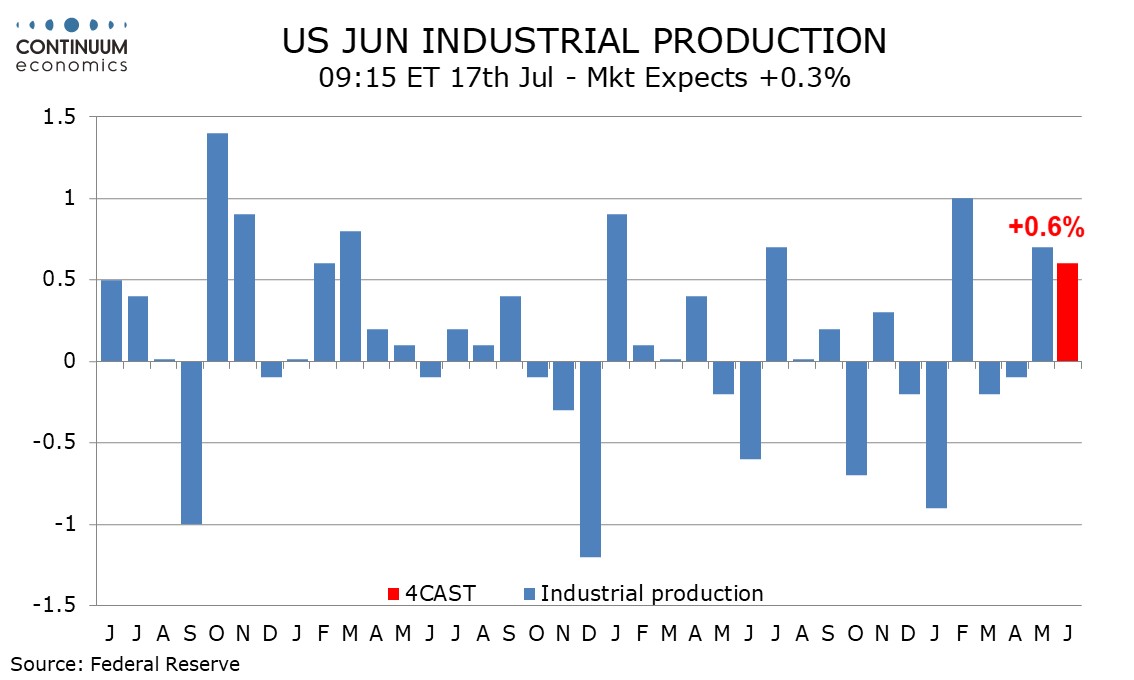

Preview: Due July 17 - U.S. June Industrial Production - Utilities to lead another strong rise

