U.S. February Existing Home Sales - Strong rise, as was seen in February 2023

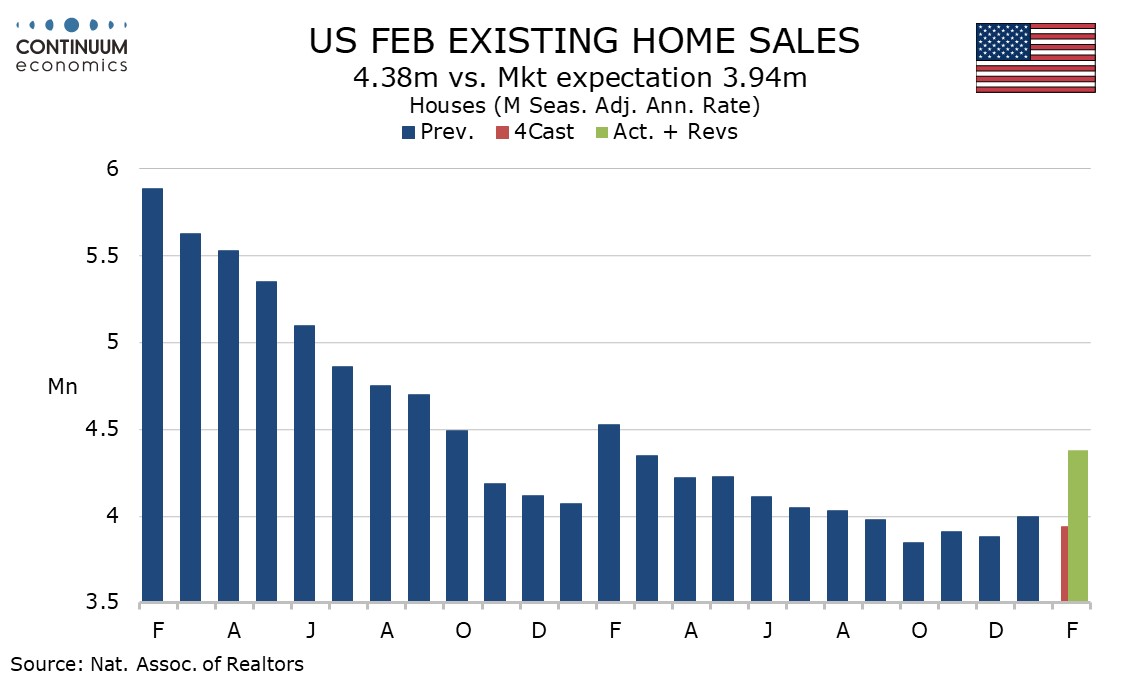

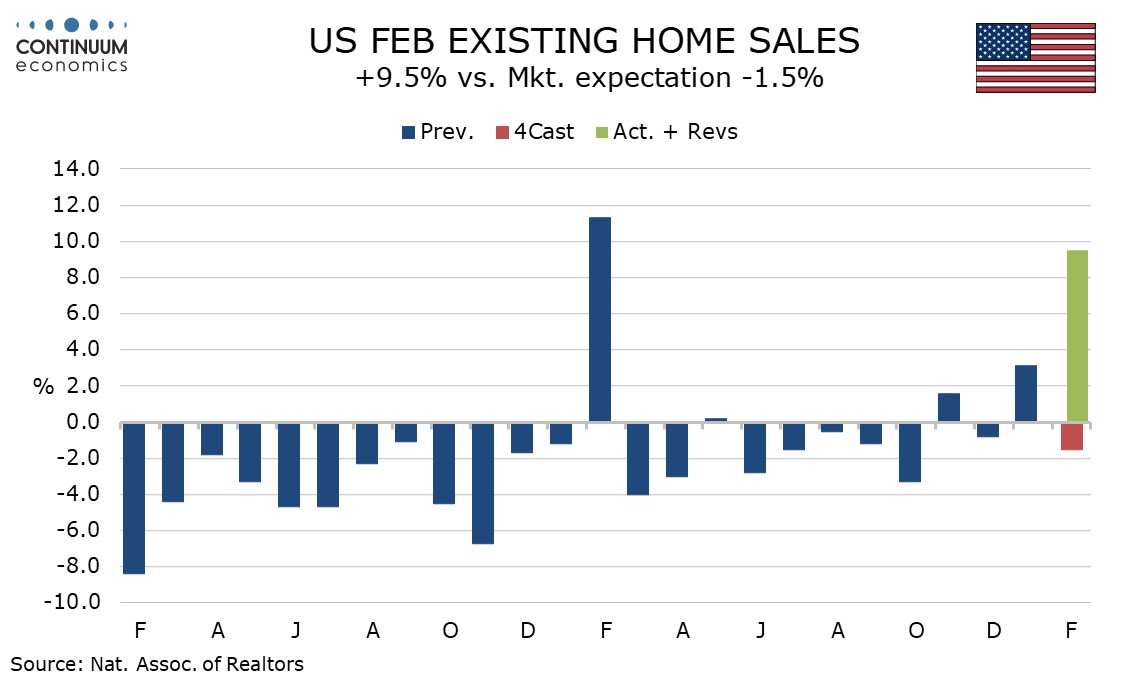

February existing home sales with a sharp 9.5% increase to 4.38m are sharply above expectations. A similar rise in February 2023 was not sustained meaning some caution is necessary though should the Fed deliver on easing expectations, a solid housing market would probably be seen.

February 2023 saw a rise of 11.3% that provided a brief and sharp break in an uptrend that preceded and followed that release. This time the gain is the third in four months, and follows some positive signals in housing surveys such as the MBA’s and NAHB’s as mortgage rates came off their highs in late 2023.

