U.S. February Consumer Confidence - Some are very pessimistic, particularly on inflation

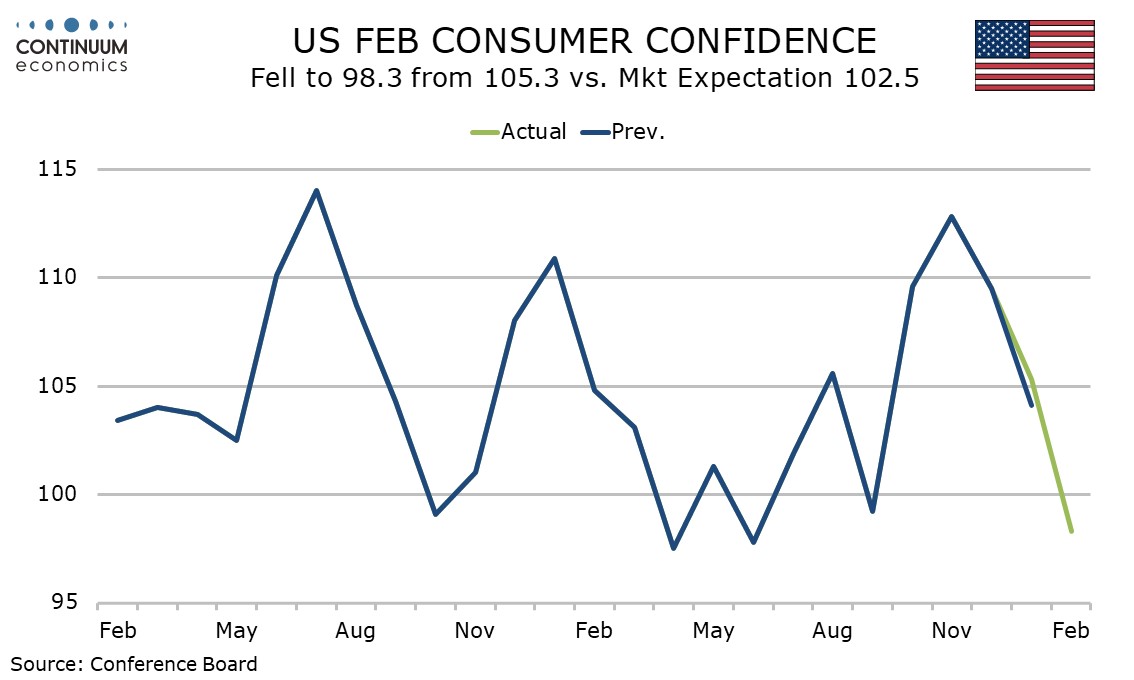

February consumer confidence at 98.3 from 105.3 is the weakest since June and near the bottom of the recent range. The fall was led by expectations, with a substantial proportion of the population clearly concerned over the outlook under Trump, with a rise in inflation expectations particularly notable.

