U.S. December PPI - Trade rebounds, tariff lift persists

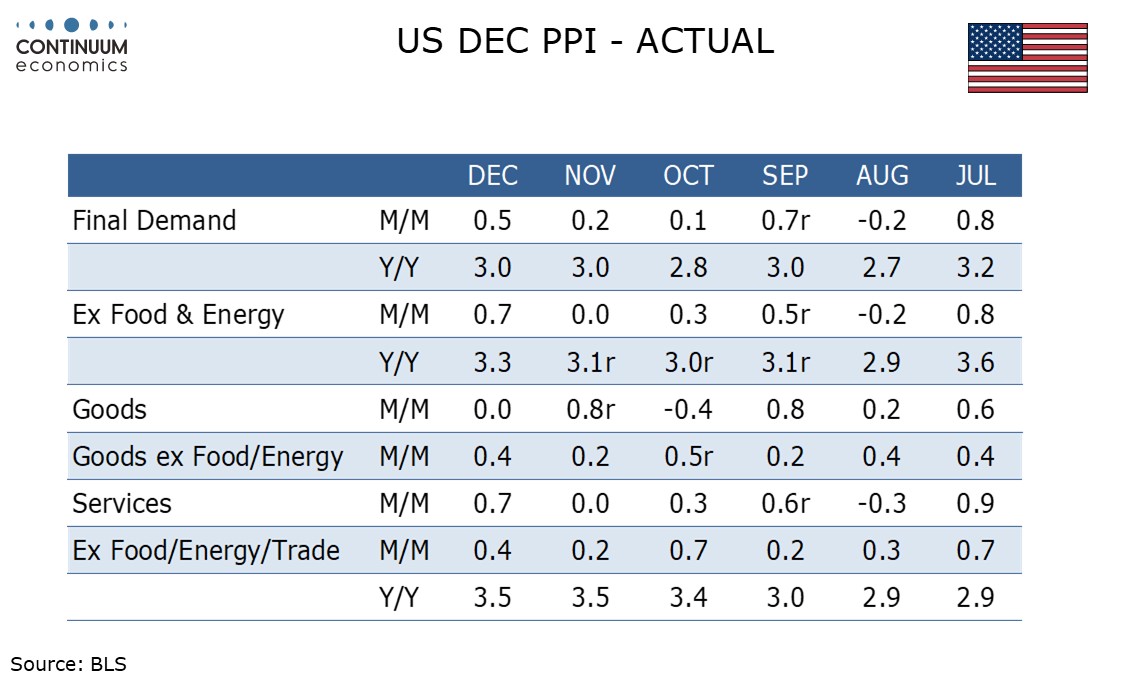

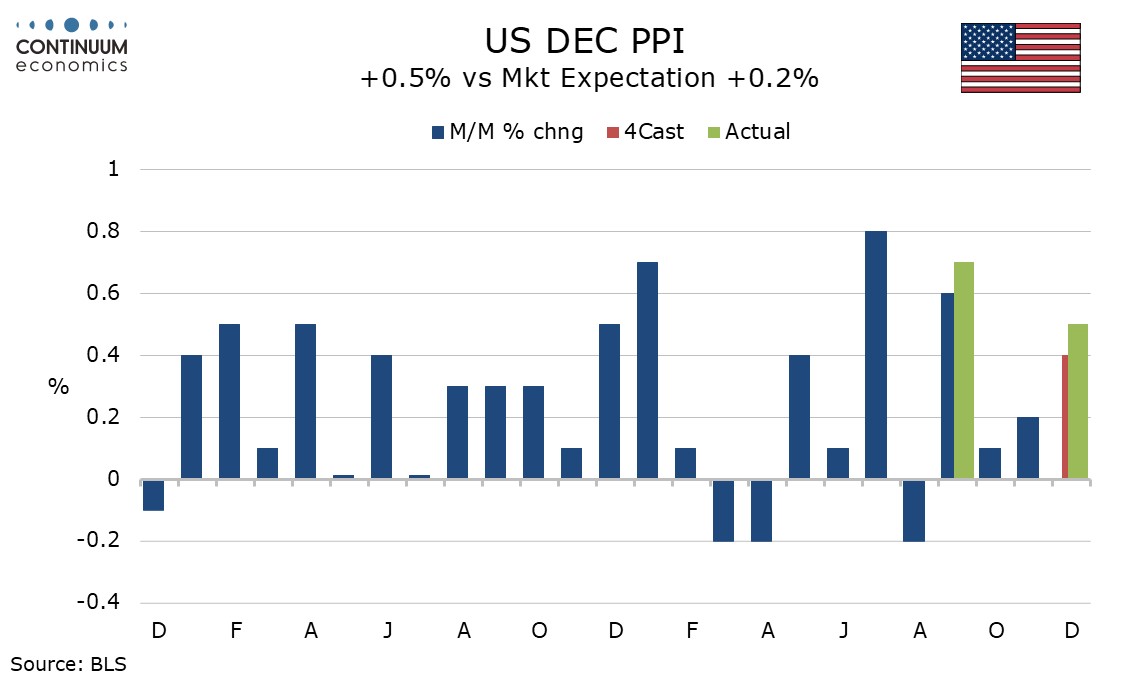

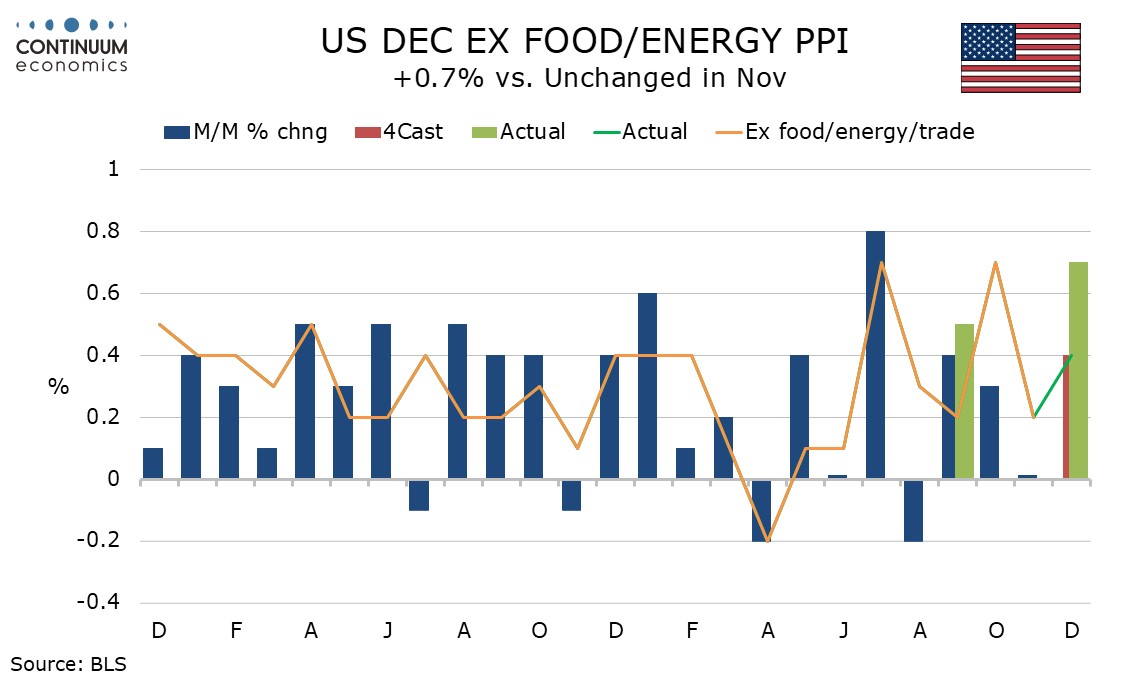

December PPI has surprised on the upside with a 0.5% increase, 0.7% ex food and energy, with even the ex food, energy and trade increase at 0;4% being on the firm side of expectations. Strength was broad based outside food and energy, including at the intermediate level.

