U.S. Initial Claims bounce, Q1 GDP revisions marginal with mixed detail

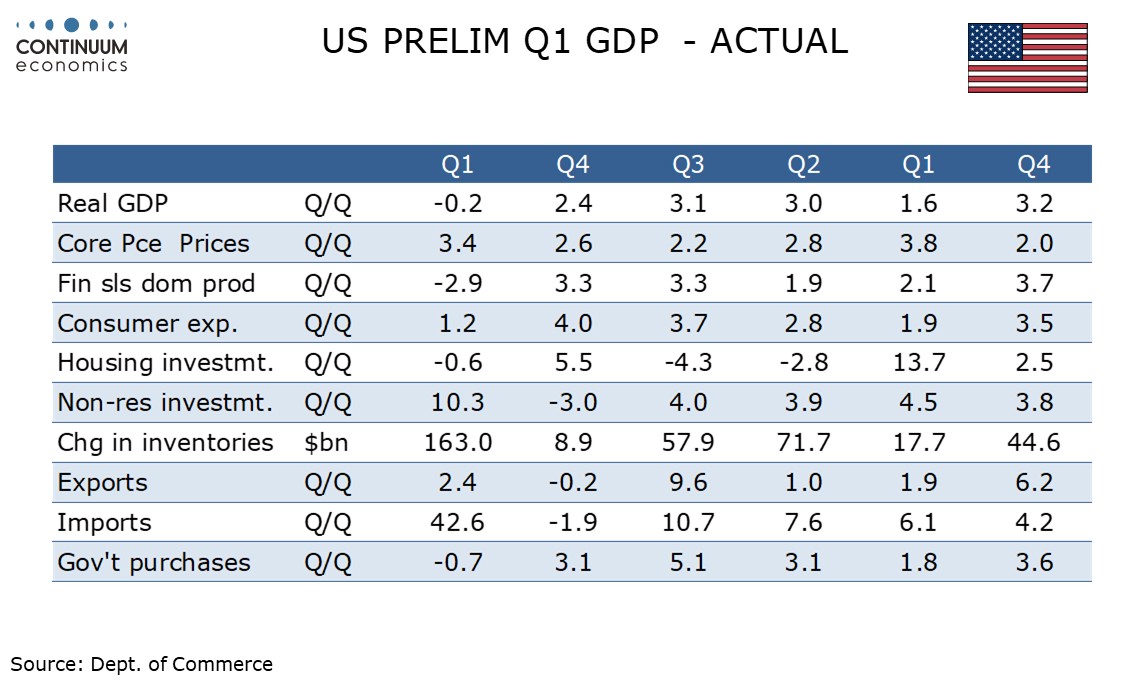

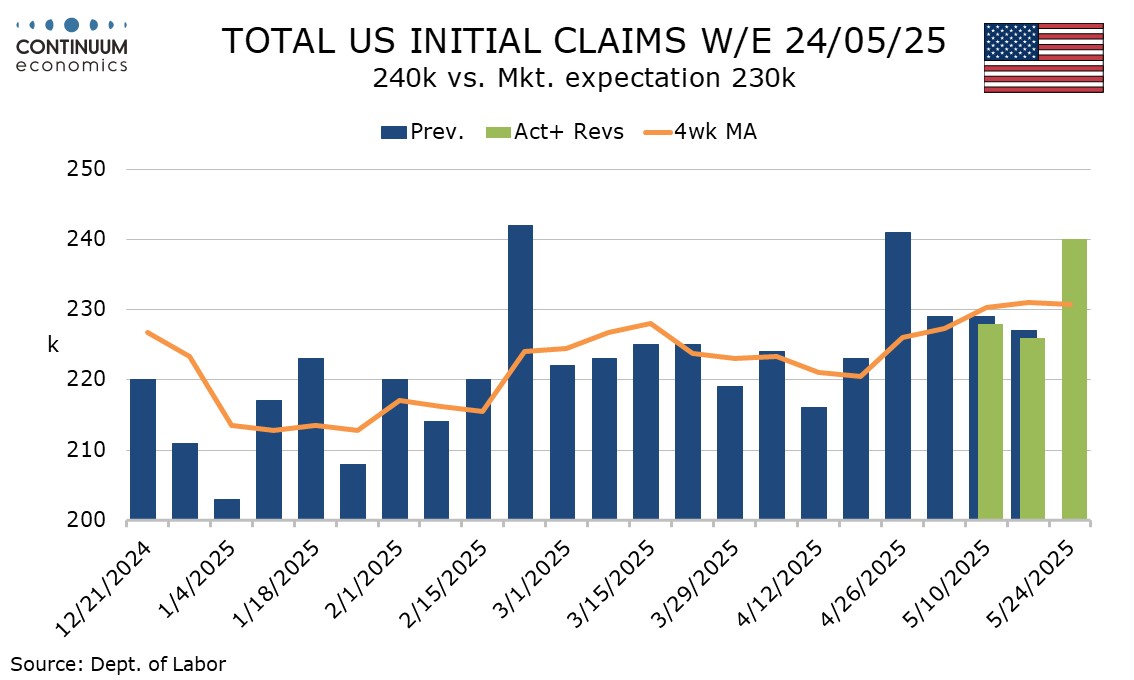

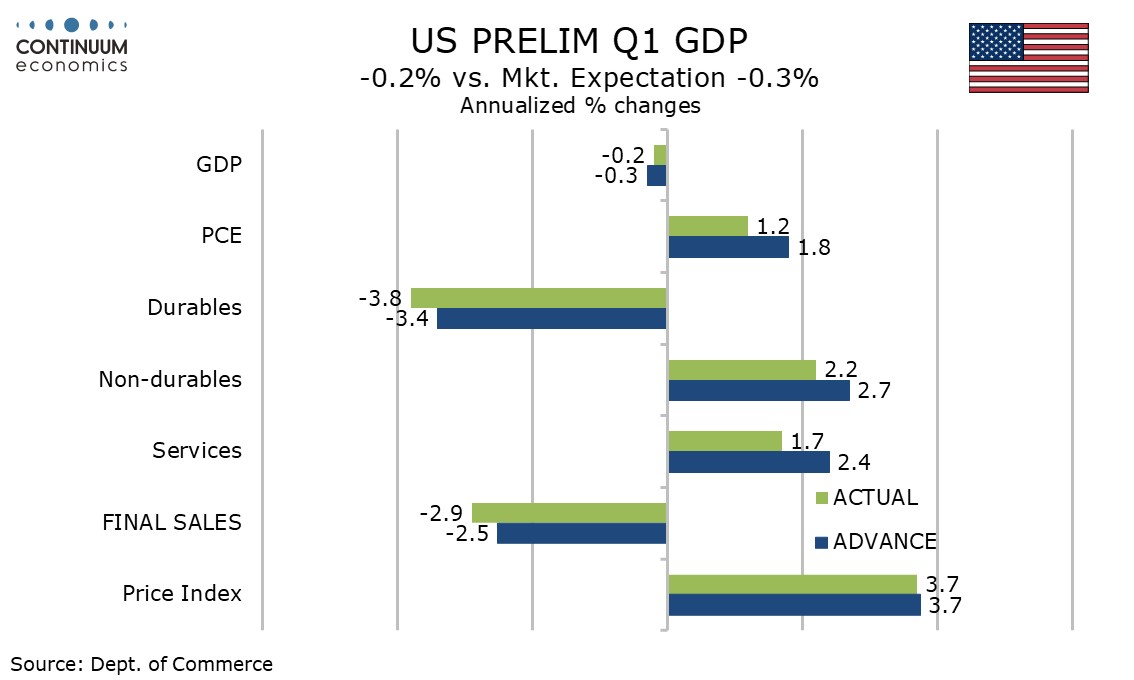

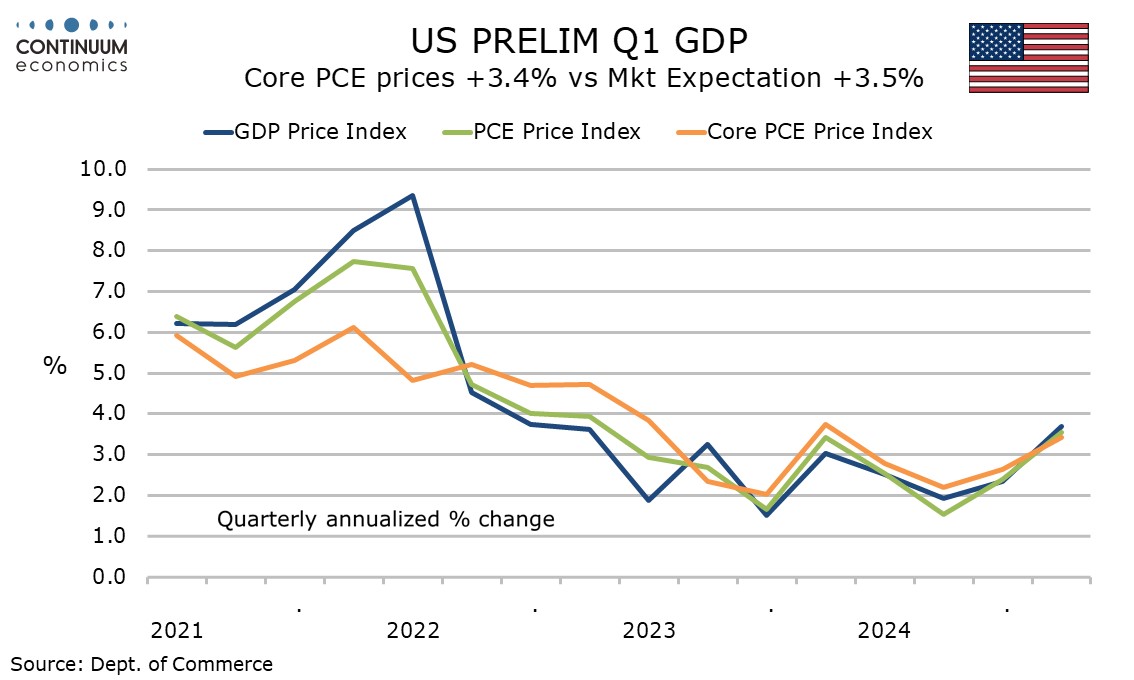

Initial claims have seen an unexpected bounce to 240k from 226k, which could be a sign of a weakening labor market but judgement must be cautious on one week of data. Q1 GDP revisions are marginal but favorable, GDP revised up to -0.2% from -0.3% and core PCE prices revised down to 3.4% from 3.5%, though GDP remains negative and core PCE prices remain firm.

Initial claims have exceeded the latest level only twice in 2024, 241k in the week to April 26 and 242k in the week to February 22, which were attributed to Easter and President’s Day respectively. There is no holiday in the current week ending May 24, though Memorial Day on May 26 was approaching.