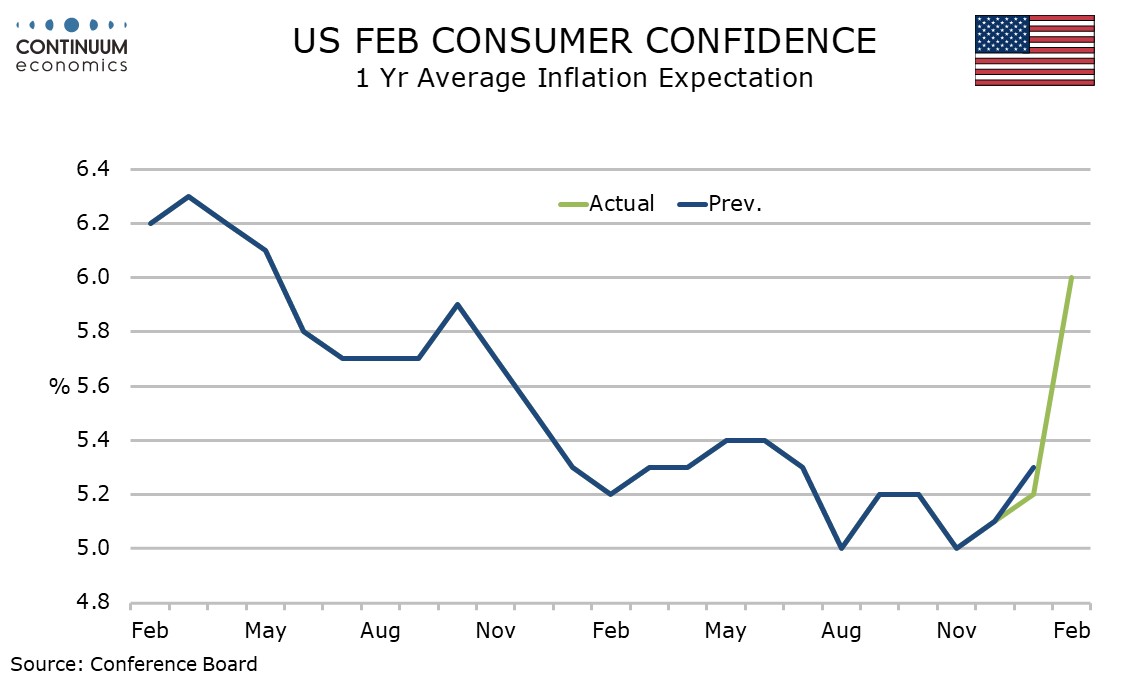

The average inflation expectation over the next twelve months has risen to 6.0% from 5.2%, though the acceleration in the median to 4.8% from 4.2%, while significant, is less extreme.

Respondents generally have strong political biases, but Republican optimism on inflation probably has a floor near zero, while Democratic pessimism probably has little upside, with a few extreme pessimists likely to be lifting the average well above the median.

