This week's five highlights

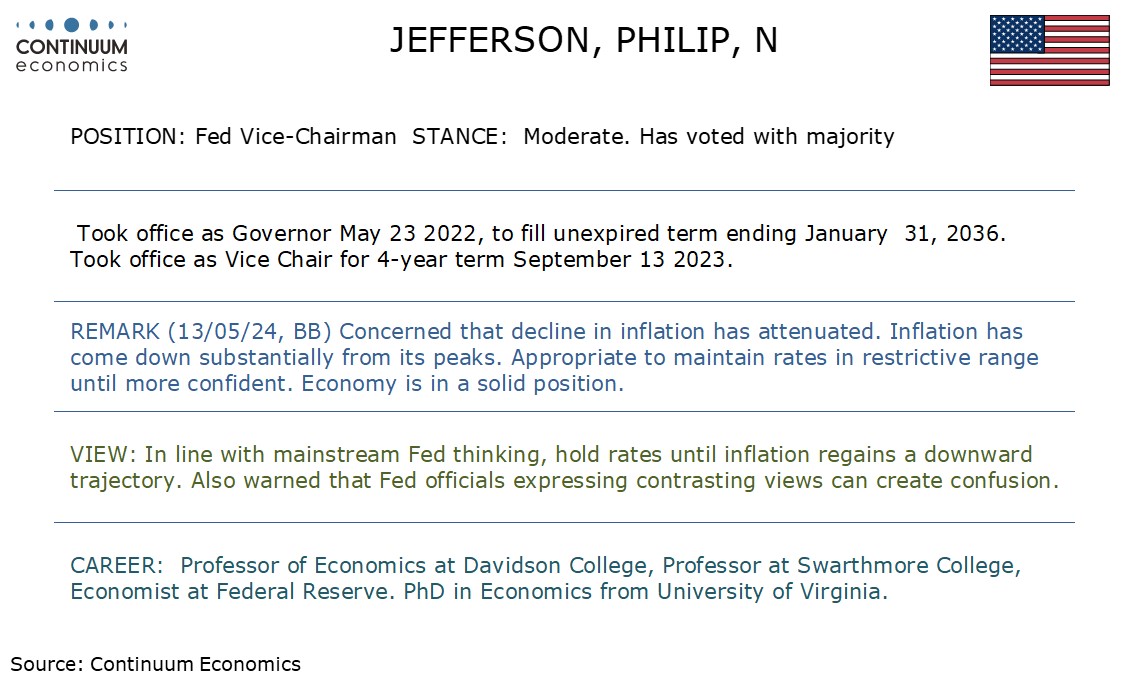

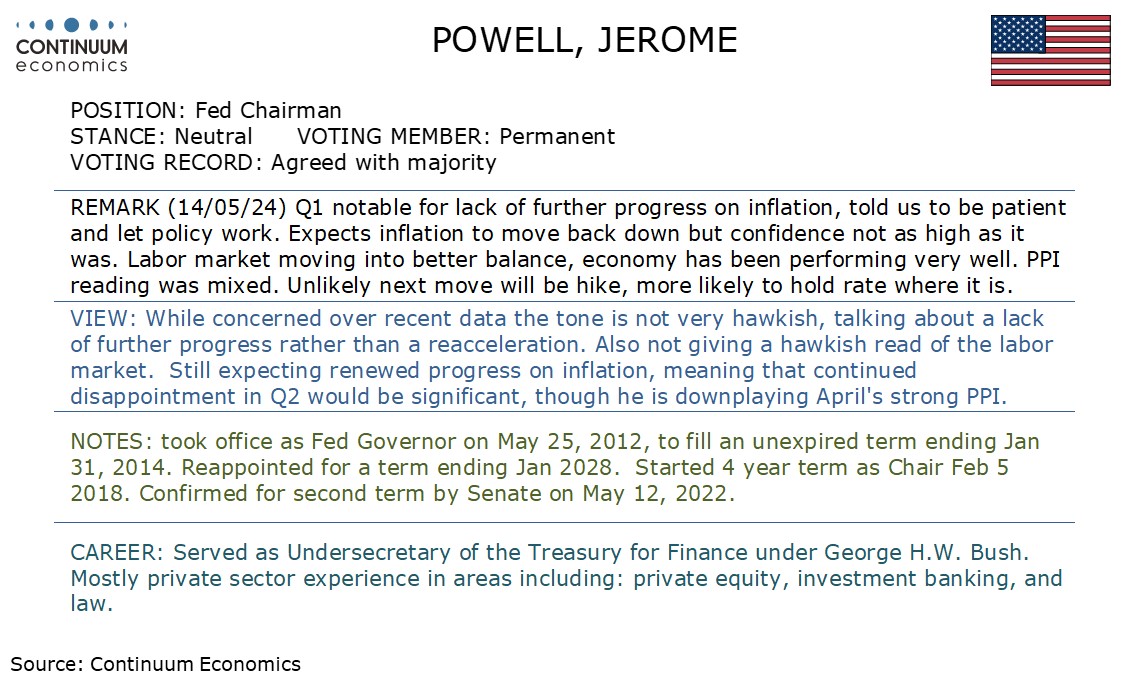

This Week's Fed Speaker

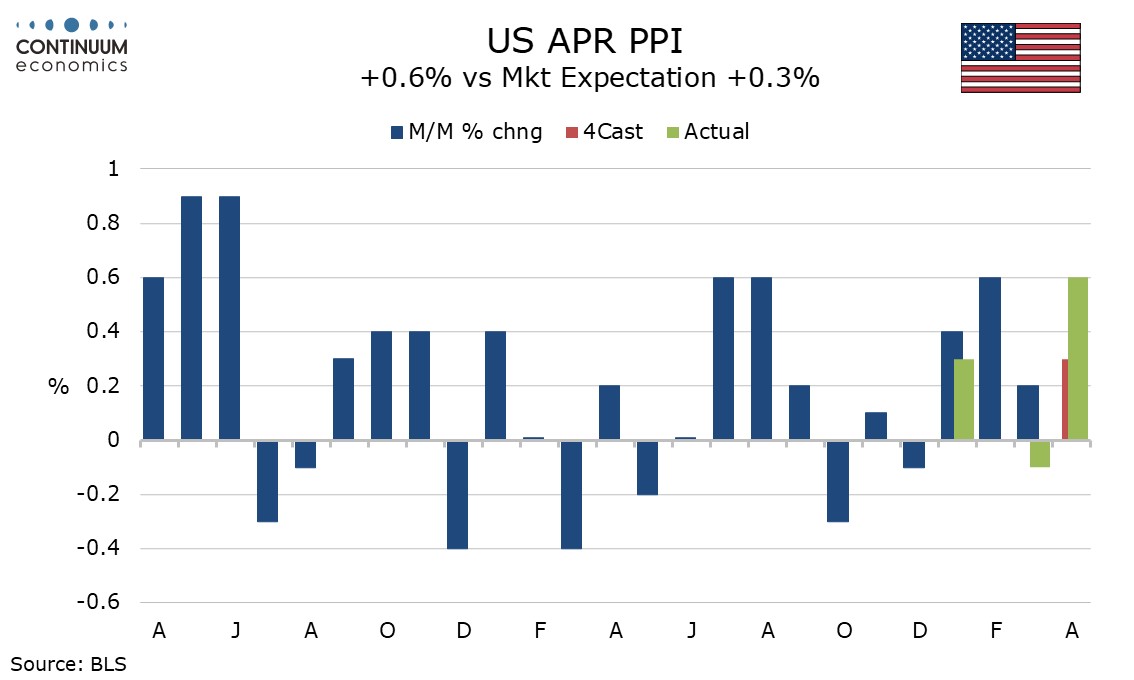

U.S. April PPI Demonstrates Worrying strength

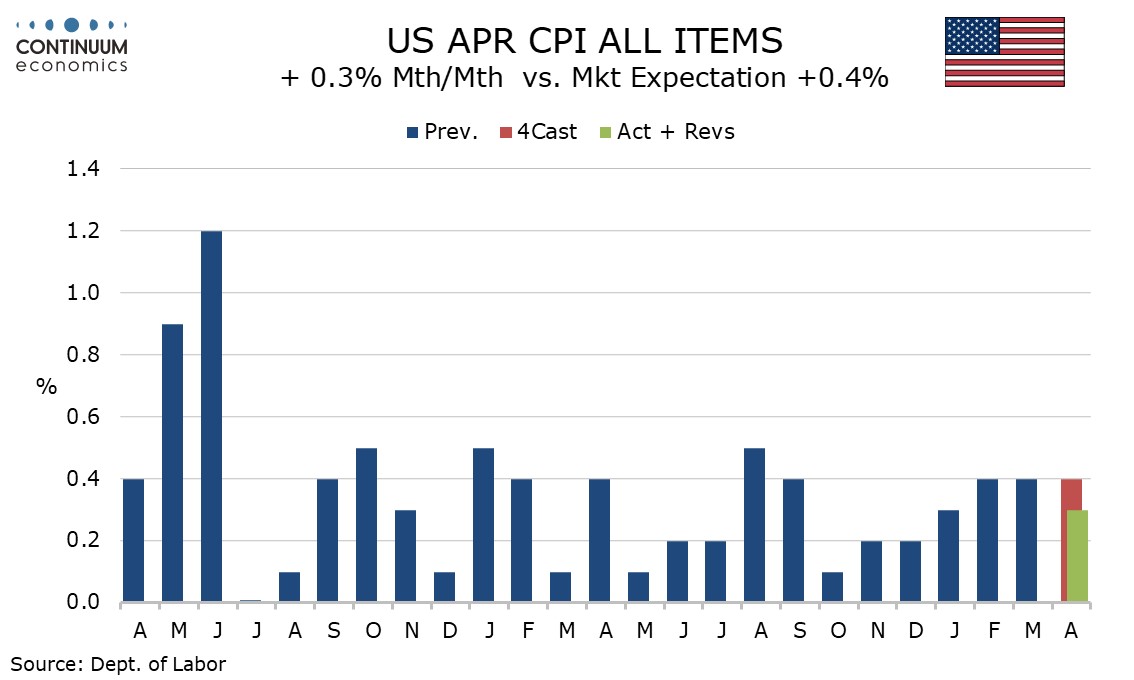

But U.S. CPI and Retail Sales are Seeing Some Loss of Momentum

UK Labor Market Shows Further Signs of Resilient Wage Pressure

Lopsided Growth and New Housing Measures For China

April PPI surprised on the upside with gains of 0.5% overall and ex food and energy, with ex food, energy and trade up by 0.4%. The upside surprise is however largely offset by downward revisions to March, both overall and ex food and energy to -0.1% from +0.2%, though March ex food, energy and trade remained unrevised at +0.2%. Yr/yr PPI at 2.2% was as the market expected with March revised down to 1.8% from 2.1%, while yr/yr ex food and energy at 2.4% was up from March’s 2.1% only because March was revised down from 2.4%. Ex food, energy and trade however the April gain of 3.1% versus 2.8% in March is a 12-month high.

Monthly detail shows a 2.0% rise in energy outweighing a 0.7% drop in food, while goods ex food and energy with a 0.3% rise rebounded from a flat April. Services with a 0.6% increase are the strongest since July 2023 but with mixed detail. Trade with a 0.8% increase corrected a 1.0% March decline but transport and warehousing at -0.6% was the weakest since May 2023. Other services were strong at +0.8%.

