U.S. Initial Claims, Housing Starts, Philly Fed and Current Account all disappoint

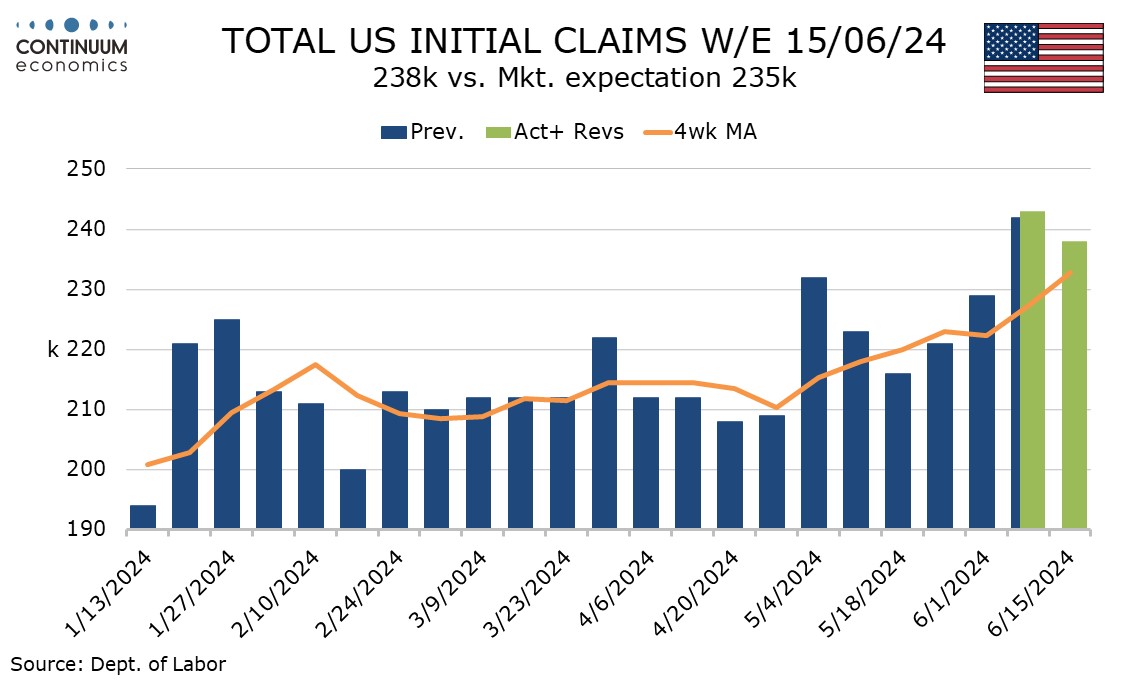

The latest round of US data is all on the weak side of expectations (though the Philly Fed survey saw higher price indices), with initial claims being of most significance in that this is the survey week for June’s non-farm payroll. While slightly lower on the week, at 238k, last week’s 14k spike to 243k has been largely sustained.

The 4-week initial claims average of 233k is the highest since September 2023 and up from 220k in May’s non-farm payroll survey week.

