U.S. June Empire State survey less weak, Prices slower

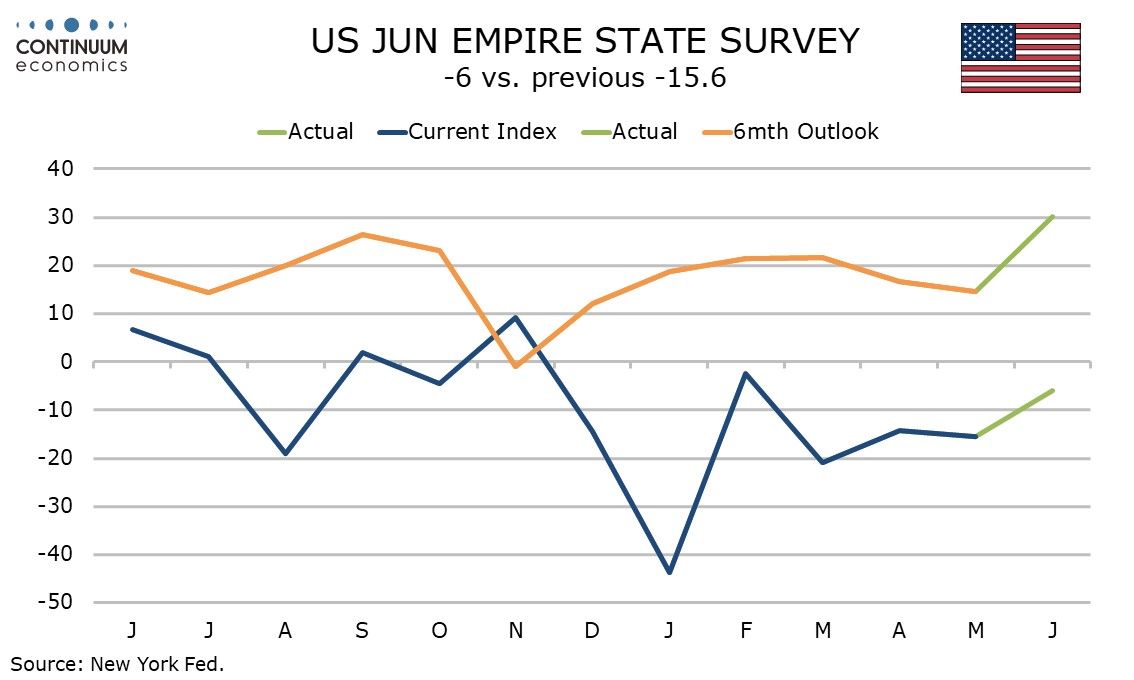

June’s Empire Sate manufacturing index of -6.0 is less weak than expected and up from -15.6 in May, though given the volatility of the index and that it remains negative we would not make any strong conclusions from this. Prices data is softer and that may be more significant.

