U.S. Q1 GDP revised lower and higher April trade deficit suggests downside risk in Q2

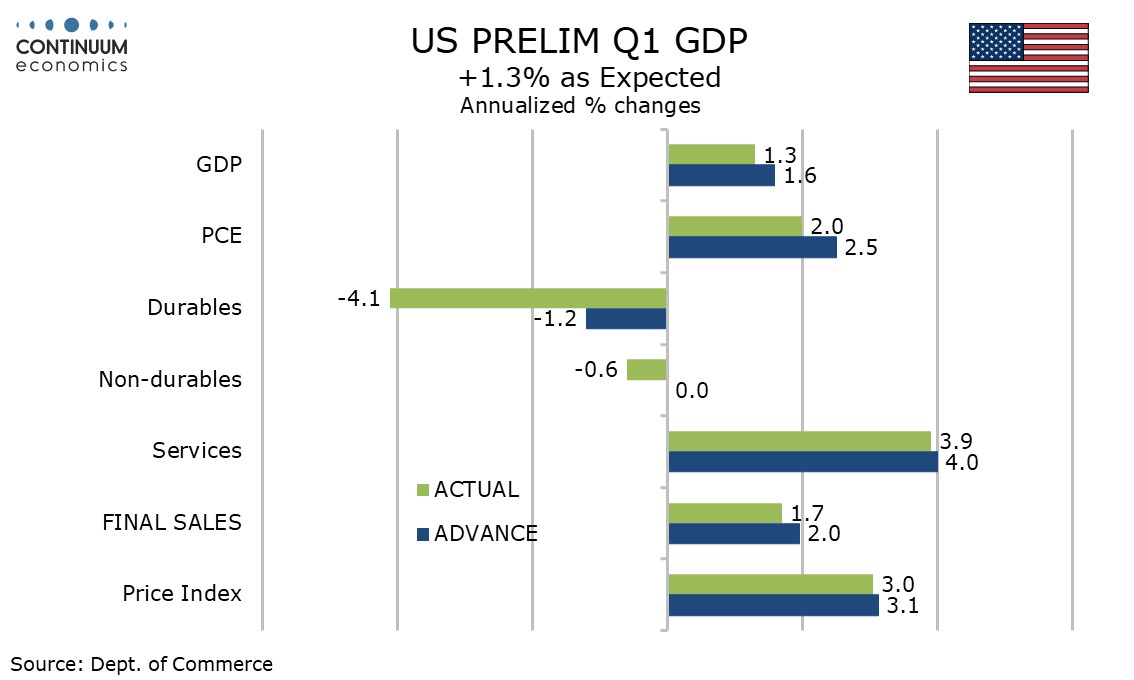

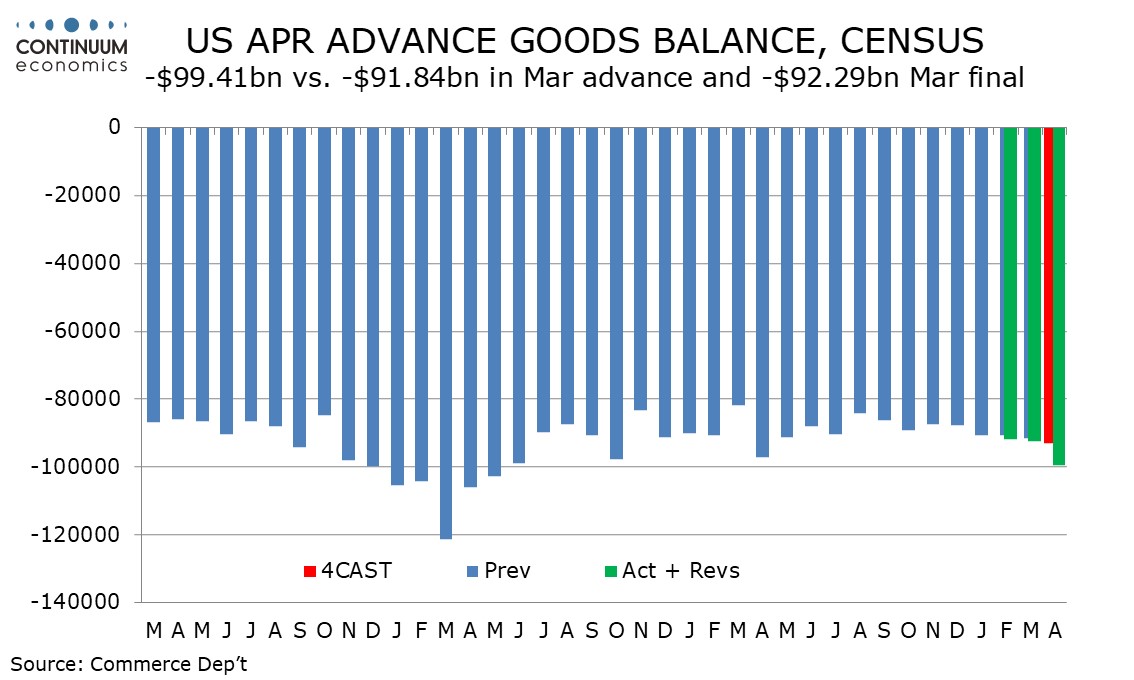

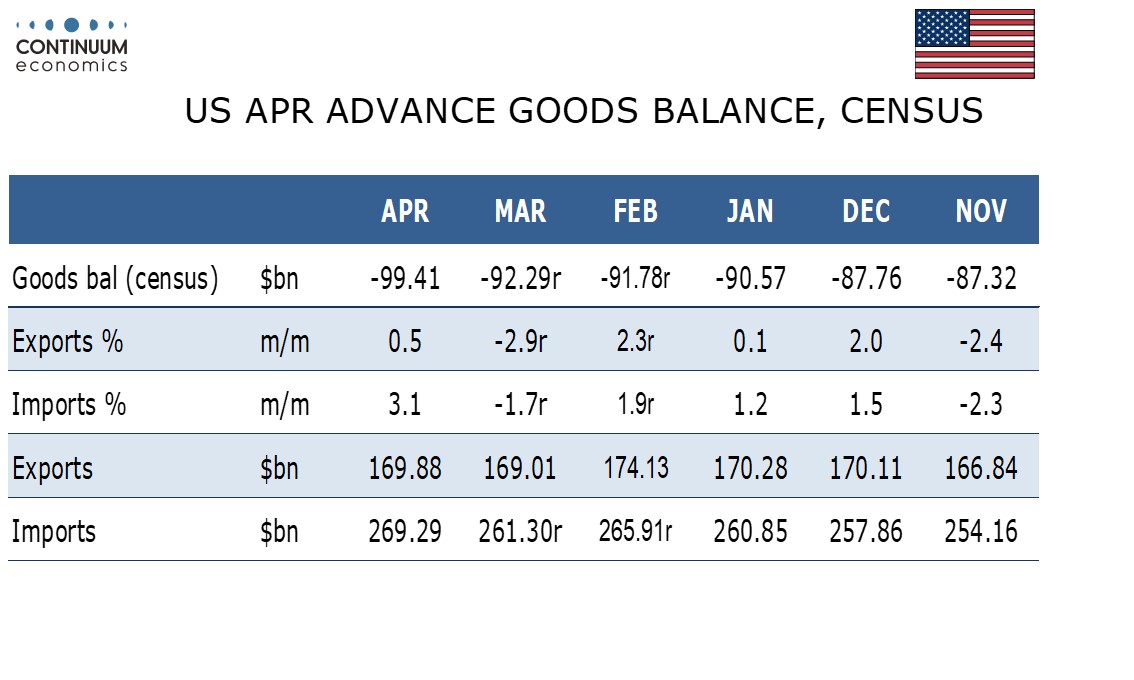

A downward revision to Q1 GDP to 1.3% from 1.6%, led by consumer spending was as expected, through a marginal downward revision to core PCE prices to 3.6% from 3.7% was not. Initial claims at 219k from 216k are only marginally higher and still imply a strong labor market. However a sharp rise in April’s advance goods trade deficit to $99.4bn from $92.3bn is a surprise and will degrade Q2 GDP forecasts with an outcome similar to Q1’s looking plausible.