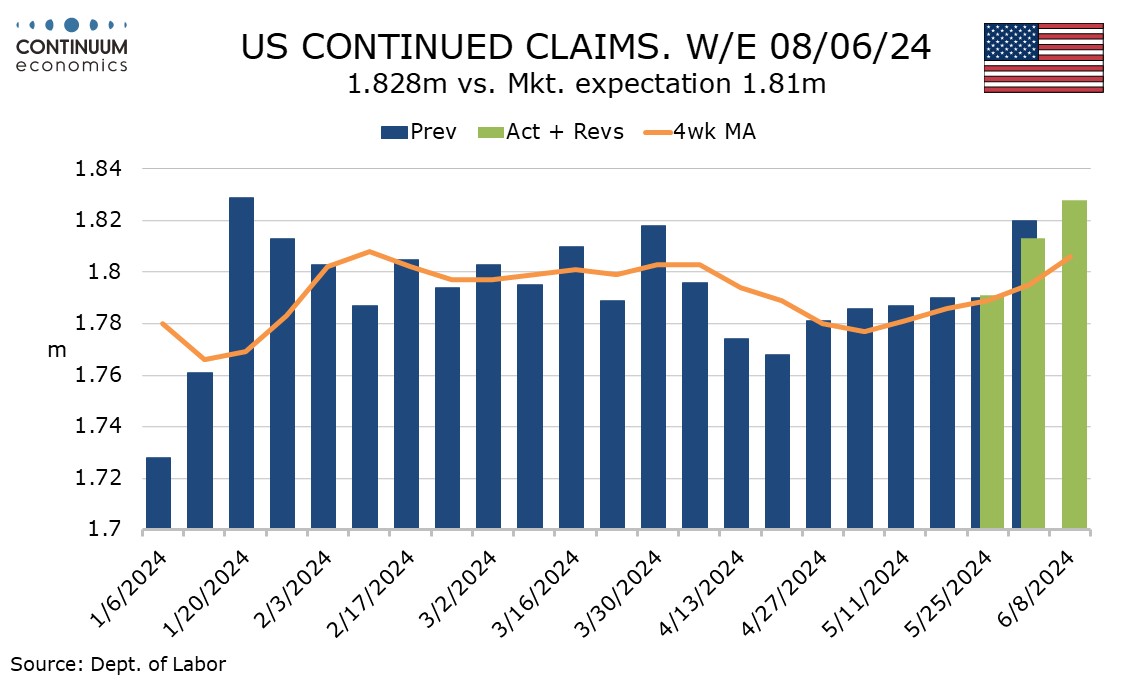

Continued claims at 1.828k are up by 15k and this is the seventh straight gain, though the size of the gains remains quite modest if gaining some momentum in the latest two weeks. Continued claims cover the week before initial claims.