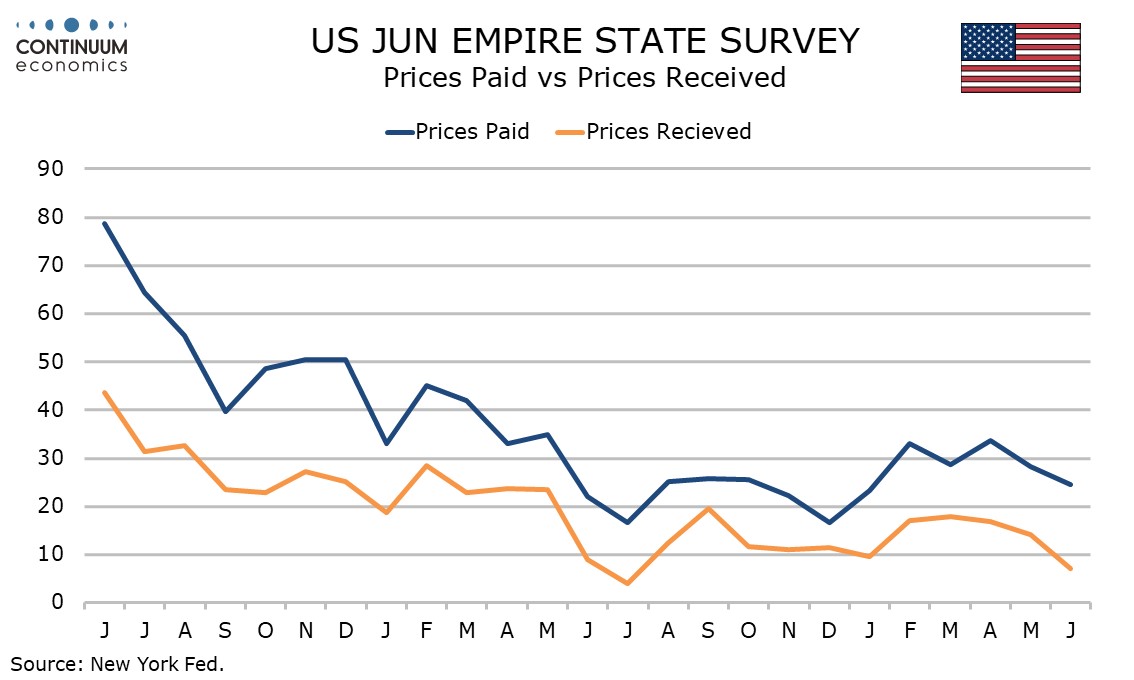

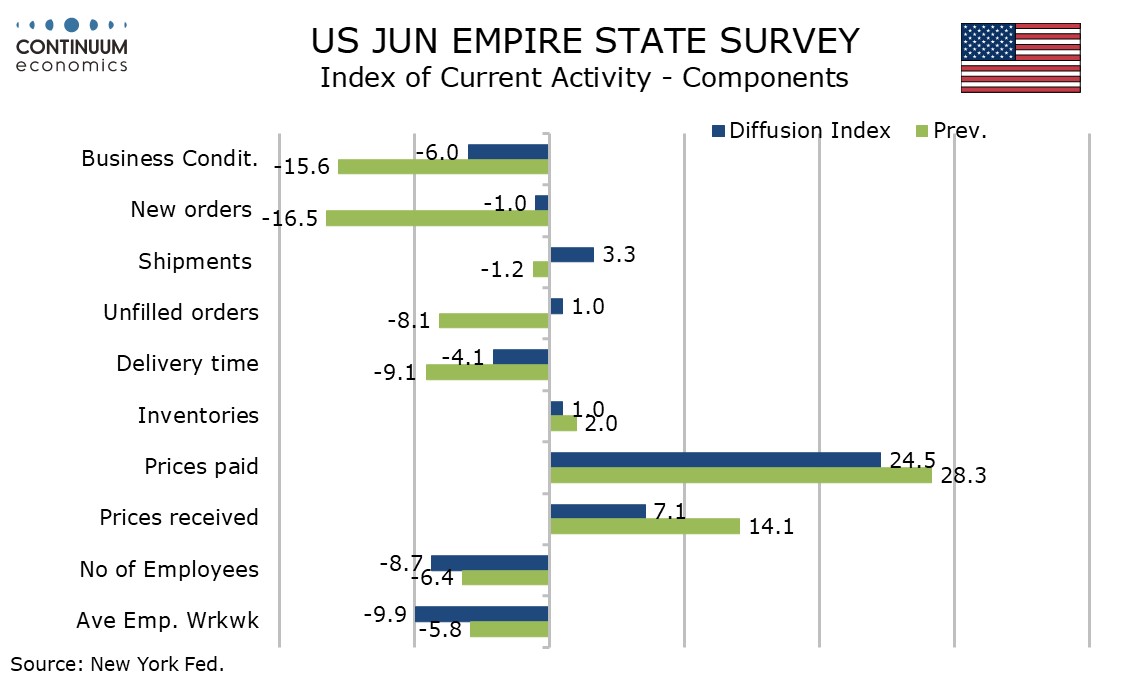

Prices paid at 24.5 from 28.3 are the softest since February but more significant is a sharp fall in prices received to 7.1 from 14.1, reaching their slowest since July 2023.

The current month detail shows new orders only marginally negative at -1.0 from -16.5 but there is increased weakness in employment at -8.7 from -6.4 and the workweek at -9.9 from -5.8, so the detail is mixed.

Six month expectations for activity at 30.1 from 14.5 showed a significant bounce to their highest level since March 2022. New orders and employment were stronger but the workweek softened in the 6 month breakdown. 6 month expectations on prices were softer, though not sharply.