The NAHB index has continued to increase into March but the existing home sales dip is a surprise given that pending home sales slipped back in January after a sharp rise in December, and mortgage rates have started to edge higher again. The future outlook is uncertain but yesterday’s relatively dovish FOMC tone will be supportive for housing activity.

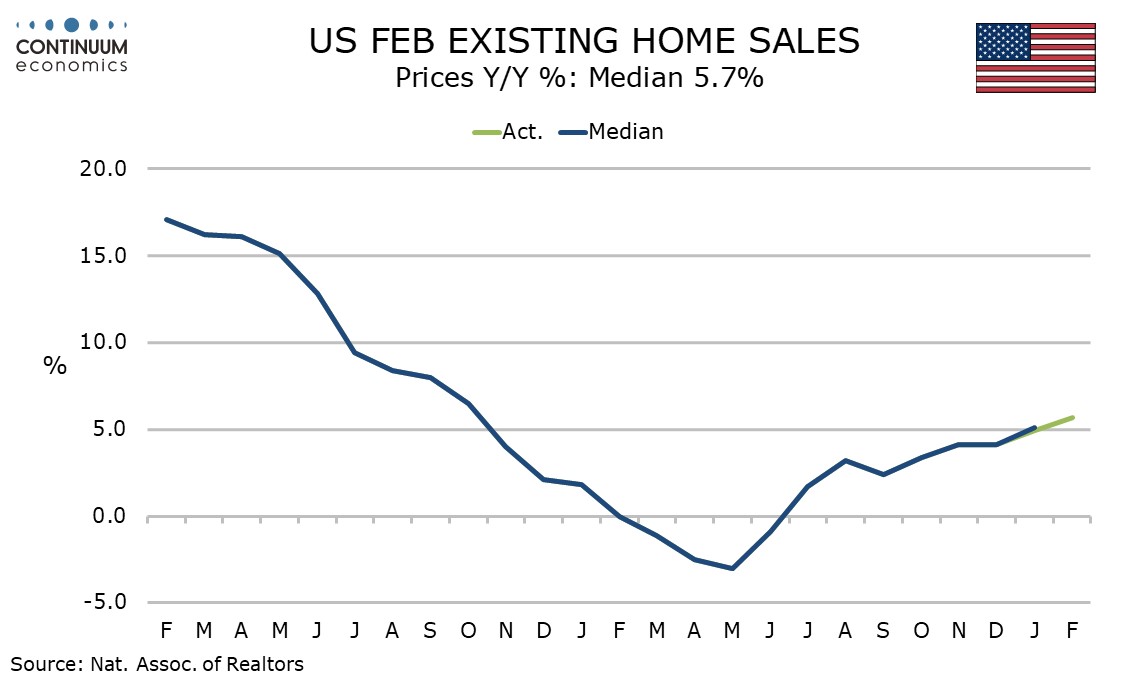

Given the strength in February 2023 yr/yr sales growth remains weak at -3.3%. Yr/yr prices are however moving higher, the average at 5.7 yr/yr from 4.9% in January. On the month the average price rose by 1.6%, its first rise since June, though this data is not seasonally adjusted and seasonal slippage is usually seen late in the year before regaining momentum in the spring. The Yr/yr figure is the one to watch for prices, and that is picking up.