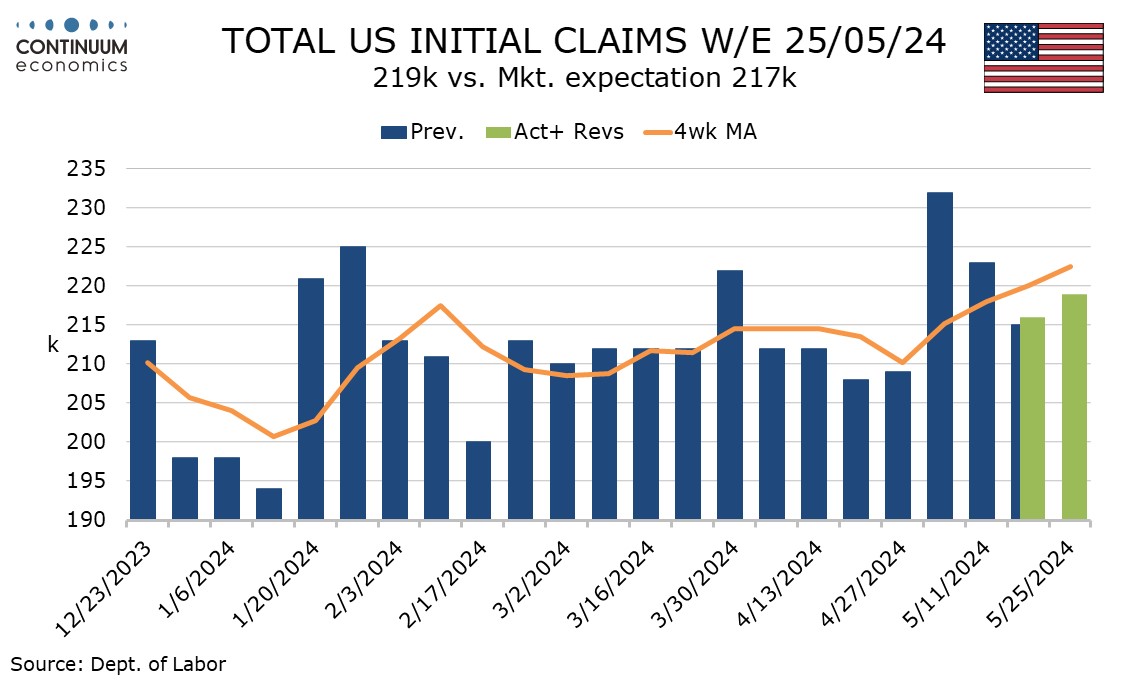

Initial claims saw their first increase in there weeks, but a sharp rise three weeks ago is inflating the 4-week average which at 222.5k is the highest since September 2023. The survey week for May’s non-farm payroll came last week.

