U.S. May ADP Employment - Slower but not far off trend

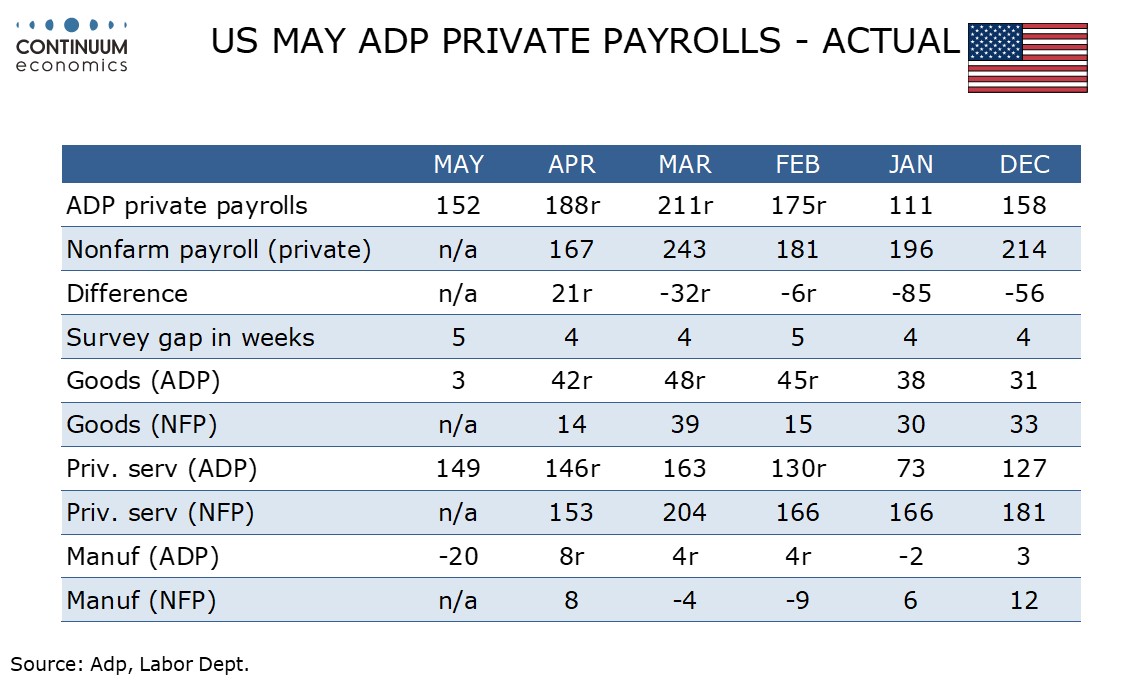

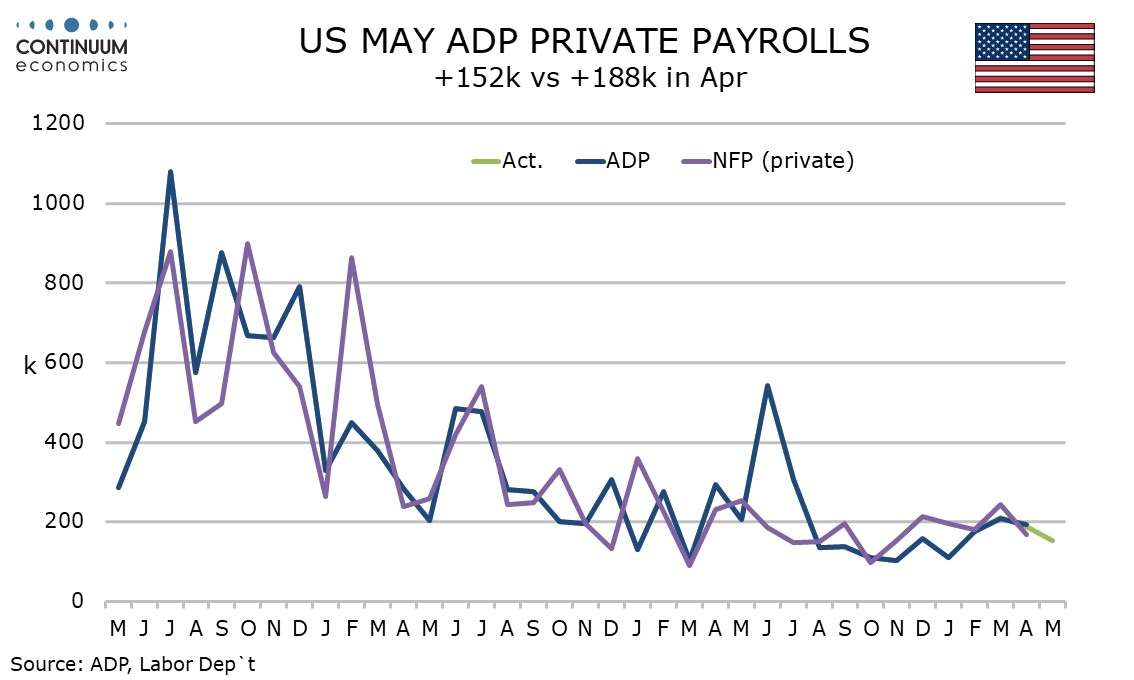

ADP’s April estimate for private sector employment growth of 152k is on the low side of expectations and if matched by private sector non-farm payrolls would be consistent with a loss of labor market momentum. However, the data is in line with the ADP trend.

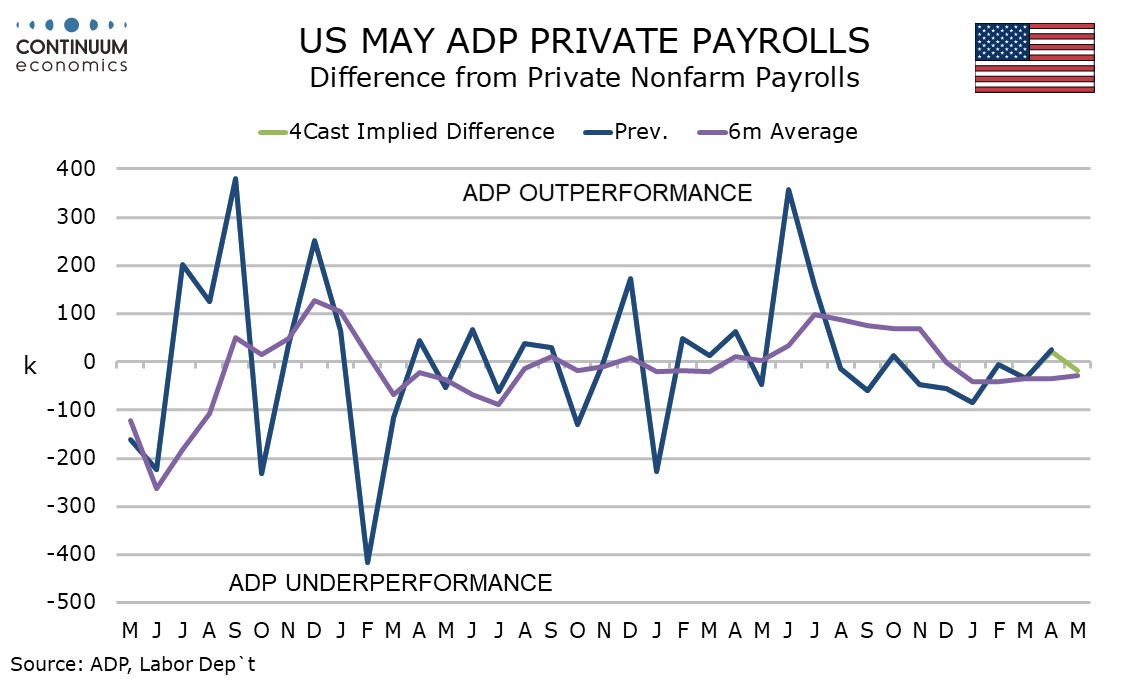

ADP data in April with a rise of 188k (revised only marginally from 192k) outperformed a below trend 167k rise in private sector non-farm payrolls, breaking a recent tendency for ADP data to underperform non-farm payrolls. We expect ADP to underperform in May, with our private sector payroll forecast being 170k, with overall payrolls at 205k. These would be slightly firmer than seen in April payroll data but still consistent with trend starting to lose momentum.

Most recent months have shown leisure and hospitality as the strongest sector in the ADP breakdown, but in May the sector rose by only 12k, with trade transport and utilities leading with 55k, with education and health at 55k (below where that sector has been trending in payroll data) and construction at 32k. Manufacturing was weak with a 20k decline.

Wage data showed a 5.0% rise for job stayers for a third straight month but for job changers the data slowed for a second straight month to 7.8%. This is consistent with a moderate slowing in the labor market which is what we also expect payroll data to imply.