EUR, USD flows: EUR not much changed after ECB but USD likely to stay soft

ECB cuts as expected, removes reference to restrictive policy. USD still at risk due to high level and rising uncertainty on US economic prospects

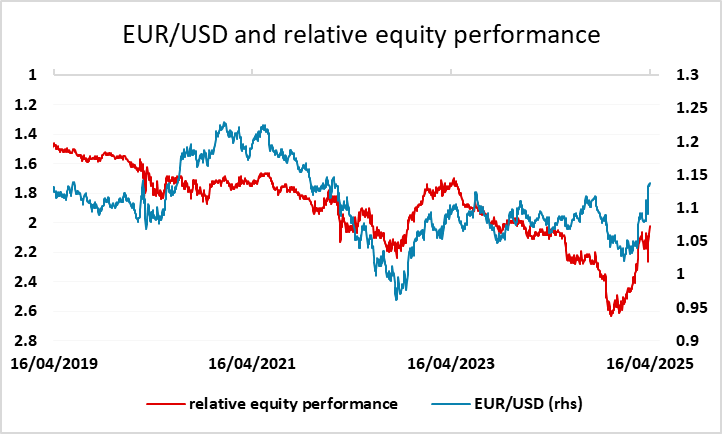

No major surprises from the ECB or the US data. The ECB cut rates as expected but has dropped the statement that monetary policy is restrictive, which isn’t a surprise after the cut. It stresses that “especially in current conditions of exceptional uncertainty, it will follow a data-dependent and meeting-by-meeting approach to determining the appropriate monetary policy stance”. The market is still pricing a further 57bps of cuts this year, with another cut in June still seen as more likely than not at around a 65% chance. EUR yields are not much changed, but the EUR is mildly softer. There is likely to be some consolidation around current levels in EUR/USD until there is more clarity on the path of the US and European economies, but we favour the EUR upside medium term as the market is losing confidence in US outperformance and is starting from an overweight position in relatively expensive equities and a high level of the USD.

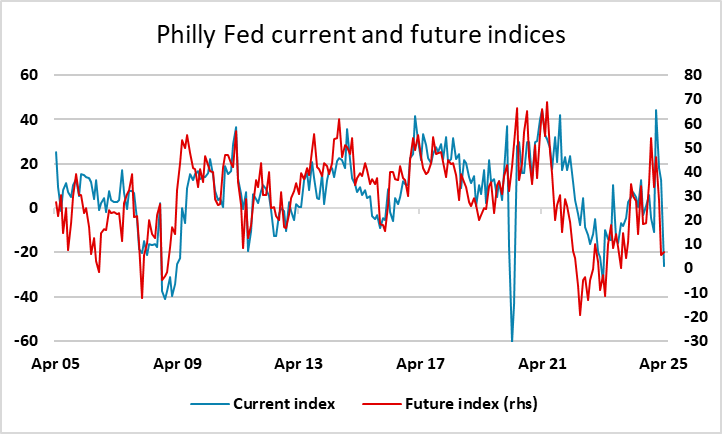

The US jobless claims data continues to suggest a solid labour market for now, but the Philly Fed manufacturing survey showed a sharp decline, no doubt reflecting concern about the impact of tariffs. This ends to support a USD negative view, particularly against the safer havens, although in the run up to the long Easter weekend there may not be much interest in extending short term short USD positions.