A 1.7% increase in trade prices follows declines of 0.6% in November and 0.8% in October so should not cause too much alarm. But a 0.7% increase in service prices included a 0.5% rise in transport and warehousing and a 0.3% rise in other services, both on the firm side.

Goods prices were unchanged with food down by 0.3% and energy down by 1.4%. Food has not risen in three months but energy is correcting a 3.7% rise in November. Goods ex food and energy were on the firm side of trend at 0.4%, and that is a disappointment to those who were hoping the tariff lift was past its peak.

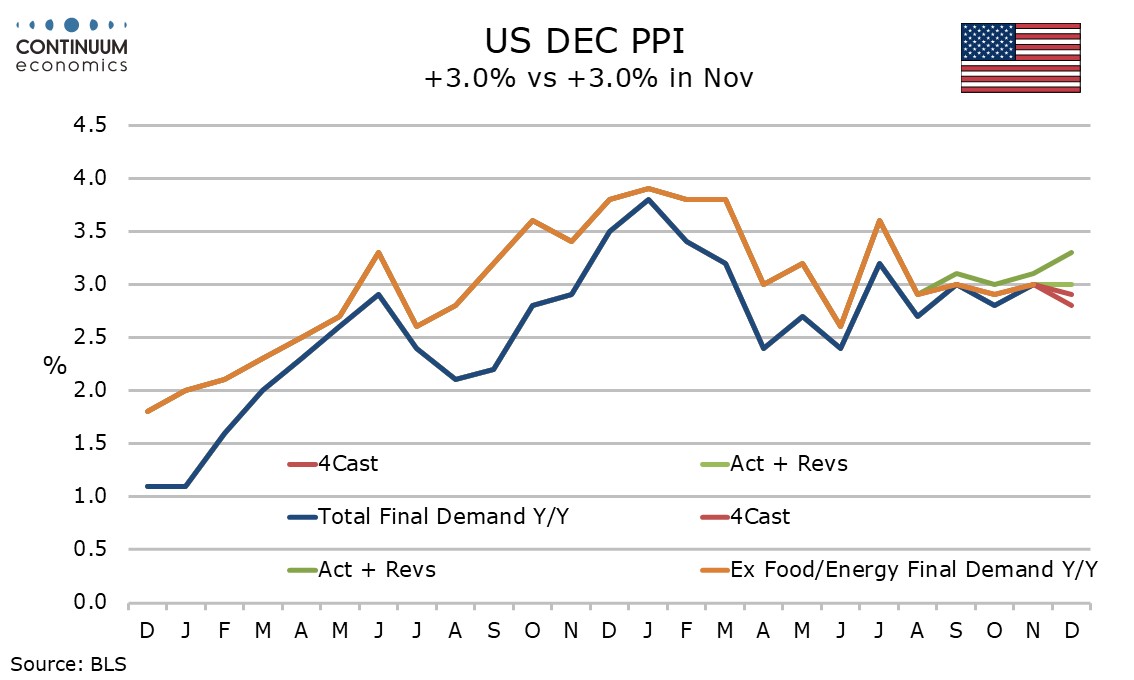

Yr/yr data was unchanged at 3.0% overall and 3.5% ex food, energy and trade. Ex food and energy did however pick up, to 3.3% from 3.1%. Yr/yr growth was slowing early in the year but has regained momentum since June, when yr/yr growth was 2.4% overall, 2.6% ex food, energy and trade and 2.6% ex food and energy. The obvious culprit is tariffs.

Intermediate goods data shows a 0.1% decline in processed goods but a 0.7% increase ex food and energy, while unprocessed goods rose by 2.3% and 2.6% ex food and energy. Intermediate services saw a broad based rise of 0.7%. Yr/yr growth in intermediate services has increased to 2.7% in December from 1.6% in June. That is less easy to blame on tariffs.