US Q3 Core PCE prices and GDP revised down, Initial Claims low, Philly Fed weak

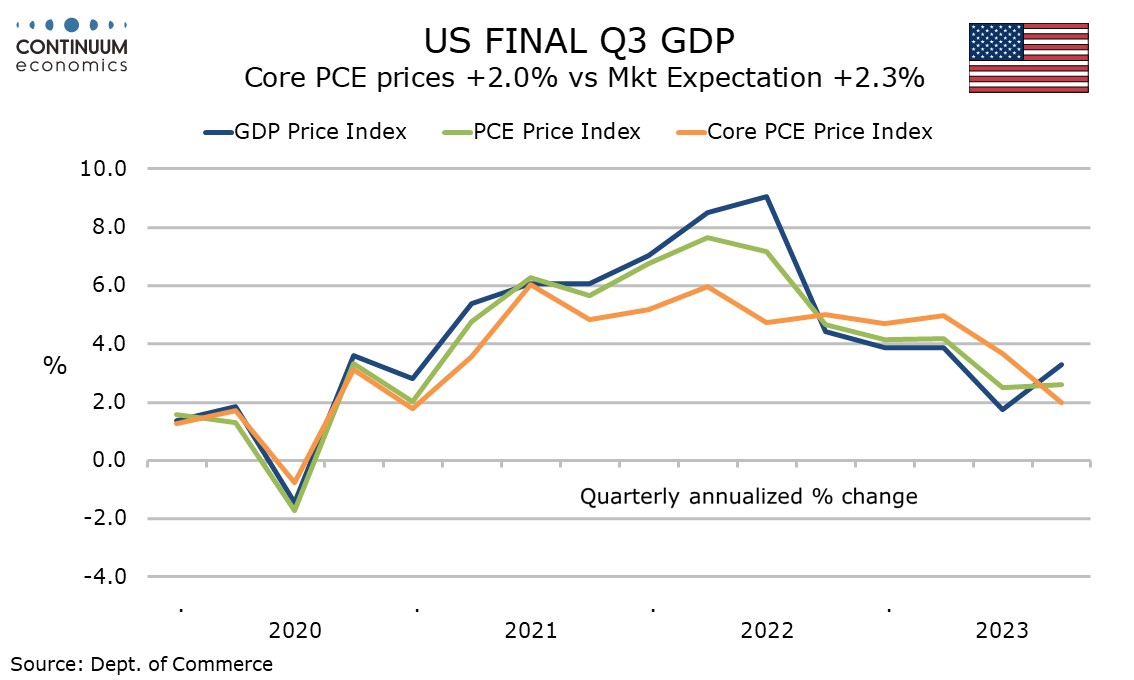

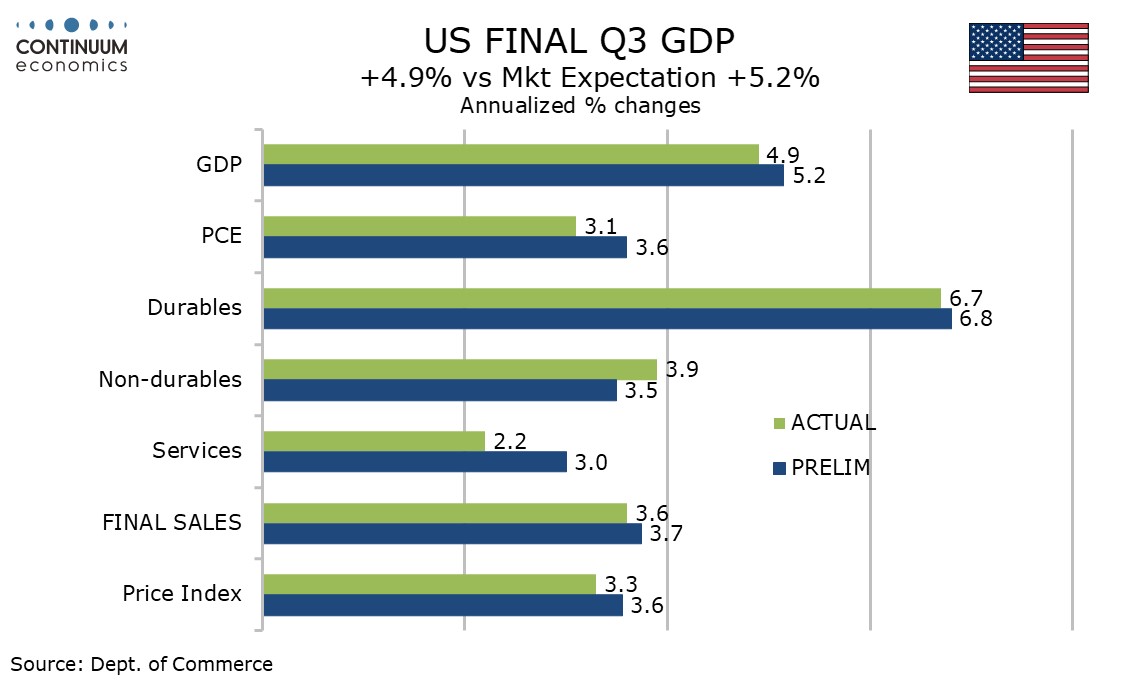

Initial claims at 205k from 203k remain low in the survey week for December’s non-farm payroll and suggest the labor market remains tight. December’s Philly Fed at -10.5 from -5.9 however looks weak while final Q3 GDP was revised down to a still very strong 4.9% from a preliminary 5.2%. Most importantly core PCE prices at 2.0% annualized saw an unusually large downward revision from 2.3%.

The core PCE price data is now on target on a quarterly annualized basis though yr/yr growth at 3.8% is still well above. The GDP price index was revised down to 3.3% from 3.6% and overall PCE prices to 2.6% from 2.8%.

Estimates made by Fed’s Powell at the post-FOMC press conference for yr/yr PCE price growth in November were lower than what was implied by November CPI, so the Fed may have been aware of this revision at the FOMC meeting.