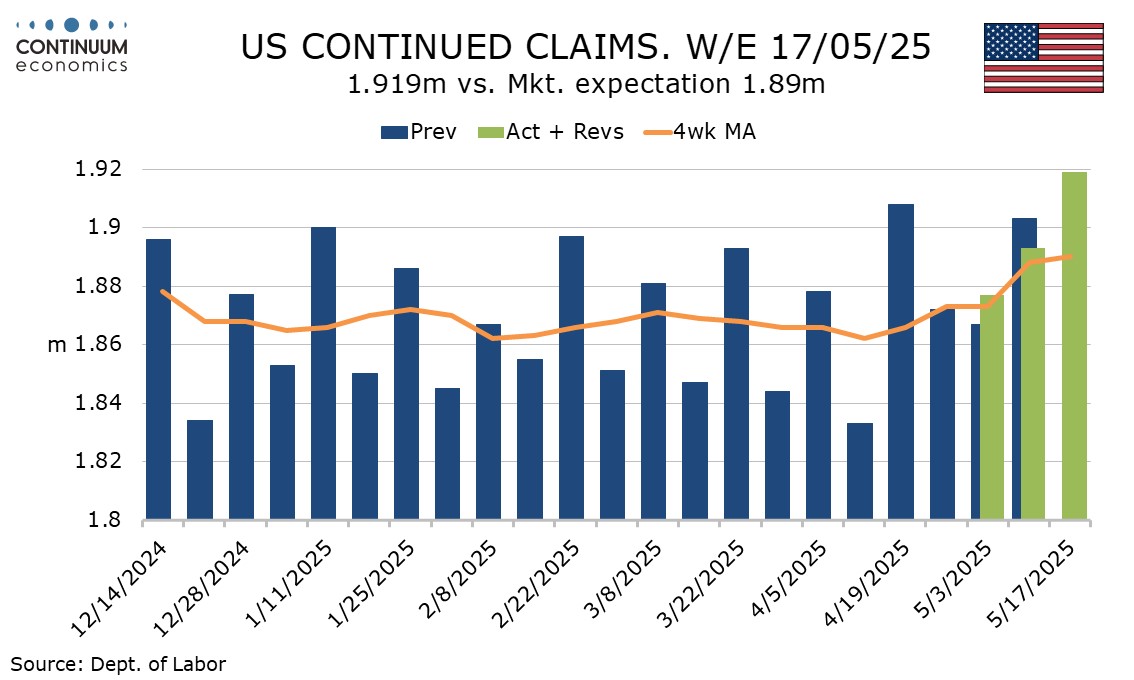

Continued claims increased by 26k to 1.919m, the highest level since November 2021. The continues claims data covers the survey week for May’s non-farm payroll, while initial claims cover the week after. The 4-week continued claims average continues to rise if marginally but the initial claims 4-week average is stable. Both series had above trend data from four weeks ago dropping out.

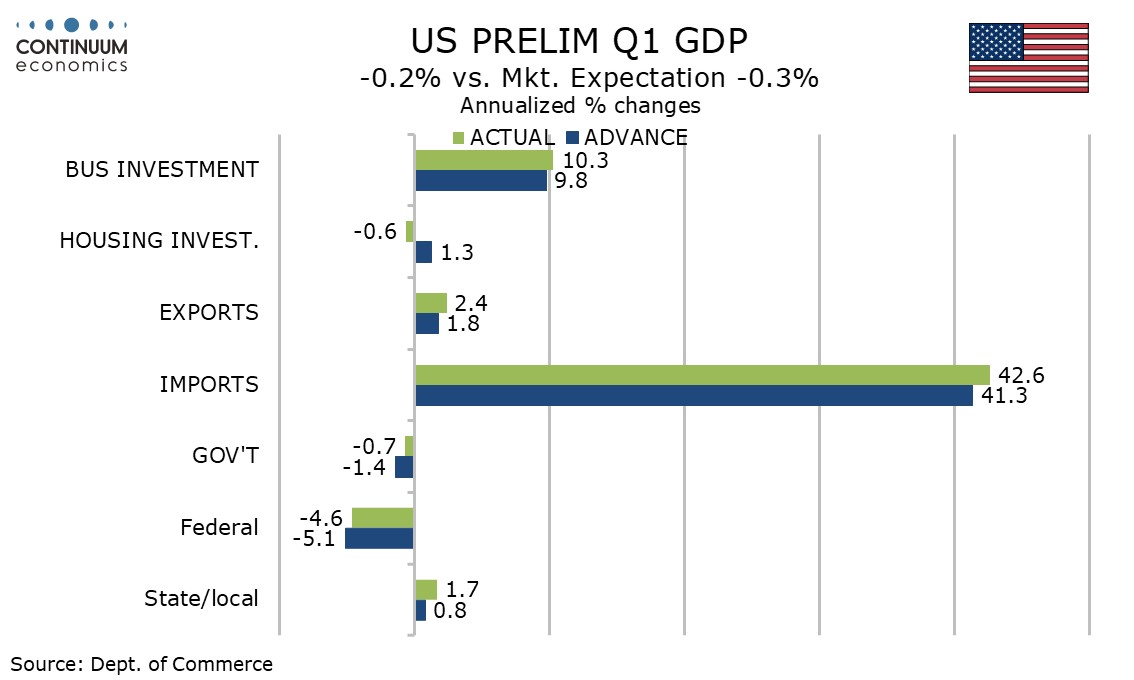

The Q1 GDP revision is marginal but consumer spending saw a significant downward revision to 1.2% from 1.8% with goods and services both revised lower. Housing investment was also revised lower to -0.6% from a 1.3% rise.

