AUD, GBP, NOK flows: Risk negative start to the week

Risky currencies dip as Asia equities slip ahead of European open. AUD and NOK weakness looks overdone

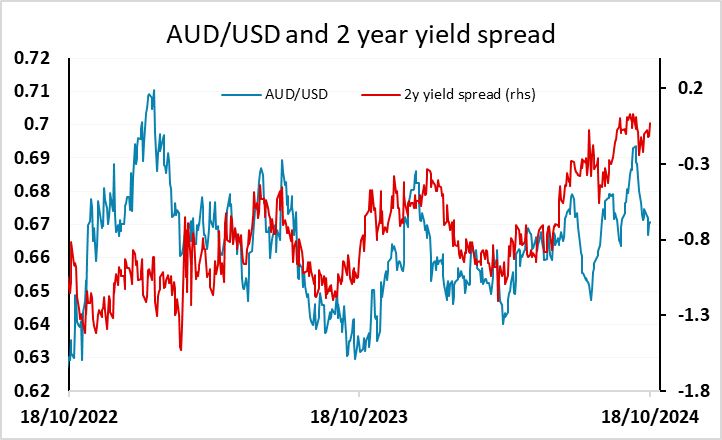

A typical data light start to the week, with very little of note on the calendar. However, there is a risk negative tone to early trading, with Asian equities falling back in the run up to the European open, and the AUD in particular suffering as a result. This follows a relatively strong AUD performance in Asia, helped by comments from the RBA deputy governor saying he is surprised by strong employment growth and monetary policy is ready to respond in either direction. We still see upside scope for the AUD, but there remains a drag from concerns about China slowdown, which have only been partially addressed by the stimulus measures announced in the last few weeks.

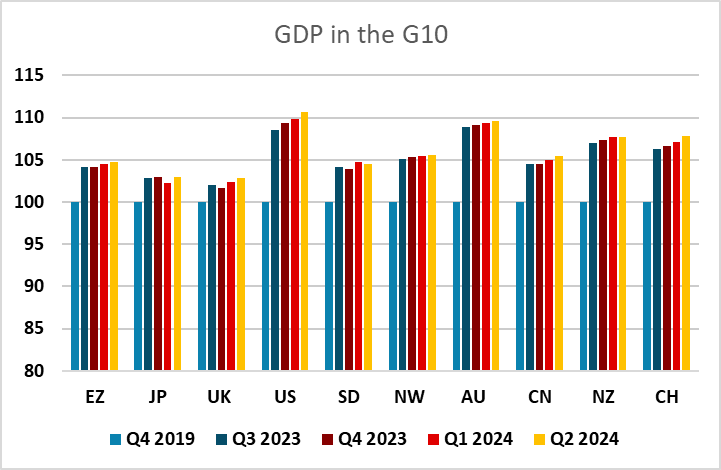

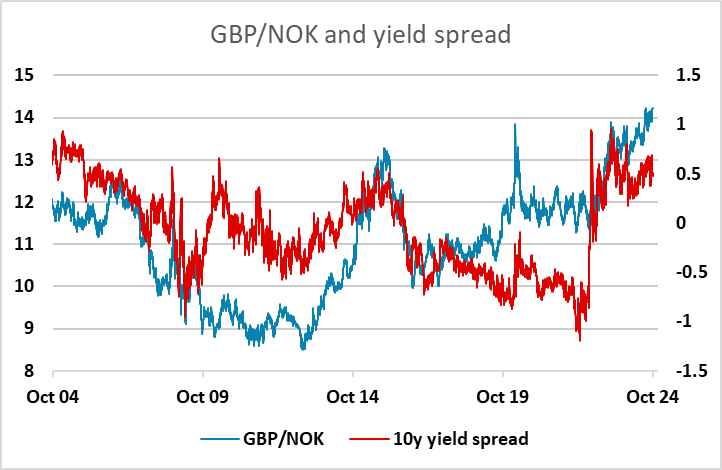

The more risk negative tone is also weighing slightly on European currencies, with the scandis in particular under pressure. The NOK remains puzzlingly weak, failing to benefit from relatively tight Norges Bank policy despite a fairly solid economy. Conversely, GBP remains relatively firm, benefiting from the relatively tight BoE policy and relatively high UK yields, helped by the better UK economic performance this year. However, the UK is still a big underperformer relative to pre-pandemic levels, and the NOK’s weakness looks hard to justify, especially if the BoE is turning more dovish.