RBNZ Review: Continue the Easing Cycle

RBNZ cut its cash rate by 50bp to 3.75%

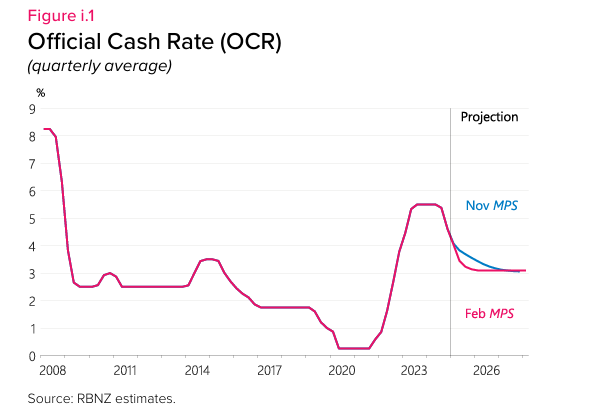

The RBNZ cut its cash rate by 50bp to 3.75% in the February meeting, revised OCR forecast to indicate more rate cut in 2025 and keep terminal rate at sub 3% after mid 2025, along with minor revision in other economic forecast.

Some key takeaways:

More Cuts to Come: "If economic conditions continue to evolve, scope to lower OCR further in 2025". The RBNZ cut by 50bps which is faster than the November forecast. The February forecast now see another frontload of 50bps before a 25bps to bring rate to 3%.

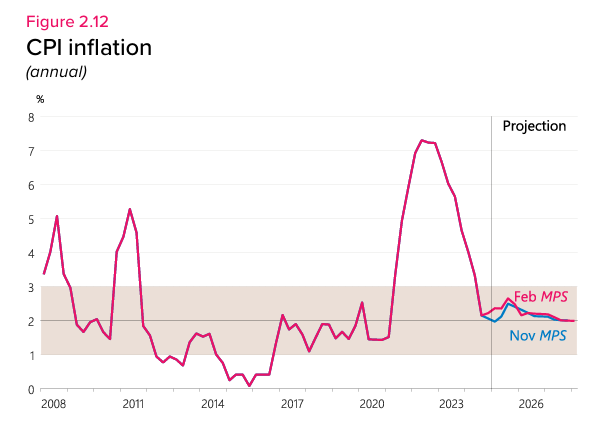

Inflation Expectation: The RBNZ sees CPI, core CPI & expectation to remain closer to the middle of target range and they are forecasting such momentum to roll through 2025. Moreover, the latest spike in Q4 CPI has been attributed to transitory factors of energy price and is expected to further moderates. Thus, the RBNZ is comfortable to further aggressively ease rates.

Forward Guidance Stays with Forecast Revision: The forward guidance has been changed in wordings but not its meaning "If economic conditions continue to evolve as projected, the Committee expects to be able to lower the OCR further early next year.". The CPI has shown stronger inflation in the first half of 2025 and sharper moderation in the second half of 2025.