USD flows: USD initially rises slightly on weak UMich survey, but...

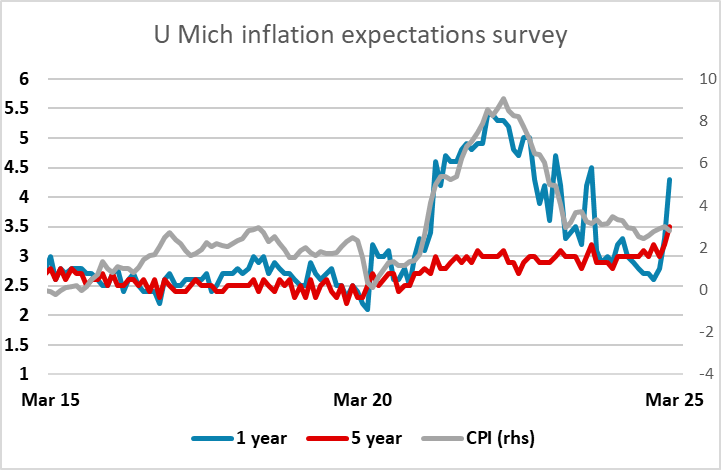

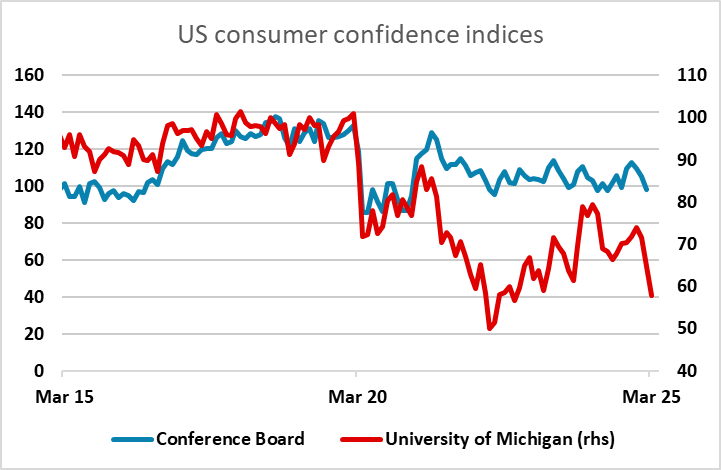

The University of Michigan confidence surey for March makes worrying reading with inflation expectations rising strongly again and confidence weakening further. Initial USD gains may not hold

A very bad University of Michigan survey has seen a further sharp decline in confidence and a further sharp rise in inflation expectations. The USD has actually risen slightly after the data, perhaps driven by the higher yields that have resulted from the increase in inflation expectations. So far, the equity market reaction has been only mildly negative, but there is potential for a more negative reaction. It isn’t clear what the Fed reaction would be to the combination of weaker growth and higher inflation, but the recent comments have suggested the Fed wouldn’t necessarily respond with rate hikes to tariff induced inflation if growth was weakening. If the equity market was also suffering, the risks to yields might be to the downside, so we wouldn’t trust the initial USD positive reaction.