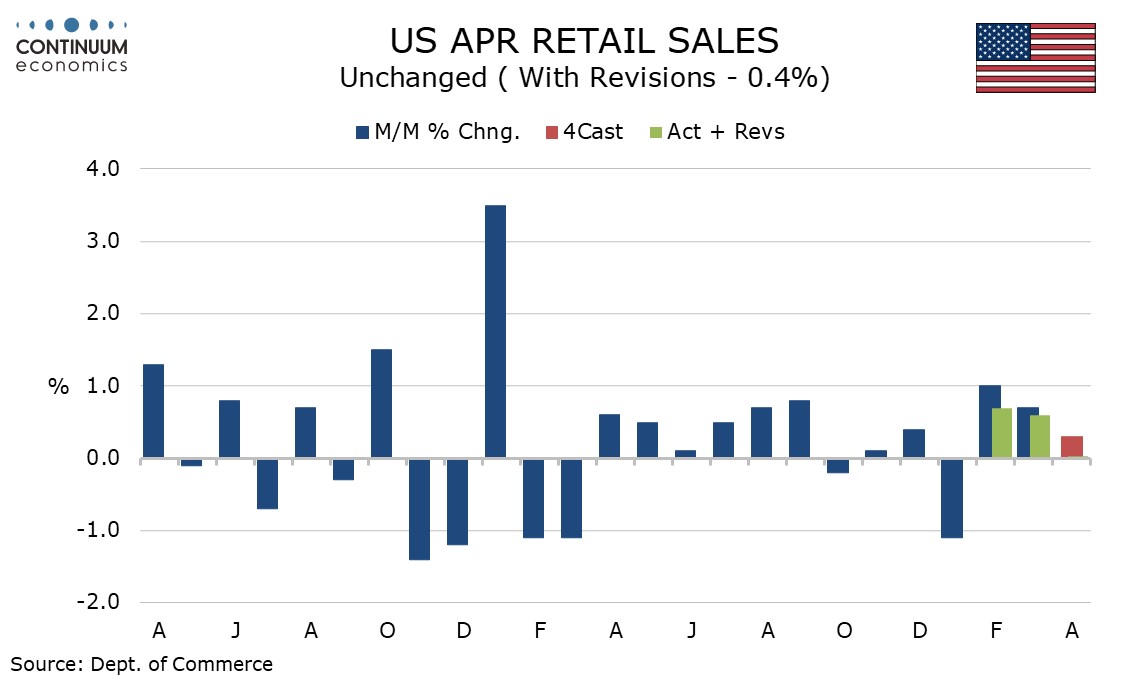

April CPI has provided some relief by coming in lower than expected at 0.3% on the headline and while the 0.3% core is on consensus, it is on the soft side at 0.292% before rounding. Retail sales have also lost some momentum in April, unchanged overall, up 0.2% ex autos but down 0.1% ex autos and gas. The CPI is still higher than the Fed would like, but yr/yr growth is slowing, the headline to 3.4% from 3.5% and the core to 3.6% from 3.8%, reaching its lowest since April 2021. Overall CPI rose by 0.313% before rounding with energy up by 1.1% but food unchanged. Commodities less food and energy fell by 0.1% despite apparel rising by 1.2%, the strongest of there straight gains which looks unlikely to extend much further. New vehicles at -0.4% and used vehicles at -1.4% were increasingly negative. There were several other negatives in the commodities breakdown.

April retail sales followed a strong March with an unchanged outcome, while March was revised to a 0.6% rise from 0.7% and February saw a more significant downward revision to 0.7% from 1.0%. Given that January saw a weather-depressed 1.1% decline momentum over the four months looks quite modest, though 3 month/3 month rates are positive again as the weak January drops out. Ex-auto sales rose by 0.2% after a 0.9% rise in March and sales ex autos and gasoline fell by 0.1% after a 0.7% rise in March. The early Easter may have inflated March and restrained April though seasonal adjustments do attempt to adjust for the timing of Easter.

Figure: Wage Resilience Evident Across Range of Measures

As we have underscored repeatedly, the BoE has come to regard the official ONS average earnings data with some suspicion given response rates to the surveys that have fallen towards just 10%. But the BoE will not be able to dismiss the latest earnings data given that alternative (and more authoritative) wage data from the HMRC (the UK tax authority) are also showing similarly resilient growth in mean and median pay as you earn (PAYE) growth (Figure). But this PAYE data also chimes with weaker activity backdrop highlighted by the ONS which showed a marked fall in vacancies alongside increased signs of employment contracting and not just in terms of self-employment. Notably, the jobs data conflict with the headline pick-up in Q1 GDP growth, albeit more in line with the soggy domestic demand picture those national account data nevertheless highlighted. As a result, it can be argued that weaker jobs may take a toll on wage growth in due course, this coming alongside the marked base effects that would curb such growth in coming months including the next set of labor market numbers that arrive a full week ahead of the June 20 MPC decision.

Resilient wage data may take center stage in any assessment of the latest UK labor market report. Headline earnings stayed at a higher-than expected 5.7% y/y in March with regular earnings ticking higher to 6.2%, albeit with the Q1 reading largely in line with the 6% BoE projection. More recently, the ONS data, (handicapped by severe reservations about their authenticity due to poor survey take-up) have contrasted with PAYE data which have shown softer and slower growth in wages. This no longer seems to be the case (Figure 1) where median pay data actually hinting at some pick-up. The question is whether this is a fresh trend or more noise, possibly accentuated by the looming rise in the minimum wage.