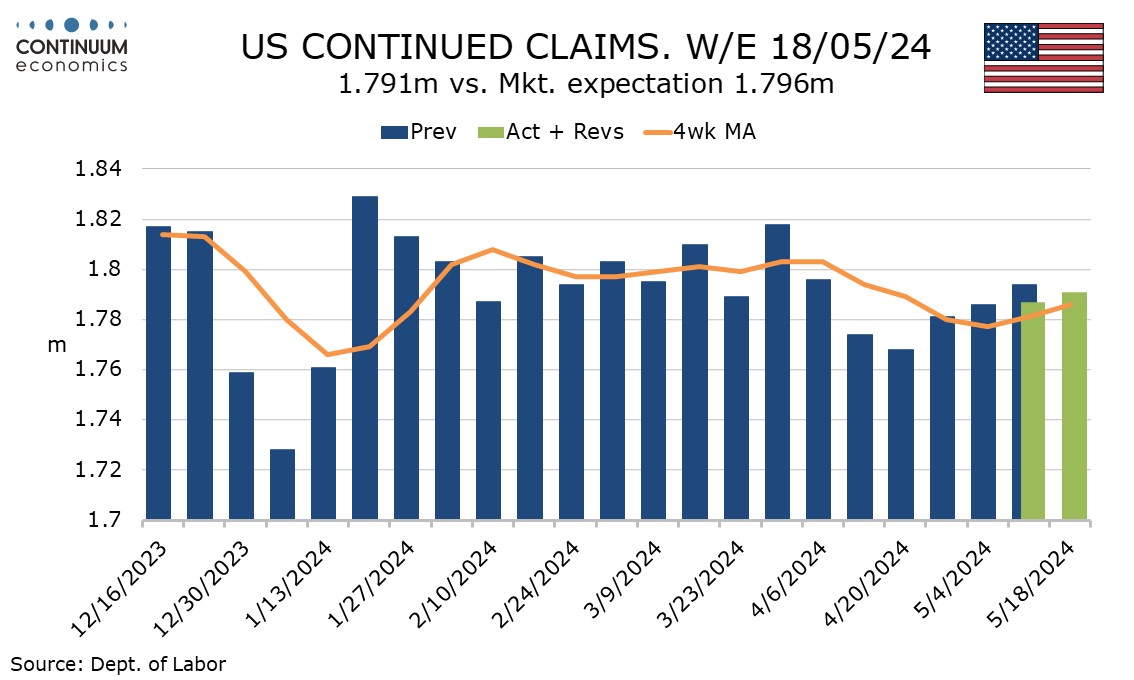

Continued claims, up a marginal 4k to 1.791m, do cover the payroll survey week. That makes four straight marginal gains but trend still looks fairly flat.

The GDP detail saw consumer spending revised down to 2.0% from 2.5%, mostly on retail revisions which had been flagged by downward revisions to February and March retail sales with the April release. Services however saw a marginal downward revision to 3.9% from 4.0%.

Real disposable income was however revised up to 1.9% from 1.1%, making income look consistent with spending rather than continuing to underperform. Gross domestic income, this the first estimate for Q1, rose by 1.5%, close to consistency with GDP.

