NOK flows: NOK firmer after higher CPI

NOK makes some gains after CPI comes in above expectations, but scope for much larger recovery

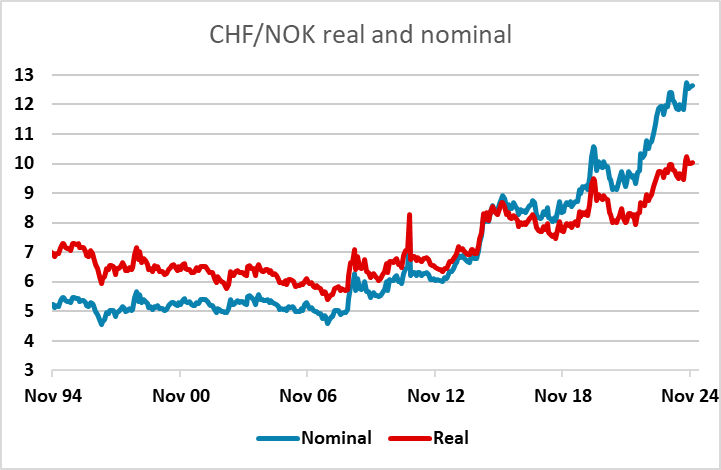

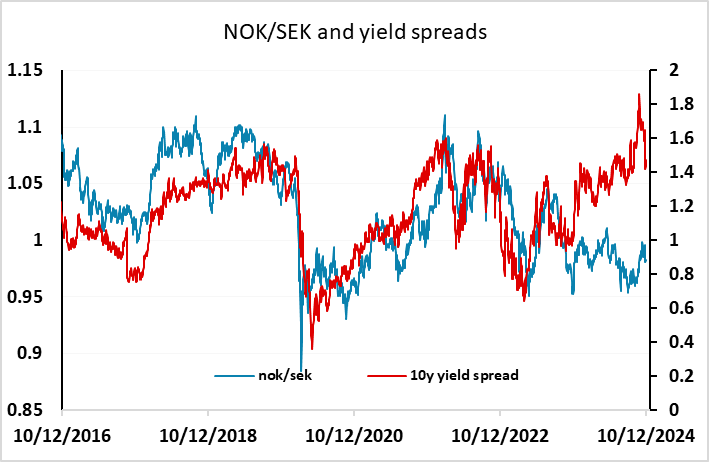

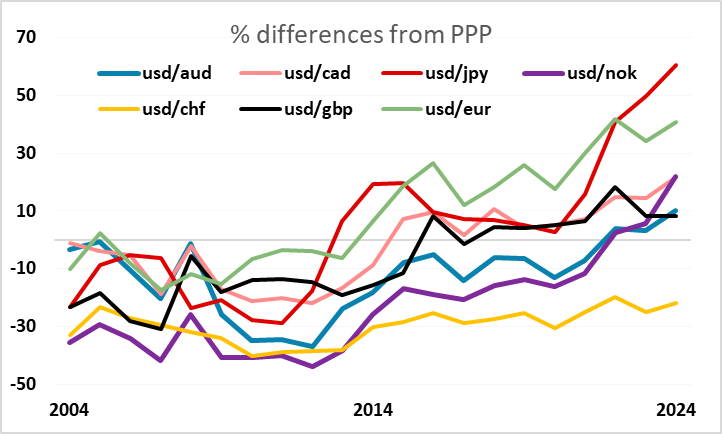

This morning’s Norwegian CPI data has come in stronger than expected at 3.0% y/y for the core, triggering general NOK gains. These gains are so far quite modest, but we see scope for the NOK to extend gains against the SEK to retest parity before the end of the year, and for EUR/NOK to move back down to 11.50. The NOK has remained weak through most of this year, underperforming the EUR and SEK, but for no good reason that we can see. Valuewise, it was one of the world’s strongest currencies 10 years ago, rivalling the CHF, reflecting its huge oil wealth, large current account surplus and comfortable budget position. These fundamentals haven’t really changed significantly even though much of the current account surplus now comes from foreign investments rather than oil and gas, but the NOK has fallen dramatically in recent years, underperforming everything except the JPY, and is now only stronger than the JPY and EUR among the G10 currencies relative to PPP. This is despite the fact that yields remain relatively attractive.

The weakness of the NOK puzzles Norges Bank as much as it puzzles us, but we doubt it can continue indefinitely. The stronger inflation numbers mean that Norges Bank will remain relatively hawkish and we see scope for sustained gains against a range of currencies, with value most obvious against the SEK, and CHF.