U.S. January Industrial Production - Cold weather hitting January data

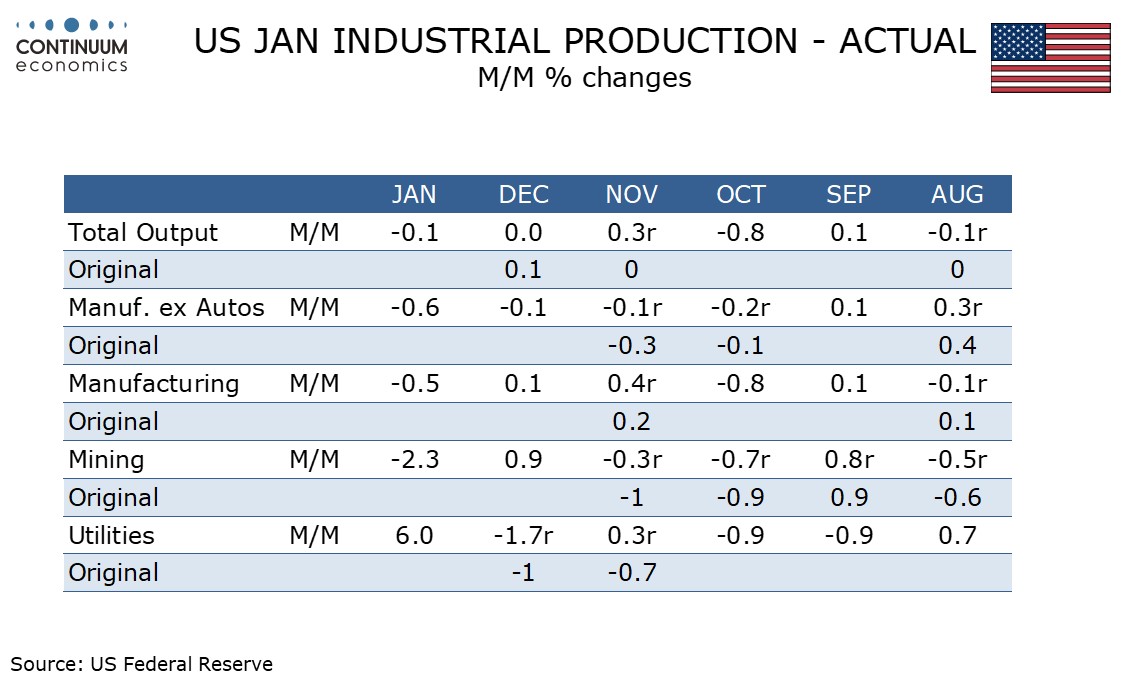

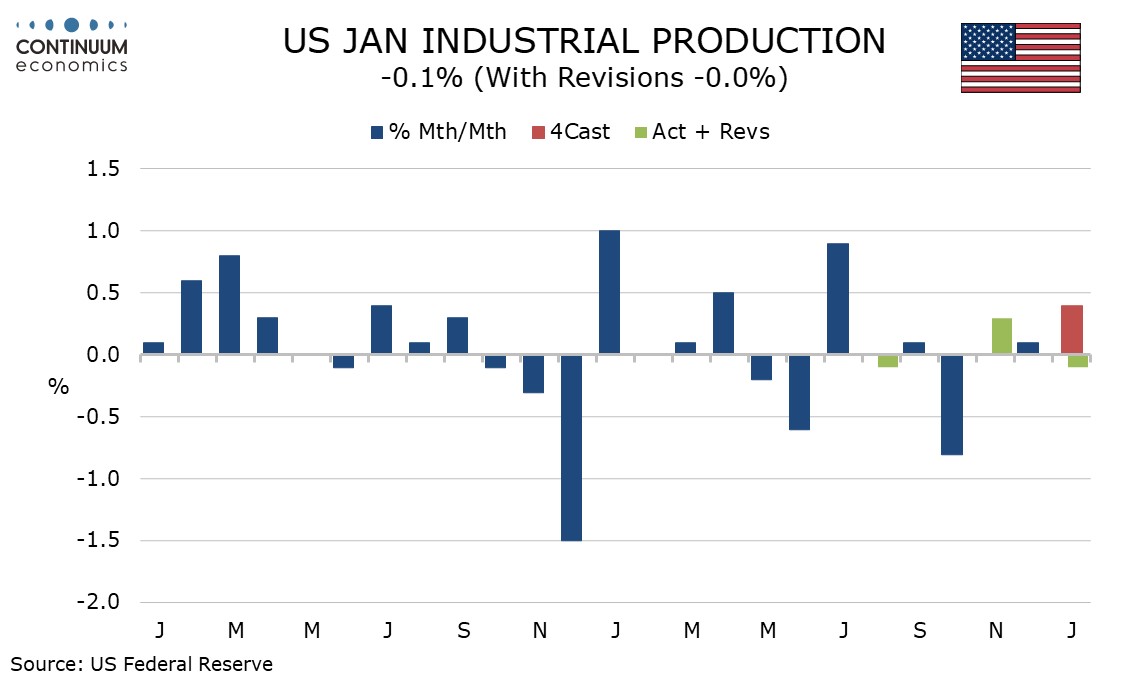

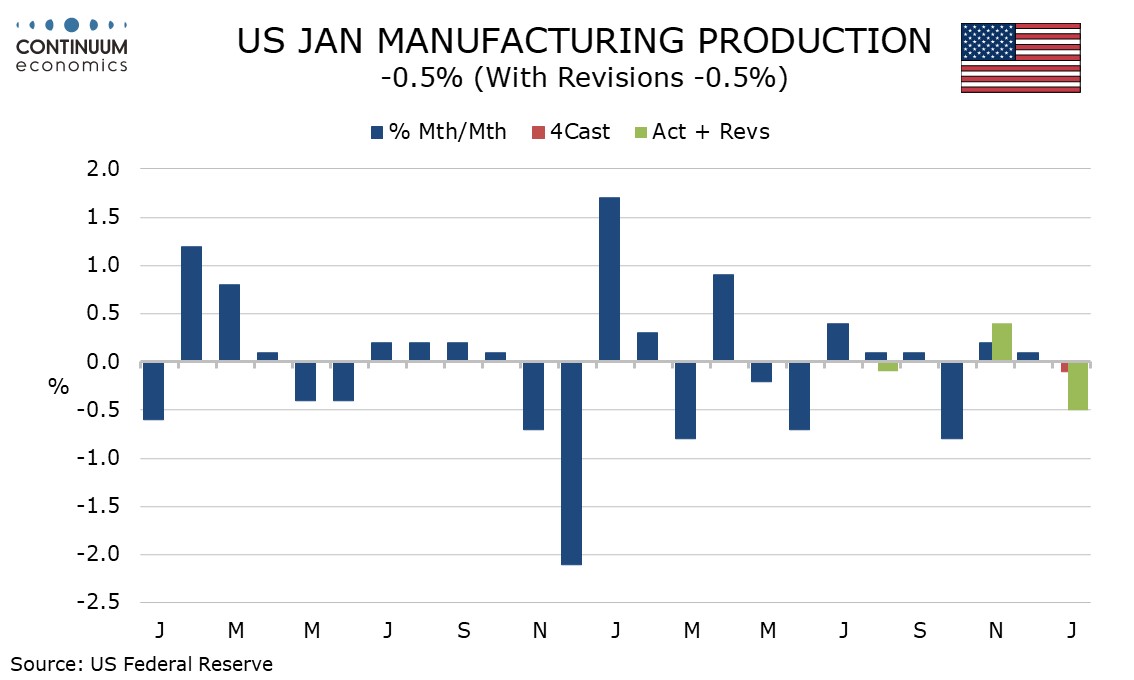

January industrial production fell by 0.1%, weaker than expected, with manufacturing down by 0.5%. Despite a strong non-farm payroll increase January retail and industrial data have shown weakness. This is consistent with a dip in the workweek seen in the payroll detail, which saw aggregate hours worked decline despite the strength in employment.

The overall industrial production figure was supported by a 6.0% increase in utilities, which is due to a surge in demand for heating as weather turned colder. Mining was weak with a decline of 2.3%.

Winter weather was cited as a factor behind the manufacturing and mining declines though weakness in oil prices may have caused mining to see a particularly step fall. That industrial production was impacted by weather hints that the weak retail sales outcome may have been too.

The dip in manufacturing follows two straight gains which were led by autos in a recovery from strikes in October. Manufacturing ex autos fell by 0.6% in January following two straight modest declines of 0.1%. This suggests implies weakness in manufacturing but improvements in the Philly Fed and Empire State data in February suggest February data could see some recovery.