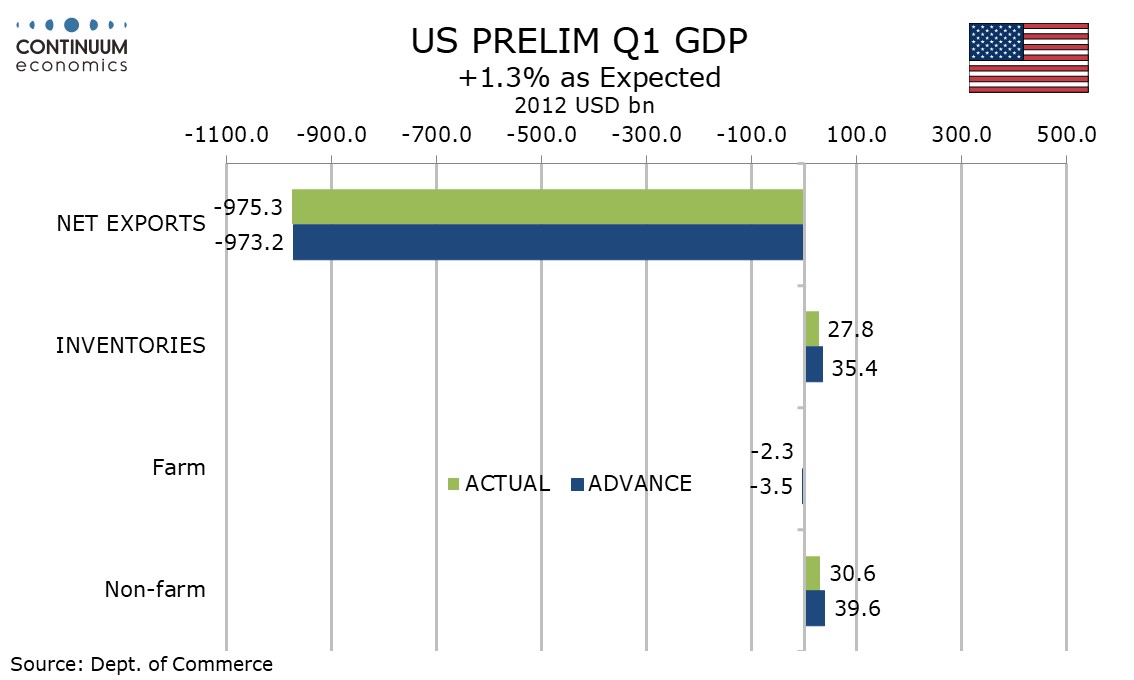

Inventories were also revised lower as we had expected but the revisionsto final sales (GDP less inventories) to 1.7% from 2.0% was similar to that seen for GDP.

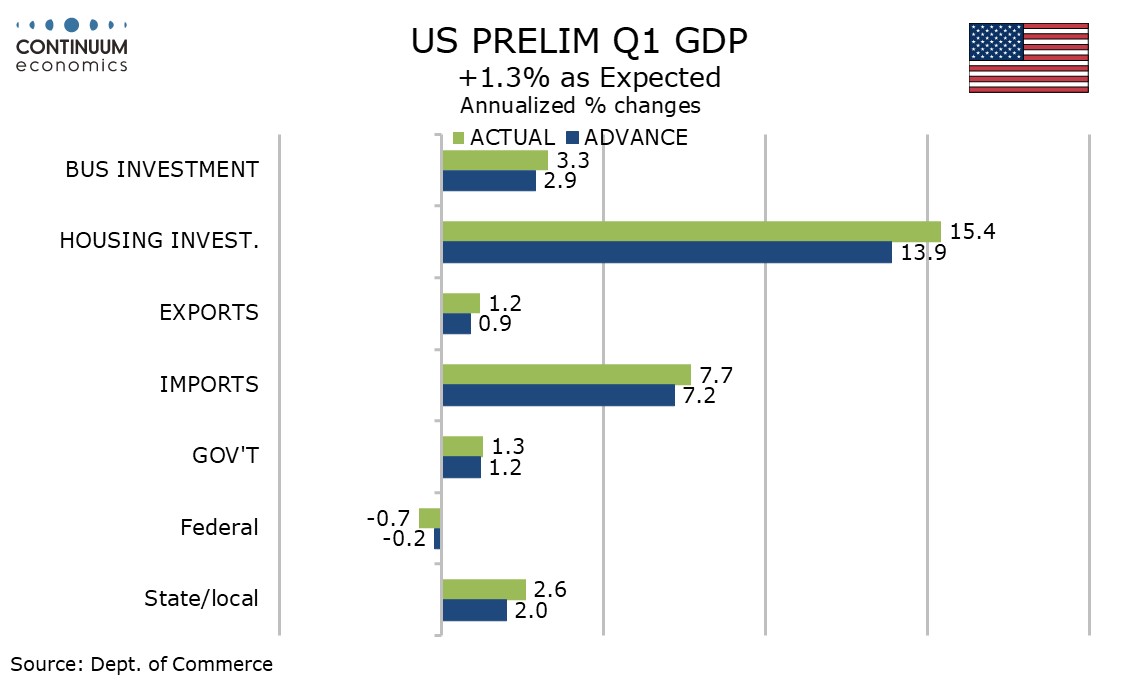

Elsewhere revisions were modest. Business investment was revised up to 3.3% from 2.9% led by intellectual property with equipment revised down. Housing was revised even higher to 15.4% from 13.9% and government up marginally to 1.3% from 1.2%. Net exports were revised slightly lower with an upward revision to imports exceeding that seen for exports.

Final sales to domestic buyers were revised down to 2.5% from 2.8%, so remain stronger than GDP and this has been seen as a sign of underlying momentum. However a sharp rise in April’s trade deficit suggests that net exports will remain negative in Q2. Exports rose by 0.5% after a 2.9% fall in March while imports rise by 3.1% after declining by 1.7% in March.

The negative implications for Q2 GDP are however partially offset by stronger advance April inventory data in particular a 0.7% rise in wholesale. Retail increased by a modest 0.2%.