U.S. July Empire State little changed in the key details

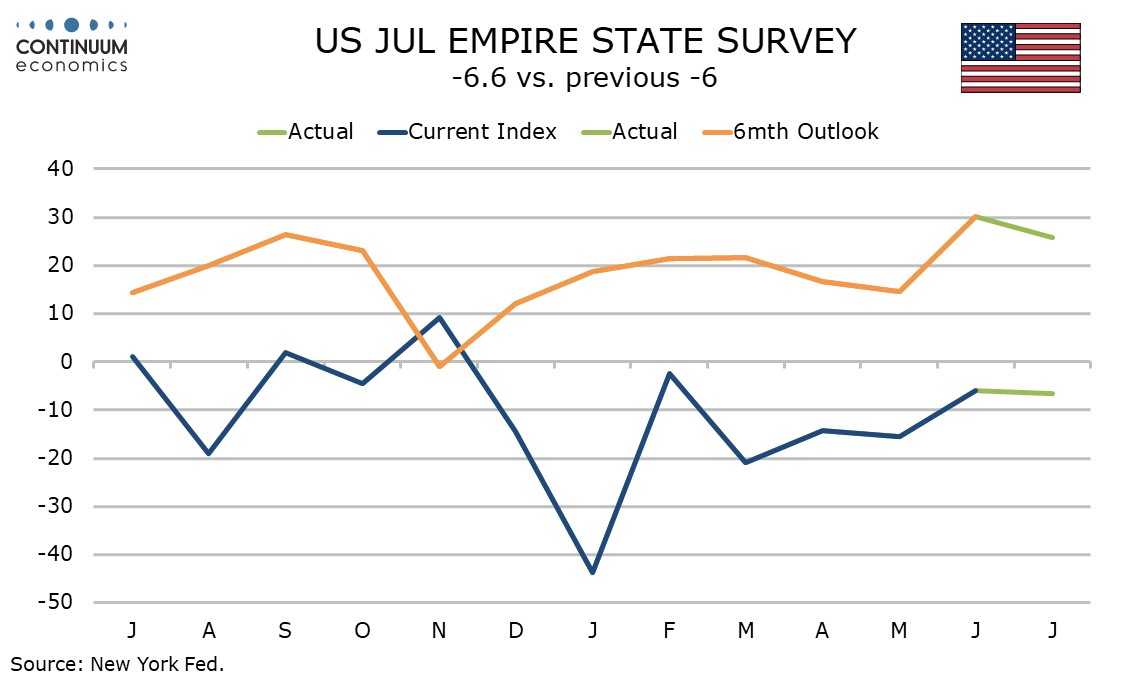

July’s Empire Sate manufacturing index of -6.6 is close to June’s -6.0 and improved from the indices of March, April and May, though broadly consistent with the trend over the past year which has been in line with most manufacturing surveys, if with a little more volatility in the Empire State’s case.