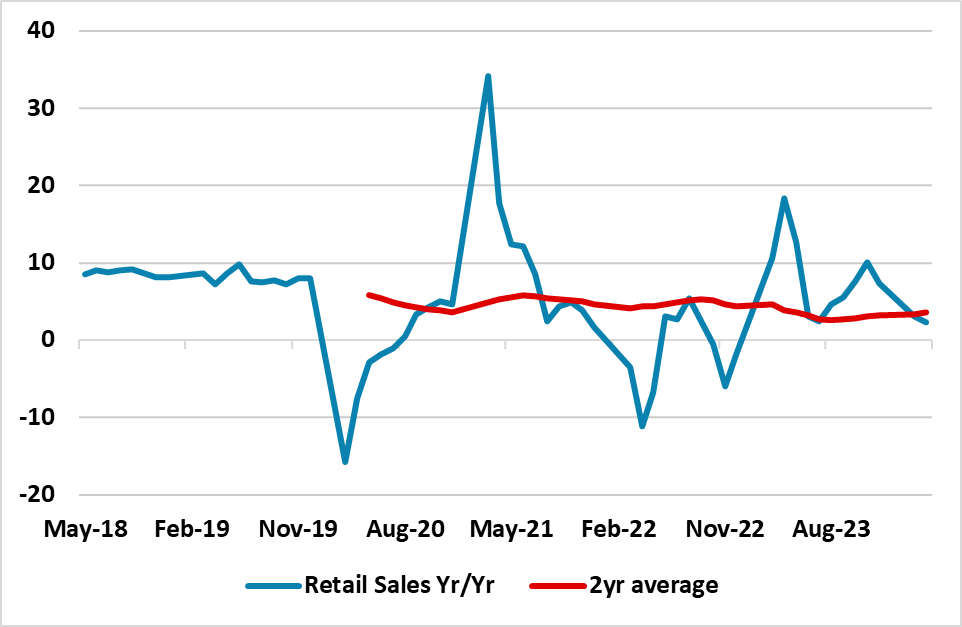

Figure: Retail Sales and 2yr average (Yr/Yr %)

Overall, the April industrial production suggests Q2 GDP should be reasonable, but weak retail sales suggests H2 2024 can be disappointing. We stick with a 4.6% forecast for 2024 GDP growth. The latest monthly figures show lopsided growth into April. Industrial production rose a larger than expected 6.7% Yr/Yr, with a 1.0% jump on the month. In contrast, retail sales was poor at a below consensus 2.3% Yr/Yr and after the soft 3.1% in March. The flat profile on the month shows a worrying trend, as the breakdown of the retail sales data shows that weakness was not concentrated but in a number of sub categories. The 4.5% contraction in construction material is to be expected given the weakness in residential housing investment. However, catering slowed to +4.4% Yr/Yr suggesting that the post COVID boom in eating out is slowing. The contrast between good industrial production and weak retail sales is most evident in cars. Car production surged to +16.3% Yr/Yr, but car purchases in the retail sales numbers were -5.6% Yr/Yr. Now export of cars can account for some of the difference, but the U.S. and soon the EU are increasing tariffs on electric vehicles from China. Some car production could soon be going into inventories, which cuts future car production growth plans!

The production surge helps to keep momentum towards hitting the 5% growth target for 2024, with high tech production up 11.3% Yr/Yr. However, underlying momentum in H2 depends on domestic demand and exports. The retail sales and residential investment numbers point to weak demand outside of public consumption and investment. Meanwhile, though exports are improving Yr/Yr, exports and net exports are still likely to be a flat contribution to GDP in 2024.

China authorities also announced extra housing measures today. The most important is the instruction to local government to purchase excess housing inventory and turn it into affordable housing, after a pilot in Hangzhou. This is an important move if it is large scale across the country, as it could be key signal to stabilize household and developers attitudes towards property and lessen the drag from housing construction. However, we need more details, with some estimate in the property sector that up to 5mln unsold apartments need to be bought (circa Yuan2trn, but the sum would go down through time if some were sold at a later date as occurred with NAMA in Ireland). For now we are not going to revise up our negative outlook on housing, as population aging means less demand for housing and property developers are weak (the authorities should nationalization most of the sector). The authorities also reduced the deposit for 1 time buyers to 15% and removed the floor on mortgage rates, which are helpful but not as important as removing excess inventory.