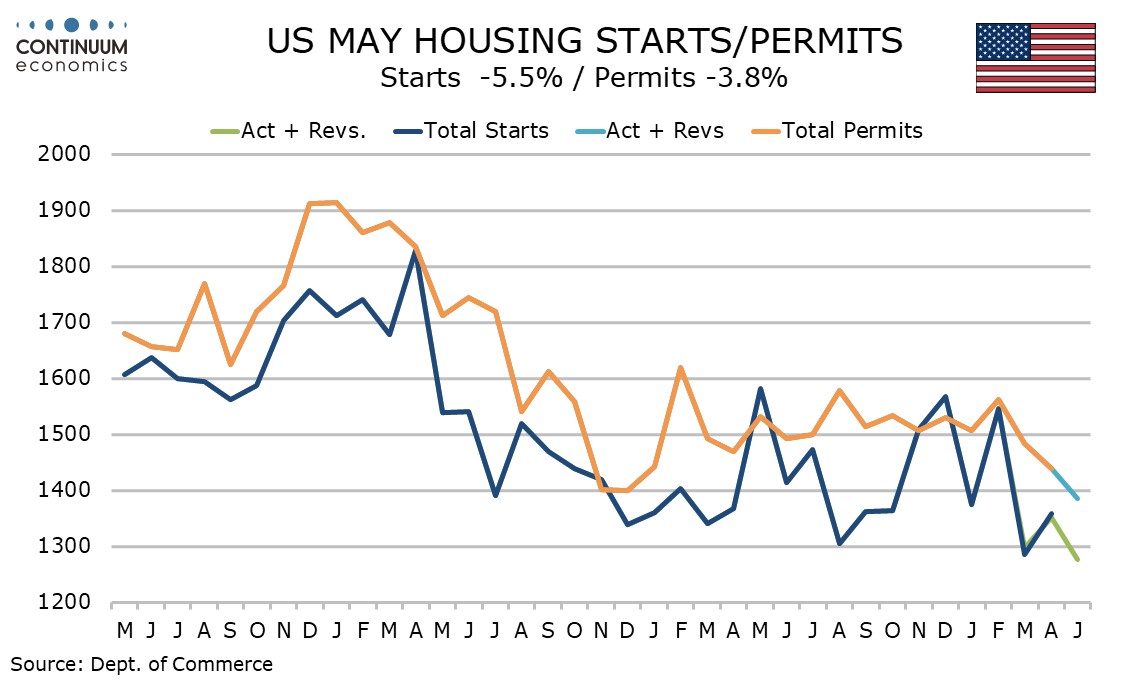

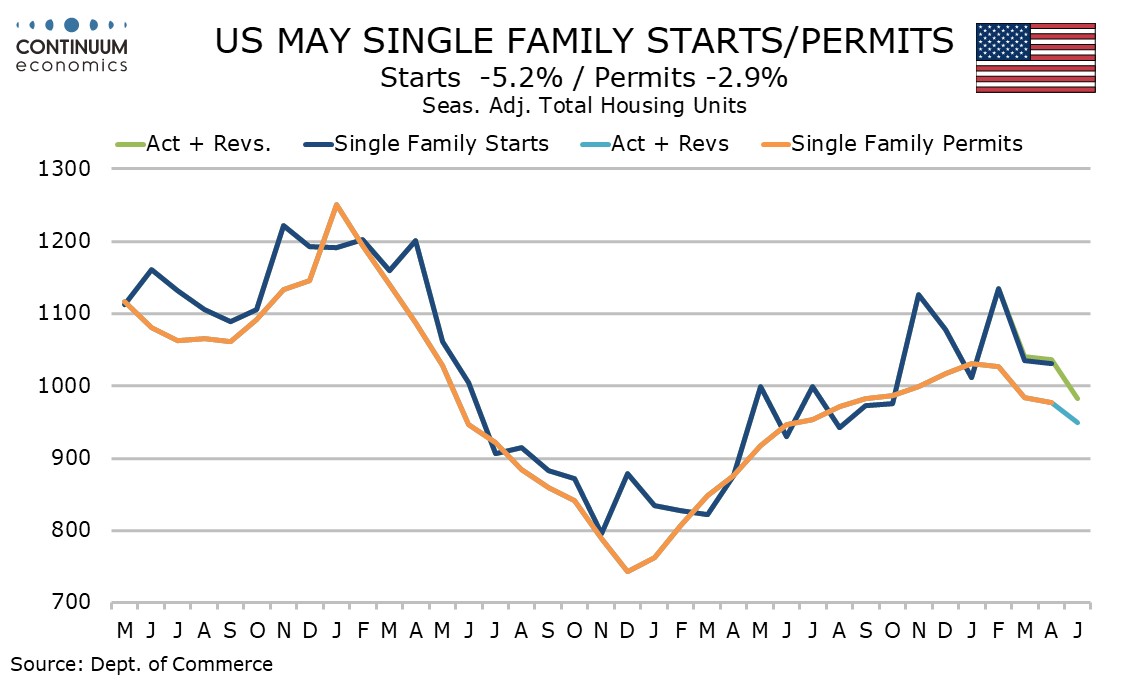

May housing starts at -5.5% to 1277k and permits, -3.8% to 1386k, both saw the lowest levels since June 2020 when we were barely past the height of the pandemic. This backs other signals of slowing housing activity, including yesterday’s NAHB homebuilders’ survey for June.

Both series saw slightly larger declines in the volatile multiples sector though singles in both series were weaker. In the case of single permits this is fourth straight decline after a string of thirteen straight increases, a clear sign that trend has turned.

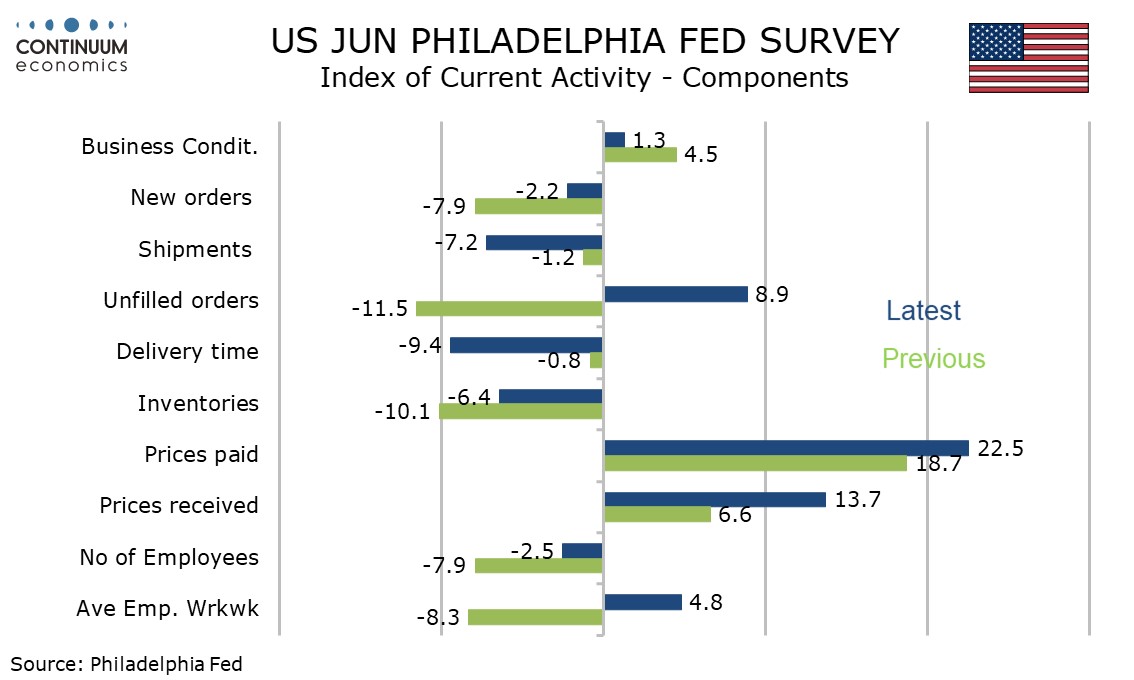

June’s Philly Fed index of 1.3 is down from 4.5 in May but still positive and the details show gains in new orders, employment, the workweek and both prices paid and received, though the new orders and employment levels are still negative. Prices received at 13.7 from 6.6 are the highest since July 2023.