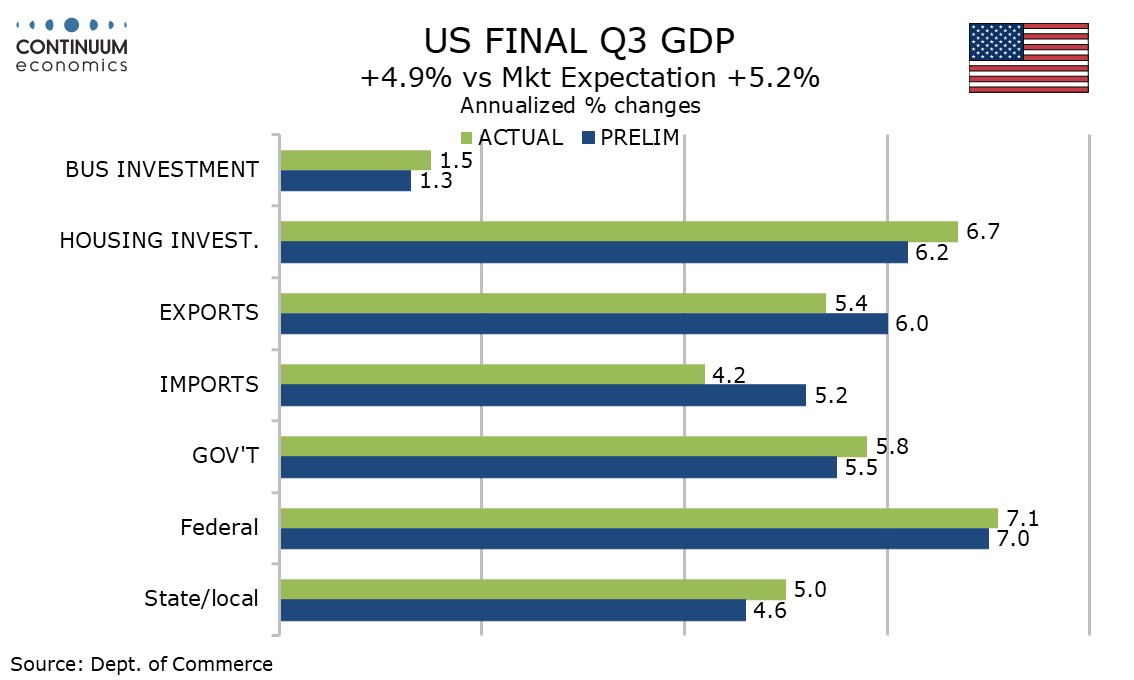

The downward revision to GDP was led by consumer spending, falling to 3.1% from 3.6%, and that led by services at 2.2% from 3.0%. Fixed investment, government and net exports were revised higher, though inventories were revised down. Final sales (GDP less inventories) saw only a modest downward revision to 3.6% from 3.7%.

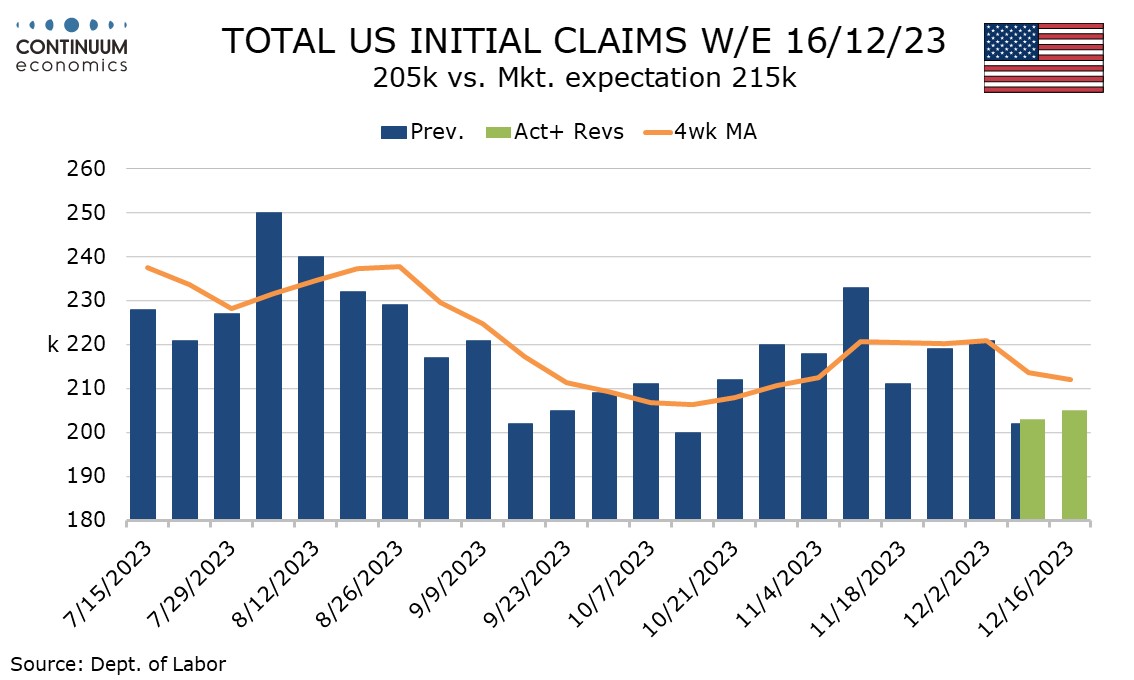

The last two weeks have seen initial claims lower than in the preceding seven, and the 4-week average of 212k in this the non-farm payroll survey week compares to 220.5k in November’s, though remains above the 206.25k seen in October.

