EUR/NOK, NOK/SEK: NOK to Uprate in 2026

We see EUR/NOK to 11.0 by end 2026.

Despite the broadly risk positive tone in markets in recent years, the NOK, which is typically a risk positive currencies, has hugely underperformed movements in yield spreads over the last couple of years. From an absolute valuation perspective, NOK ought to benefit from their relatively high yields, and in Norway’s case, from their substantial budget and current account surplus. Norway’s budget and current account position suggests the NOK ought to be considered a safe haven akin to the CHF, and indeed that was the case 15 years ago when the valuation of the two currencies relative to PPP was similar. However, the NOK has fallen back rapidly in recent years, and started to be seen as a risk currency rather than a safe haven, helped to some extent by the selling of NOK by the government pension fund which neutralizes the direct impact of the current account surplus on the currency.

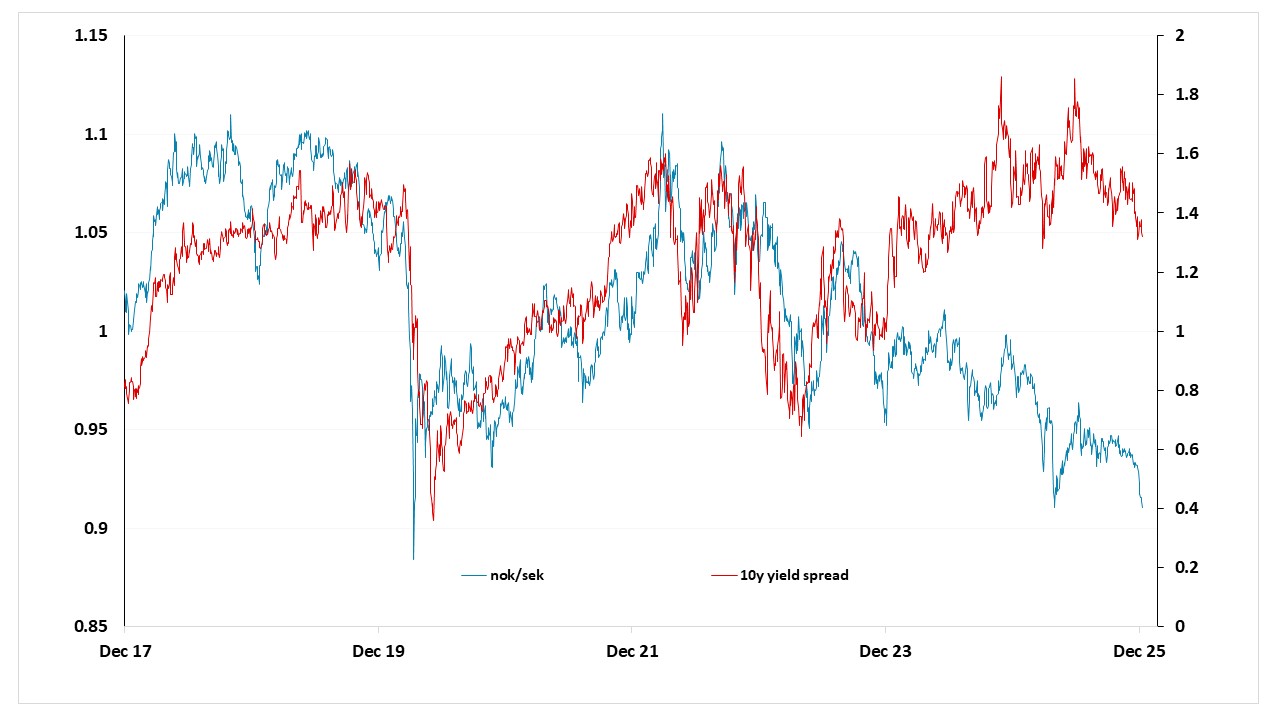

However, the NOK offer yields at or above U.S. levels which suggests it should be trading above long term equilibrium levels. From a pure valuation perspective, relative to PPP, NOK trades at a similar level to the SEK. For the NOK, more attractive yields and a bigger current account surplus relative to Sweden suggests valuation should be above the SEK, but NOK/SEK has fallen to close to all time lows in the last year and has substantially underperformed moves in yield spreads. We see 11.00 on EUR/NOK and NOK/SEK coming close to parity by end 2026.

Figure 1: NOK/SEK and 10 year yield spreads

Source: Datastream, CE