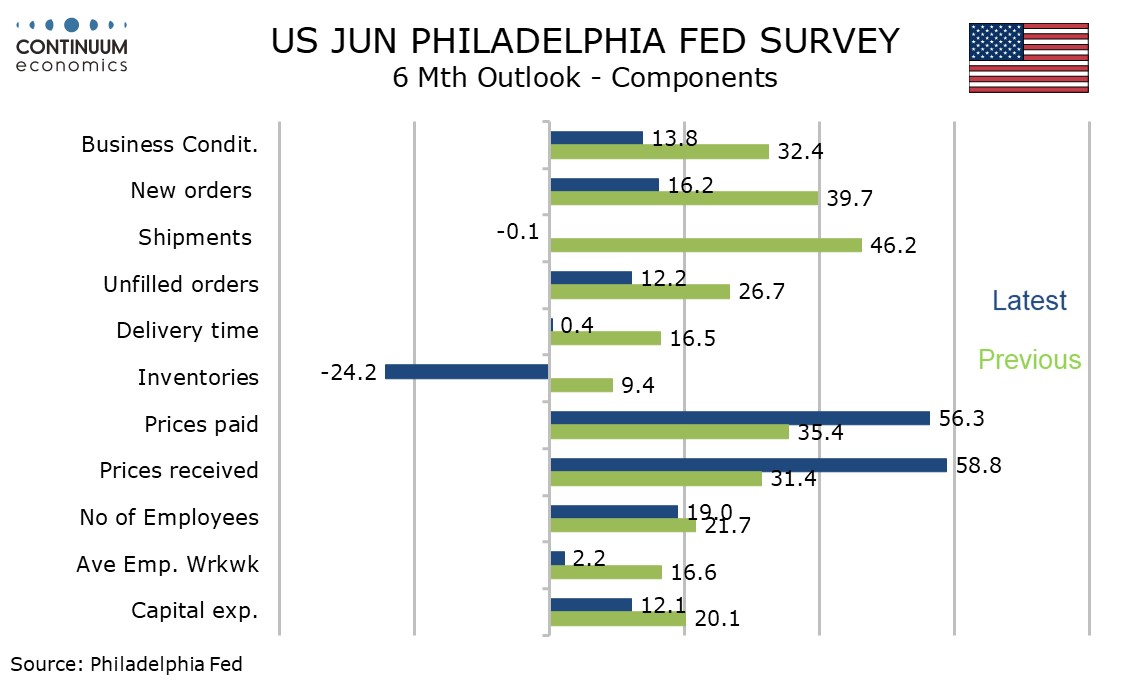

Six month expectations on activity slowed to 13.8 after three straight readings in the thirties. Six month price expectations however moved above 50 for both prices paid and received after May readings in the thirties, so the Philly Fed survey cannot be seen as a weak one, particularly in its signals on inflation.