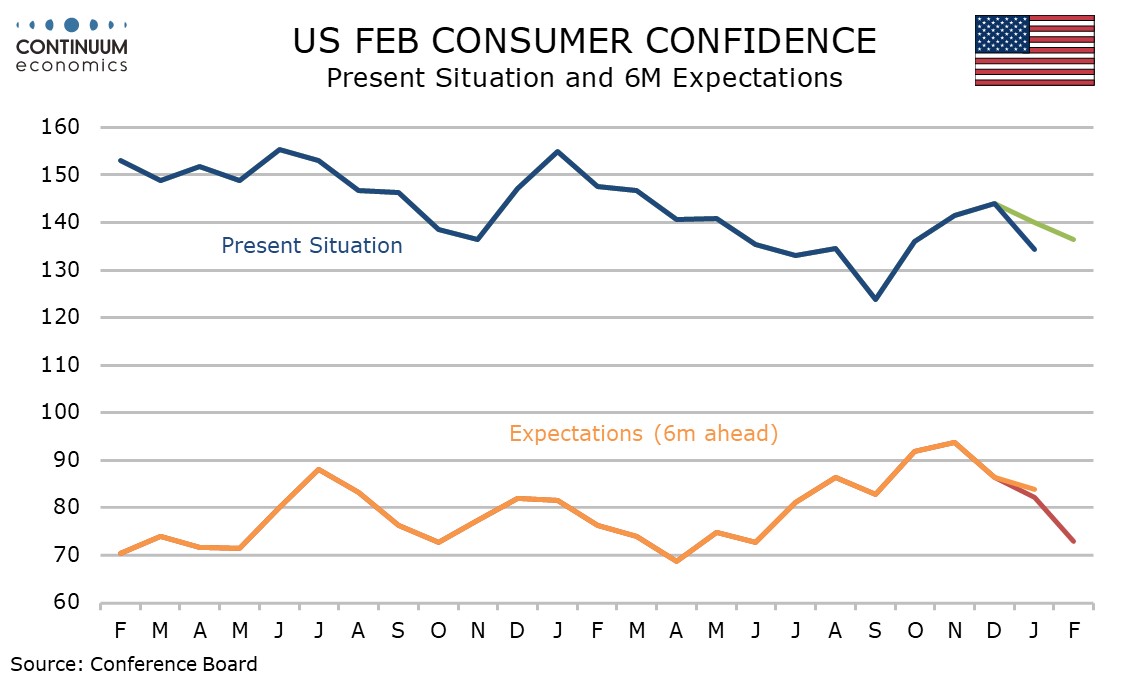

The dip in the present situation index to 136.5 from 139.9 was quite modest, with the index still well above September’s 123.8. The expectations index of 72.9 from 82.2 is the lowest since June.

Normally after elections optimism from the winning side tends to outweigh pessimism from the losers, while Republicans have tended to react more strongly to changes in administrations. This time however, Democrats appear to have become very pessimistic indeed. It should be noted that many of their reasons for pessimism are on issues with tenuous economic implications.

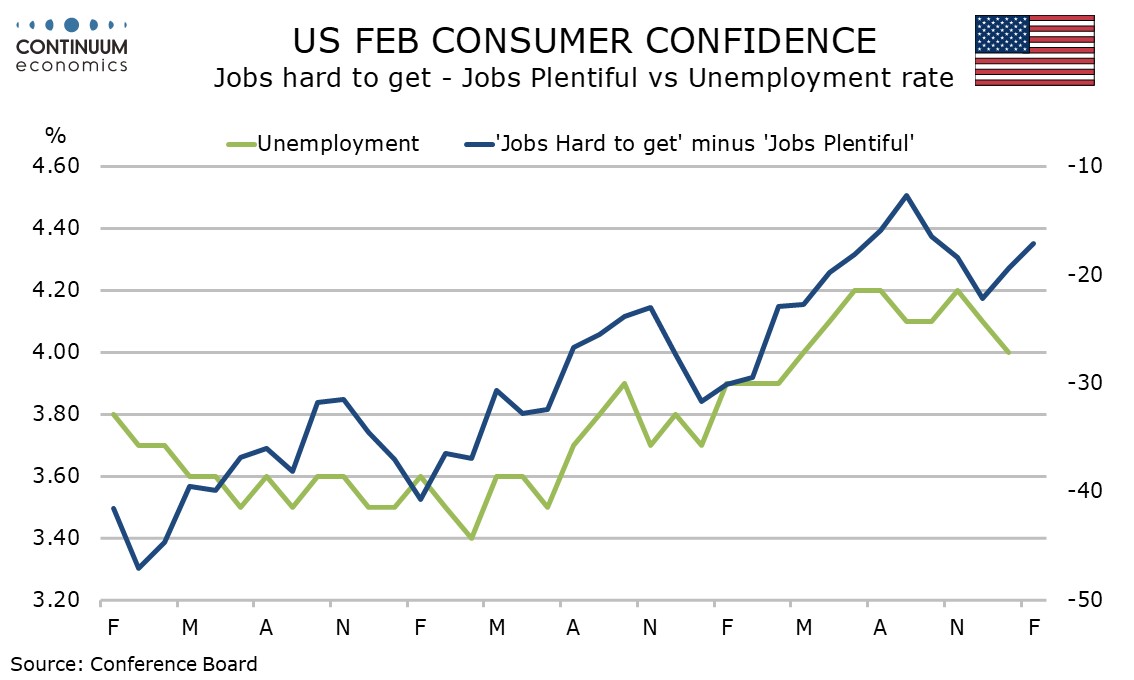

Respondents are a little less positive on the labor market, with those seeing jobs as plentiful exceeding those seeing them as hard to get by 17.1%, down from 19.4%. This is the weakest since October and consistent with a recent acceleration in the labor market losing momentum, but is a long way from being a recessionary signal.