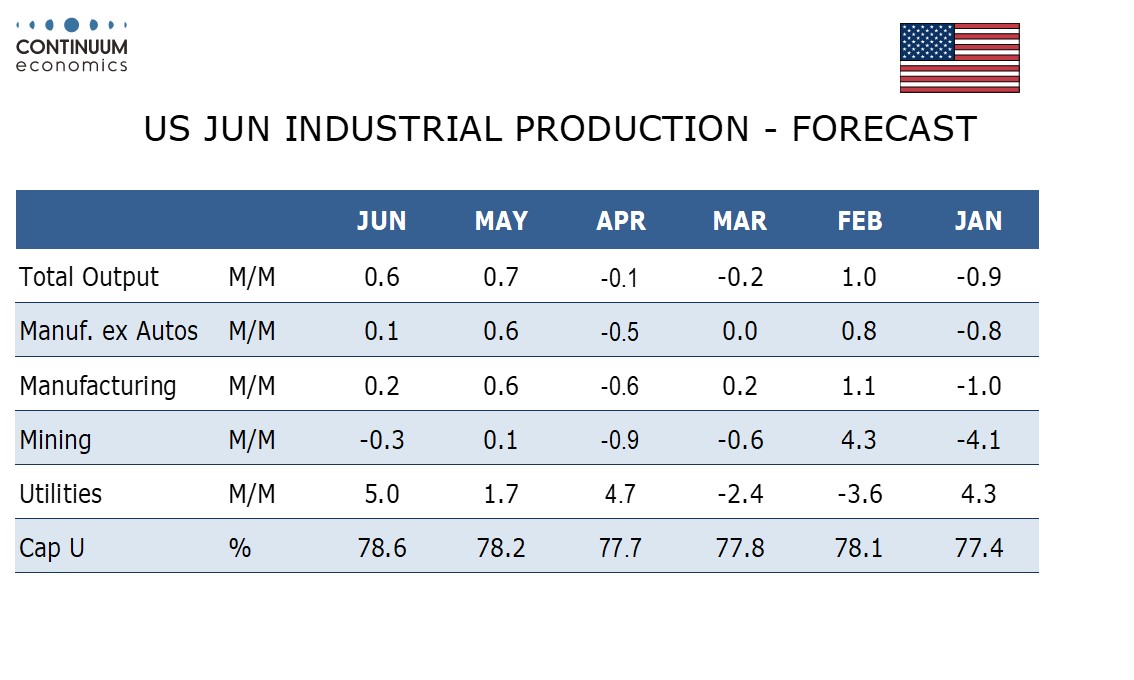

We expect June industrial production to rise by 0.6% overall, extending a 0.7% May increase, led by a weather-related boost to utilities. We expect a modest 0.2% rise in manufacturing, extending a 0.6% bounce in May.

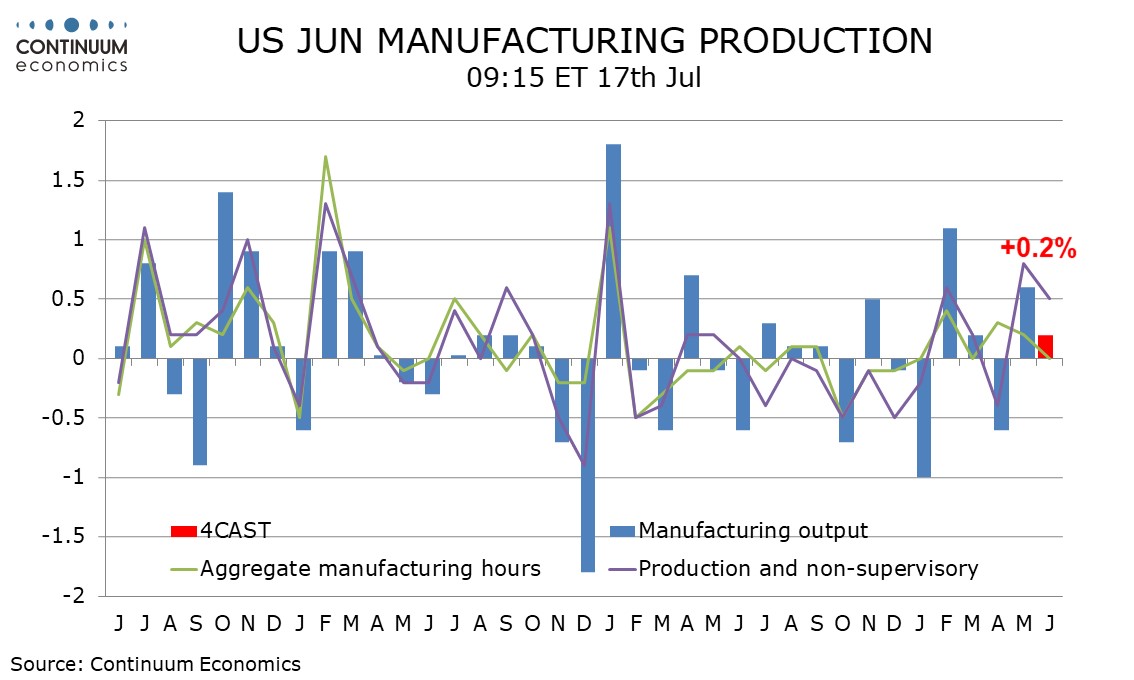

June’s non-farm payroll shows manufacturing aggregate hours worked unchanged overall but a healthy 0.5% increase for production and nonsupervisory workers. This hints at a positive manufacturing output outcome, though a repeat of May’s 0.6% increase, which reversed a similar decline in April, looks unlikely, with ISM manufacturing data weaker in June.

We expect autos to make a modest positive contribution to manufacturing given that payrolls showed a rise in auto employment despite slippage in overall manufacturing. Weekly electrical output suggests a strong 5.0% increase in utilities due to warmer weather which will comfortably outweigh what we expect will be a modest 0.5% decline in mining, maintaining a recent weakening in trend.

We expect capacity utilization to rise to 78.6% overall from 78.2%, a figure that was revised down from 78.7% with historical revisions released on June 28. 78.6% would be the highest since September. Manufacturing we expect to see only a marginal gain, to 77.4% from 77.3%, still below March’s 77.5%.