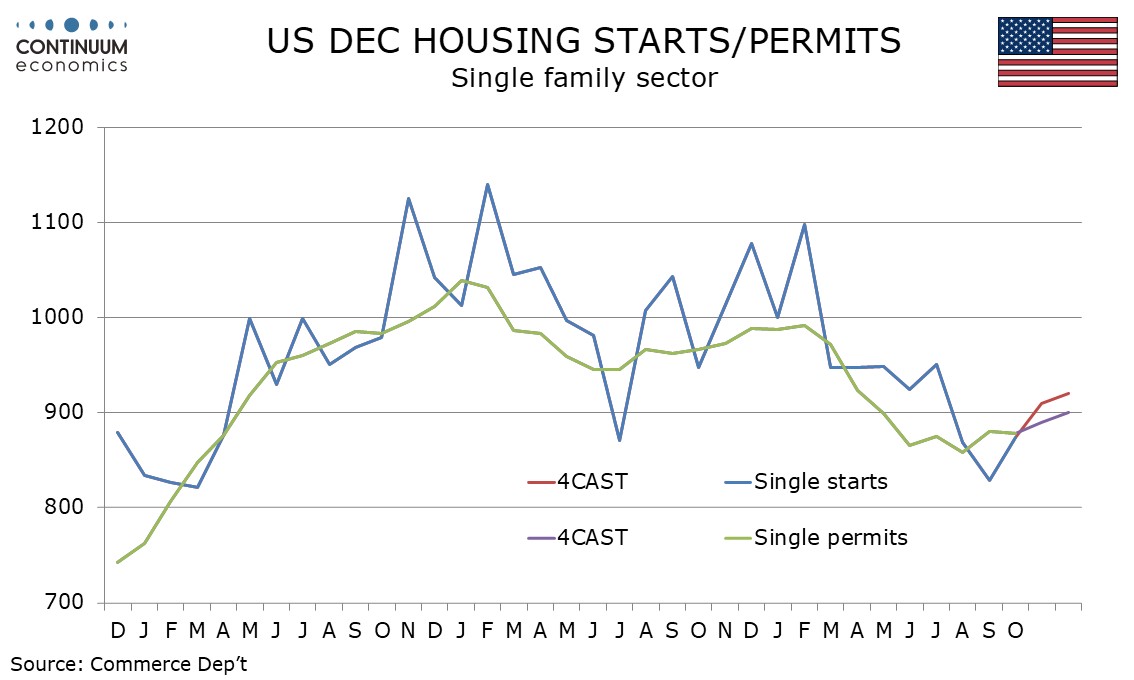

October’s slippage in starts came fully in multiples with single starts picking up from two straight declines. There is scope for single starts to extend the bounce in November, we expect by 4.1%, before a more moderate 1.1% increase in December. For single permits we expect moderate gains of 1.4% in November and 1.1% in December after a moderate drop of 0.2% in October.

We expect multiple starts to see a strong 18.3% bounce in November after a 22.0% drop in October before pausing at November’s level in December. For multiple permits we expect November to see a second straight marginal decline, by 0.6% following a strong September, before a moderate 1.9% increase in December. Monthly volatility is difficult to predict over two months but a moderately positive underlying picture should be implied.