Banxico Preview: Cuts are Coming but it Still too Soon

Banxico's Feb. 8 meeting holds crucial decisions on the policy rate at 11.25%. Despite global trends, cautious Banxico may delay cuts due to Mexico's robust labor market and positive output gap. Expenditure plans and CPI data on the meeting day shape Banxico's considerations. While a 20% chance of a cut exists, caution prevails due to inflation trends misaligned with targets. Banxico may signal a March cut, likely mirroring Brazil's 50bps reduction.

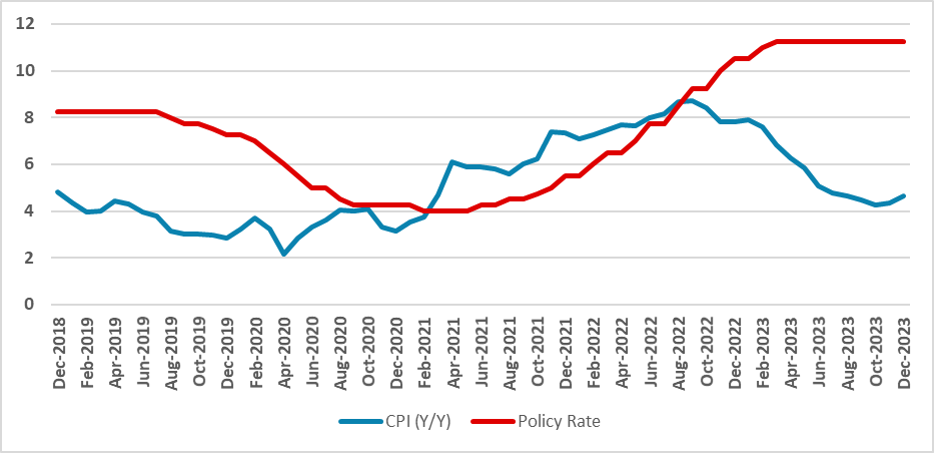

Figure 1: Mexico’s Policy Rate and CPI (%)

Source: Banxico and INEGI

The Mexico Central Bank (Banxico) will convene on Feb. 8 to decide the policy rate (Overnight). At the moment, the policy rate is set at 11.25%, and despite several emerging countries having started the cutting phase of the cycle, we believe the next meeting will be too soon for a cautious Banxico. Unlike other countries, Mexico's labor market is showing remarkable strength, and some estimations point that the output gap is likely positive, meaning Banxico has to look after demand pressures. Additionally, the rise in expenditures planned for this electoral year is also an important factor Banxico will look after.

The CPI data will only come out on the same day as Banxico's meeting, meaning most of the data Banxico will be using during their analysis has already come out. We believe there is still some chance Banxico decides to cut, but it is narrowed to 20%. Preliminary reading of the January CPI points to a transitory acceleration of inflation, and the CPI expectations for 2024 and 2025 are not yet fully aligned with Banxico's target, which will demand caution from Banxico to start the cutting cycle. With neutral rates estimated to be around 7.0%, Banxico will have a long road towards reaching it, and at the moment, the general recommendation is not about going towards neutral but rather diminishing the general level of tightening, meaning contractionary monetary policy will continue in motion to compensate for the strong labor market.

It will also be interesting to see whether Banxico will make any comments on the Fed. With a relatively strong Mexican Peso, and remittances, FDI, and exports pushing inflows towards Mexico, Banxico has been little worried about the Fed, and the timing of the Fed to start cutting will be of marginal relevance for Banxico right now. We believe the first cut will be scheduled to happen in March, and Banxico is likely to signal it during the meeting. Then, the discussions will be about the magnitude of the cuts. We believe the most likely scenario is that Banxico will follow Brazil, and it will apply a 50bps cut while it monitors the effects of a less contractionary monetary policy, another option is to start slowly at 25bps and in mid-year accelerating towards 50bps.