USD flows: Mild recovery on employment report, but risks remain

US emloyment report modestly stronger than expected, but of limited significance

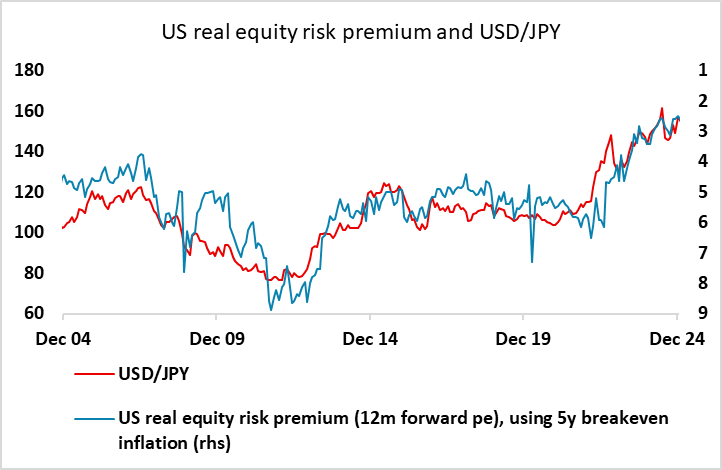

Although the employment report showed a larger rise in non-farm payrolls than expected in March, the miss was only 43k net of downward revisions, and with the unemployment rate rising slightly and average earnings growth a little lower than expected on a y/y basis, the report as a whole wasn’t significantly stronger than expected. The USD and equities have edged up slightly on the news, with US yields also slightly higher, but the focus is much more on whether the US economy will be able to sustain a strong labour market in the face of the US tariff increases, the retaliation that is coming from abroad, and the negative market reaction to all of it. This month’s numbers are therefore not hugely relevant, and while there might be some mild corrective gains for the USD and equities into the end of the week, the fact that the US equity market remains expensive in the face of concerns about a potential recession means that further declines look very likely unless we see some reversal of Trump’s tariff policies.