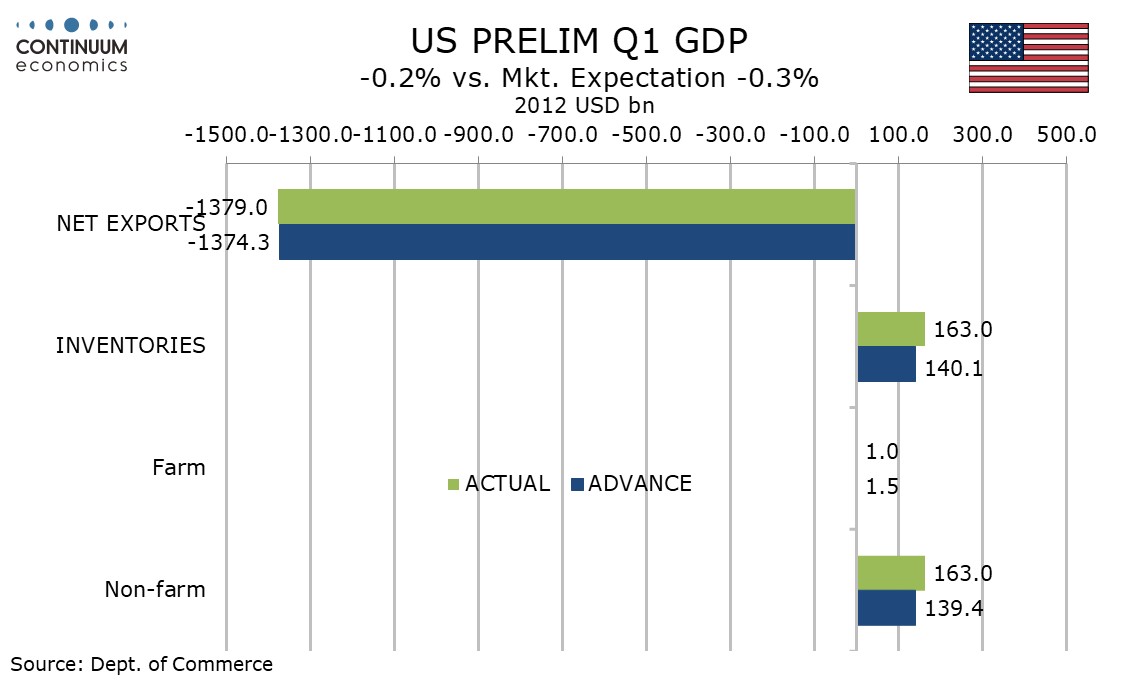

Positive revisions came from business investment, to 10.3% from 9.8%, and inventories, with final sales (GDP less inventories) revised down to -2.9% from -2.5%. Stronger inventories and business investment help explain where a surge in imports went, something the FOMC minutes yesterday struggled to understand.

Net exports were revised lower from an already sharp negative with imports and exports both revised higher. Final sales to domestic buyers (GDP less inventories and net exports) was revised to a 2.0% increase from 2.3%. Government was revised up to -0.7% from -1.4%. Final sales to private domestic purchases (GDP less inventories, net exports and government) were revised down to 2.5% from 3.0%.

Despite the downward revision to consumer spending real disposable income was revised up to 2.9% from 2.7%. However Gross Domestic Income, this a first estimate, was consistent with the GDP data at -0.2%. This agues against suggestions that the decline in GDP was a false estimate.

The overall price index of 3.7% and the PCE price index of 3.6% were both unrevised, making the downward revision to core PCE prices to 3.4% from 3.5% of marginal importance, if in the right direction.