Published: 2024-02-09T18:18:56.000Z

Preview: Due February 22 - U.S. January Existing Home Sales - Due for a bounce

Senior Economist , North America

-

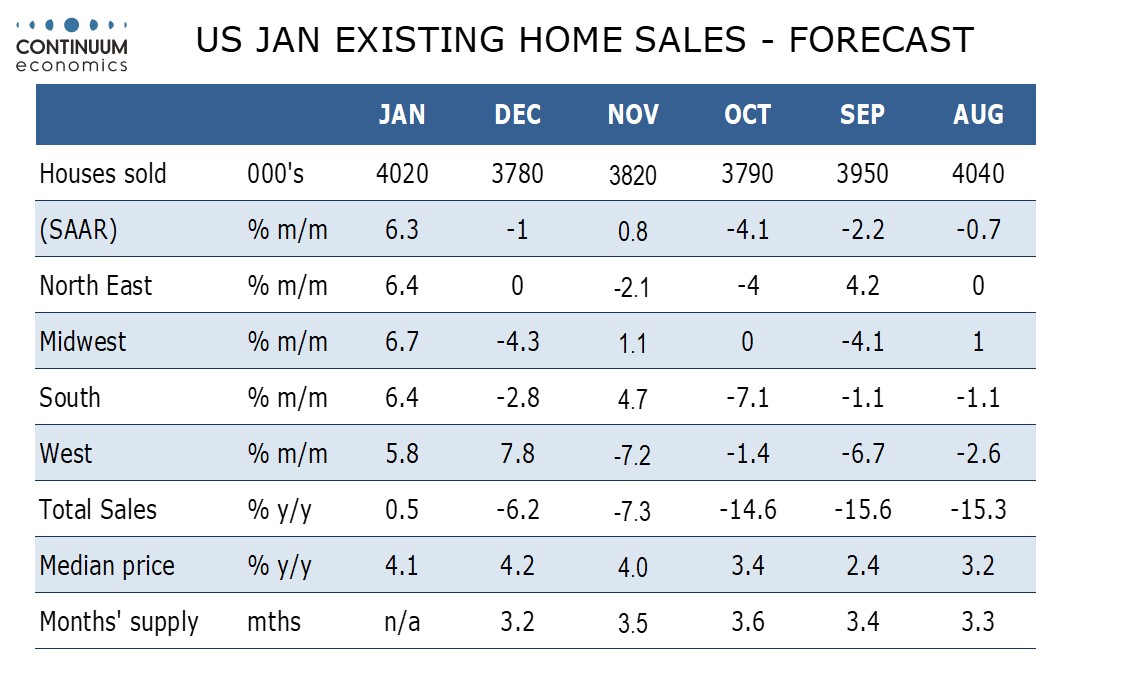

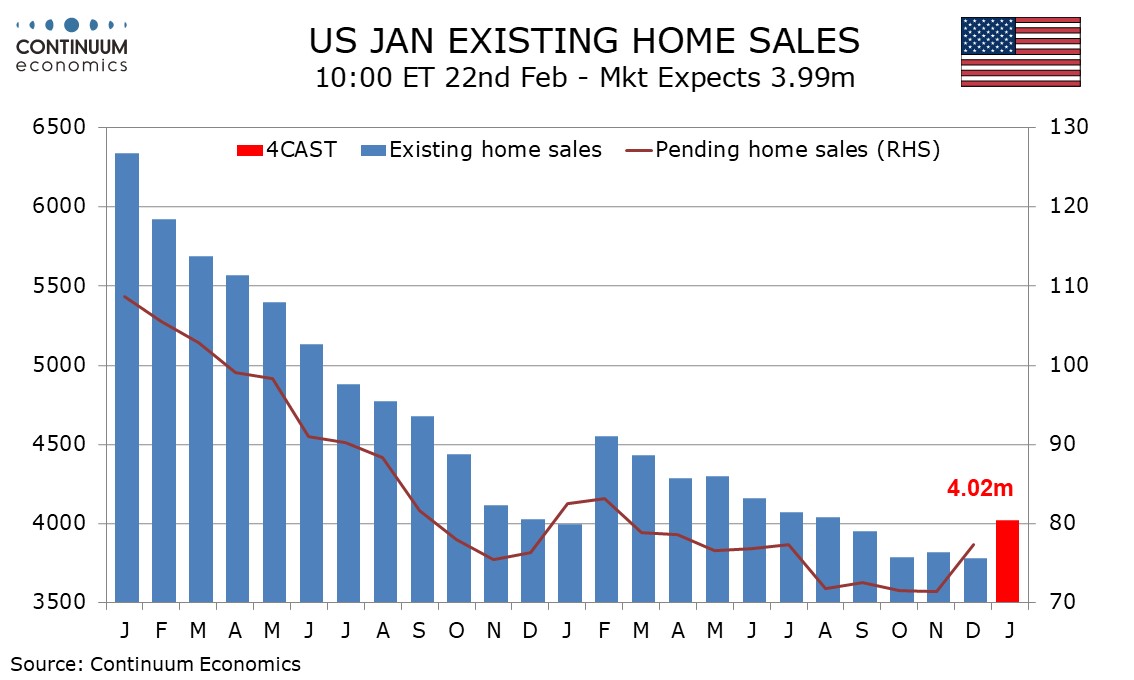

We expect existing home sales to see a 6.3% January increase to 4.02m. This would be the strongest rise since February 2023 and the highest level since August 2023, lifting yr/yr growth to 0.5%, the first positive since January 2022.

Pending home sales rose by 8.2% in December, their strongest rise since January 2023, which preceded a 13.8% surge in February 2023 existing home sales. The housing market appears to be responding to falling mortgage rates in late 2023, as also suggested by survey evidence from the NAHB and MBA moving off their lows.

The monthly rise is likely to be broad based regionally with even the West extending a strong December gain that only partially reversed some steep preceding declines. We expect the median price to fall by 1.0% on the month, which would be a seventh straight decline. However the decline will be in part seasonal and we see yr/yr growth little changed at 4.1% versus 4.2% in December.