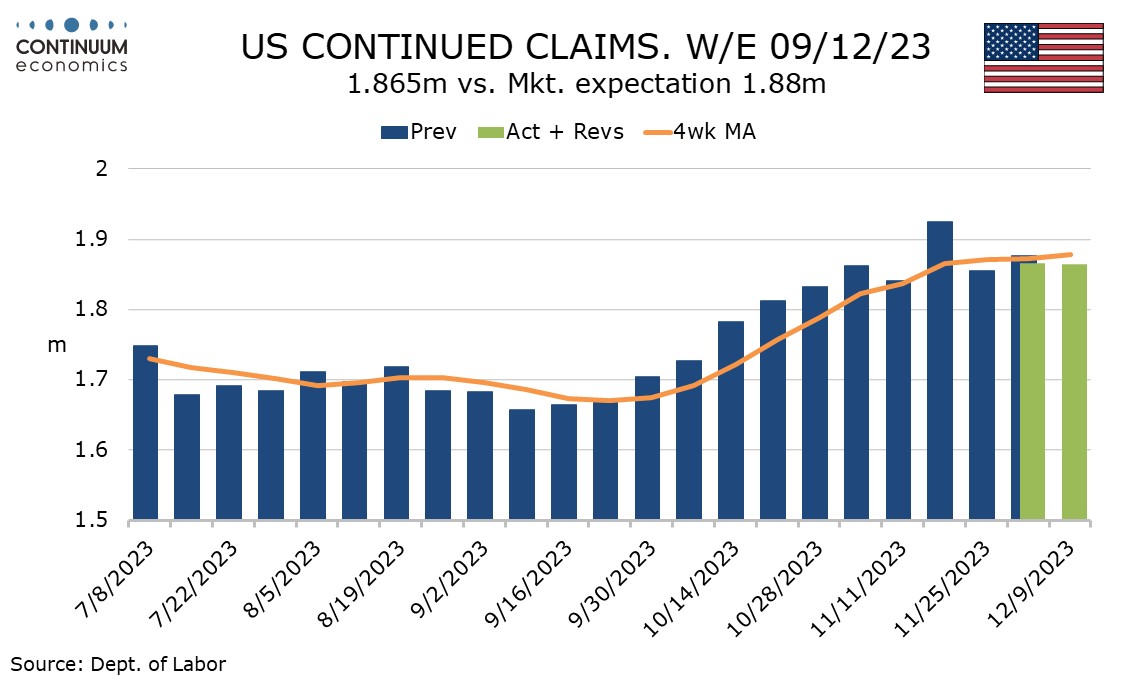

Continued claims cover the week before initial claims and were also lower than expected a 1.865k from 1.866k. Here the 4-week average continues to creep higher, but upward momentum has faded in recent weeks.

