AUD flows: AUD slips after employment data

Australian employment data disappoints, AUD retreats from key resistance area

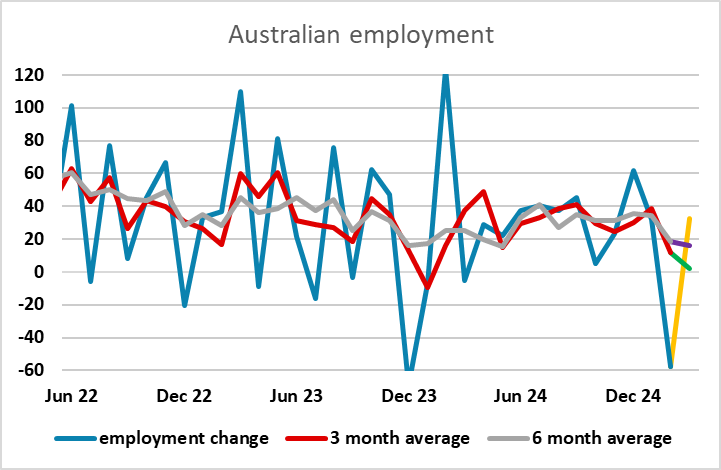

The AUD has weakened overnight after some disappointment at the March Australian employment report which showed a rise in employment, but a smaller rise than expected and failed to reverse the decline in February. While the unemployment rate did move a little lower, the trend in employment looks to be weakening and suggests a need for RBA easing. As it stands, the market is now pricing in at least a 25bp cut in May, with around a 20% chance of a 50bp cut.

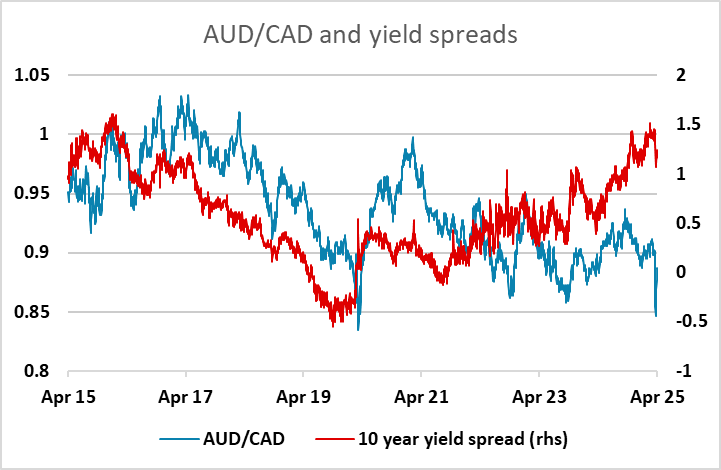

This has undermined the AUD in general after gains in recent days that led to AUD/USD challenging resistance at 0.64. Some of the dip in AUD/USD is due to a modest general USD recovery, but the AUD is also weaker on crosses, reflecting the disappointment at the employment data. Bigger picture, the AUD still looks like relatively good value given attractive yields and reasonable economic performance, particularly against the CAD, which has similar risk characteristics. Canada also likely has more serious problems to face with tariffs. But against he USD the 0.64 level looks like remaining strong resistance until we either see a bigger risk recovery or a sharper general USD decline.