EUR/NOK, EUR/CHF, CHF/JPY flows: NOK up on Norges Bank hike, CHF vulnerable vs JPY

NOK gains strongly after surprise Norges Bank rate hike. CHF lower after SNB turns more dovish.

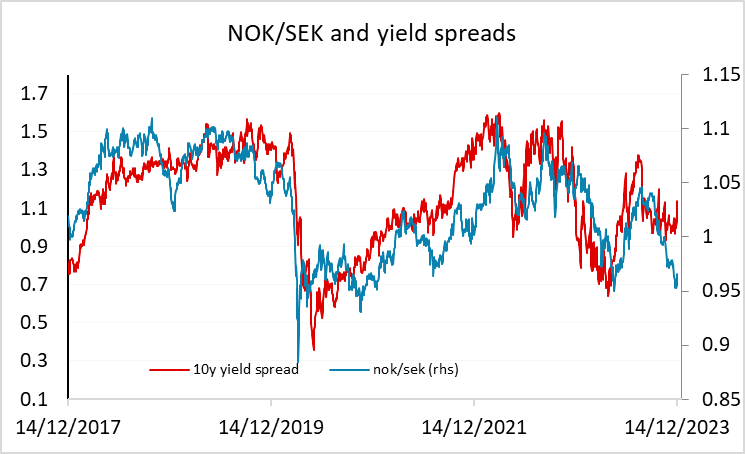

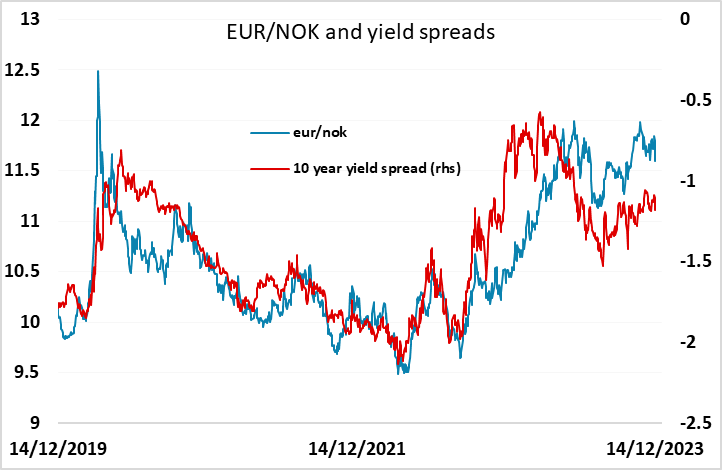

Norges Bank has surprised with a 25bp rate hike to 4.5%. The market consensus was for rates to be left unchanged at 4.25%, but it was a close call, with around 40% of forecasters calling for a hike. EUR/NOK lost around 1% on the news, but was already significantly lower from yesterday, having fallen more than 1% from 11.80 at the close in Europe yesterday to 11.67 ahead of the announcement. Thus far, there hasn’t been much impact on Norwegian yields, but we would expect the NOK to at least hold onto gains, having underperformed in recent weeks against the SEK and in recent months against the EUR.

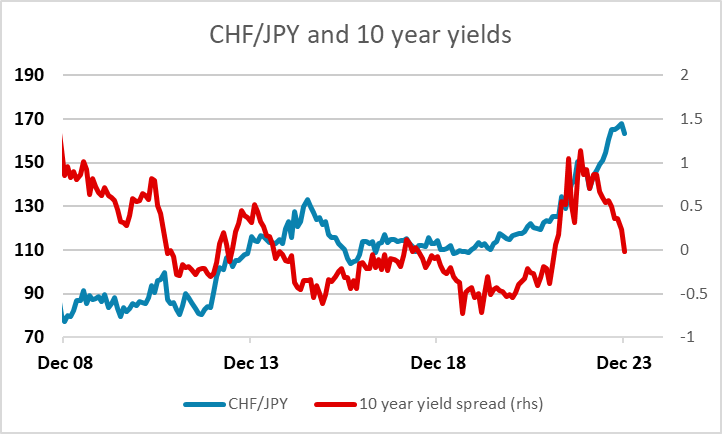

The SNB has left rates unchanged but their tone has turned clearly more dovish with the tightening bias gone, FX sales toned down and marked undershoot of inflation target in medium term. EUR/CHF initially spiked a little higher, but has subsequently slipped back. Still, after trading its lowest since the 2015 spike last week, we see little reason for any downside in EUR/CHF but we still see CHF/JPY as the most attractive trade, with JPY 10 year yields now above CHF 10 year yields and CHF/JPY still 30% higher than it was last time this was the case back in January 2022.