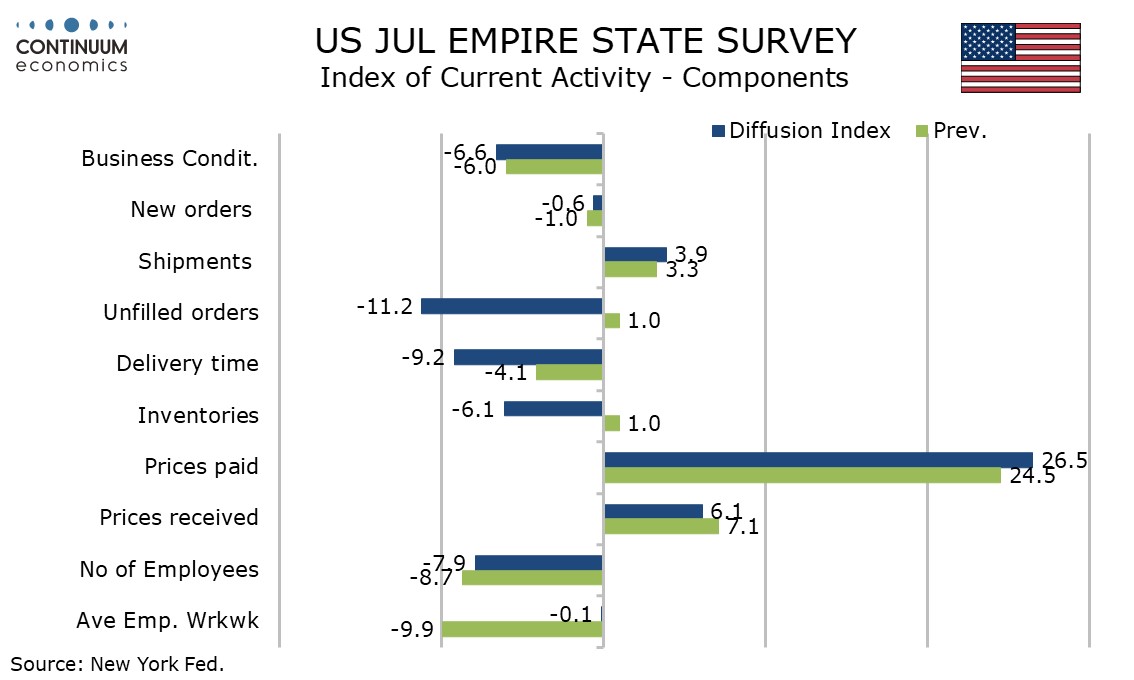

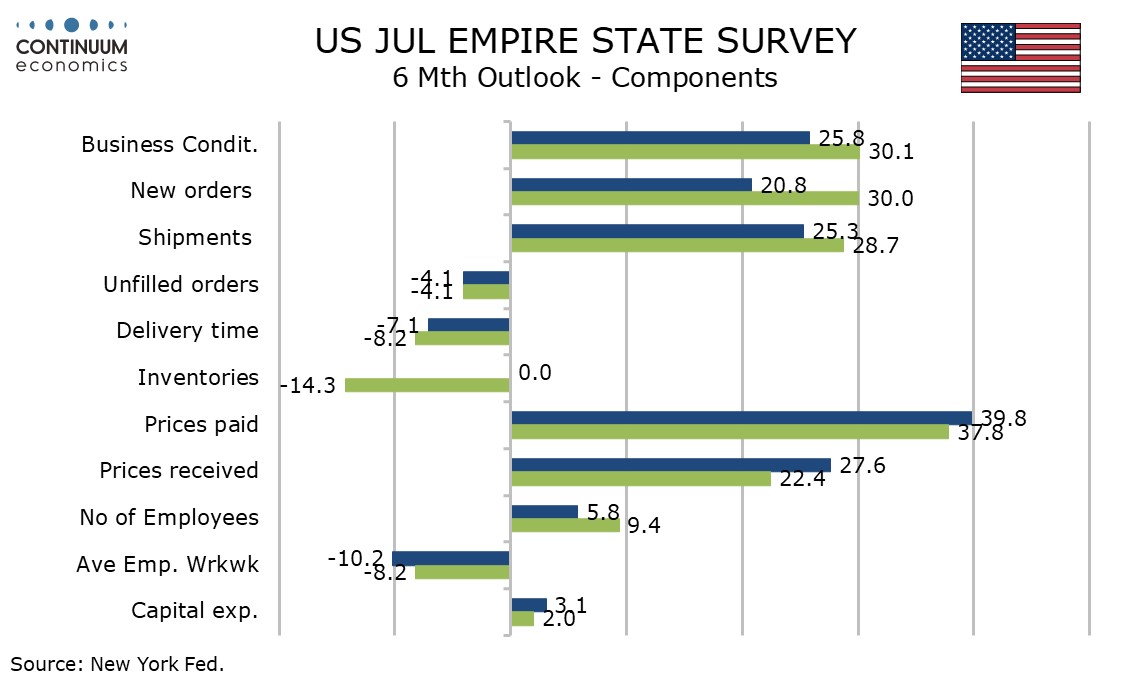

There is not much change in the key details, new orders at a near neutral -0.6 from -1.0, employment negative at -7.9 from -8.7 and 6 month expectations reasonably healthy at 25.8 from 30.1.

Price data also looks stable on both a one month and 6 month view. Correct month prices paid at 26.5 from 24.5 have kept to quite a tight range for a year now, but prices received at 6.1, while not much changed from June’s 7.1, sustain a significant slowing seen in June.

6-month price expectations, both paid at 39.8 from 37.8 and received at 27.6 from 22.4 are a little higher but comfortably within recent ranges which have been fairly stable over the past year.