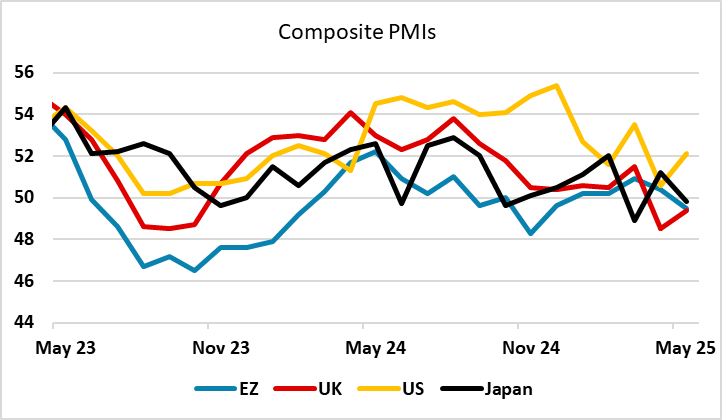

USD flows: USD gains some support from PMIs

Better US PMIs push the USD higher

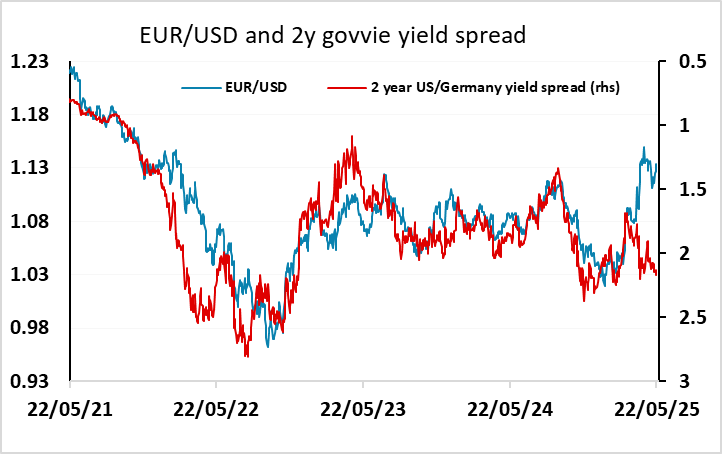

A stronger than expected US PMI has given the USD a lift early in the US session, following the weaker than expected European PMIs earlier. While the correlation between US yields and EUR/USD has broken down in recent weeks, relatively stronger US activity data will still tend to support the USD and reduce the USD risk premium. Higher yields based on higher inflation or concerns about the US budget are more likely to push the USD lower, but stronger activity data should be supportive. If concerns about the impact of tariffs on the economy wanes, there is plenty of scope for EUR/USD in particular to decline, as European currencies have been the biggest beneficiaries of the loss of confidence in the USD. The bottom of the EUR/USD range is below 1.11, so still some way away and unlikely to be threatened near term, but there is scope for some short term slippage to 1.12.