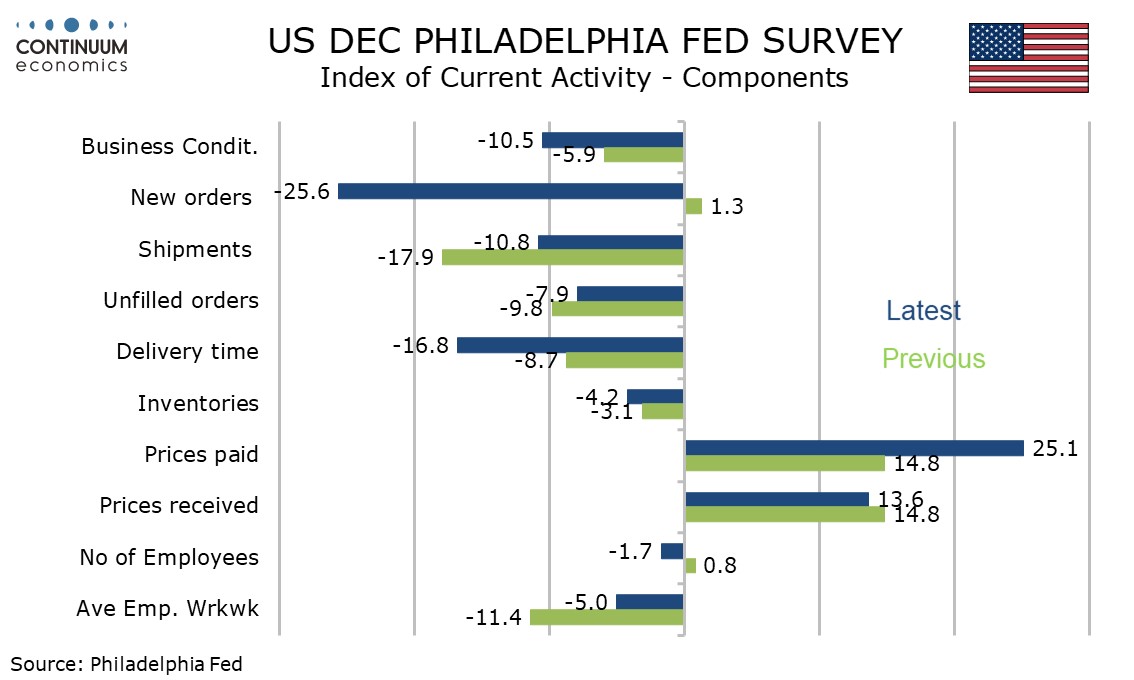

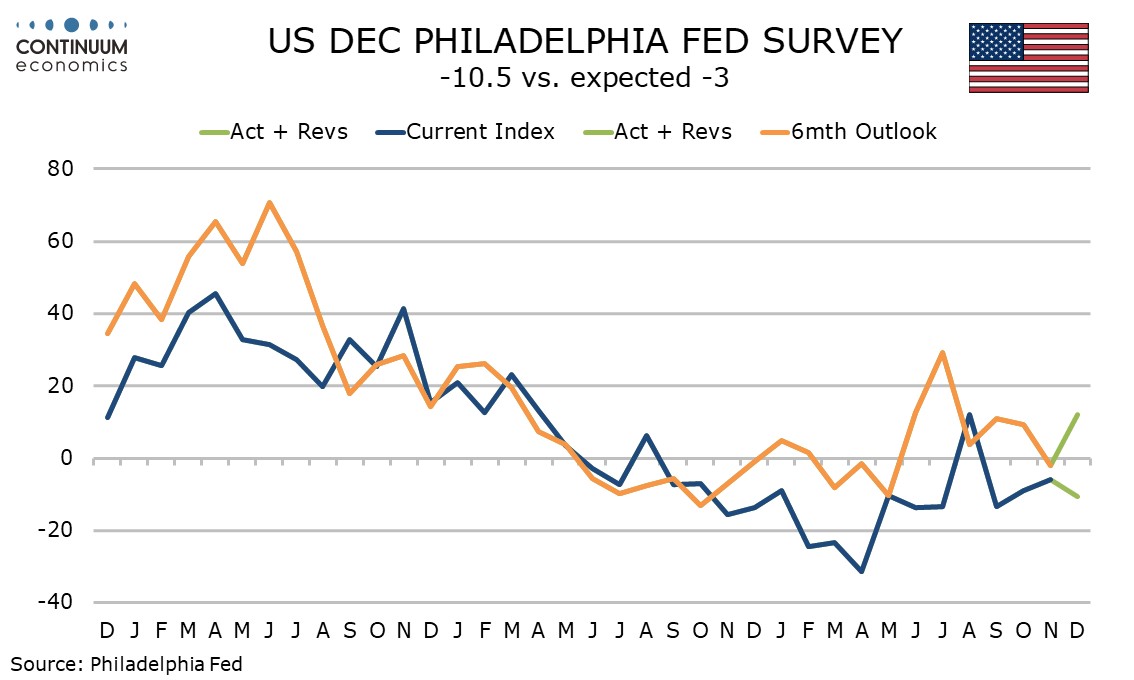

Current month Philly Fed details are mostly weak, in particular new orders at -25.6 which comes after two straight marginal positives. Employment at -1.7 also follows two straight positives. Prices paid picked up to 25.1 from 14.8, reversing a November dip, but prices received slipped to 13.6 from 14.8.

The Philly Fed does show a pick-up in 6-month expectations for activity, to a 5-mongth high of 12.1 from -2.1, probably reflecting hopes rates have peaked, though 6-month expectations for prices softened.