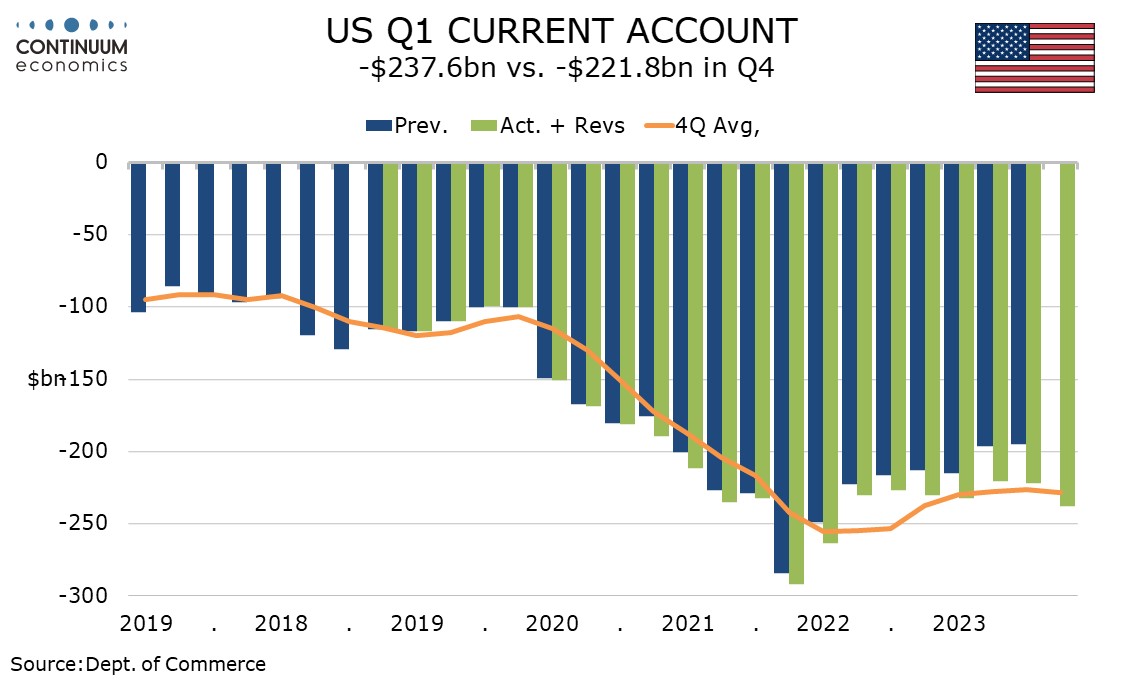

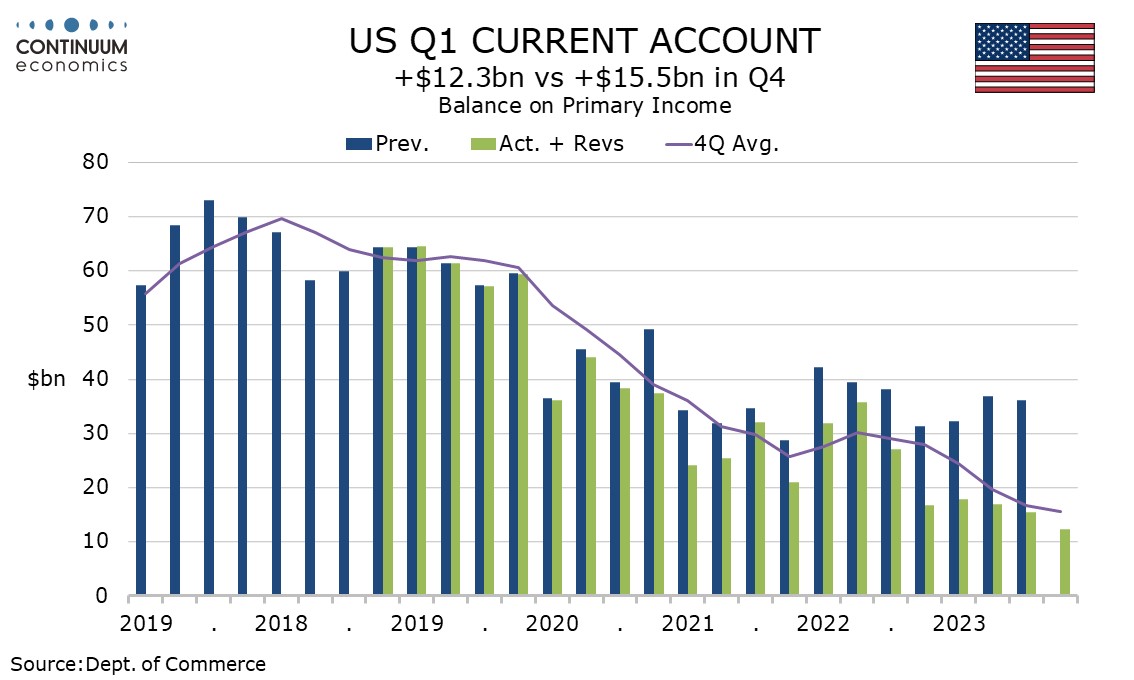

A wider than expected Q1 current account deficit of $237.6bn versus a Q4 total of $221.8bn (revised from $194.8bn) completes a set of disappointing data.

Goods and services data was already visible with the main surprises coming in primary (investment) income, where the $12.3bn surplus was not much down from Q4’s $15.5bn but the latter was revised sharply from $36.1bn. The secondary (unilateral transfers) income deficit also increased to $45.5bn from $43.3bn, the latter revised from $38.9bn.