Canada Q1 GDP falls short of expectations but domestic demand firmer and April seen stronger

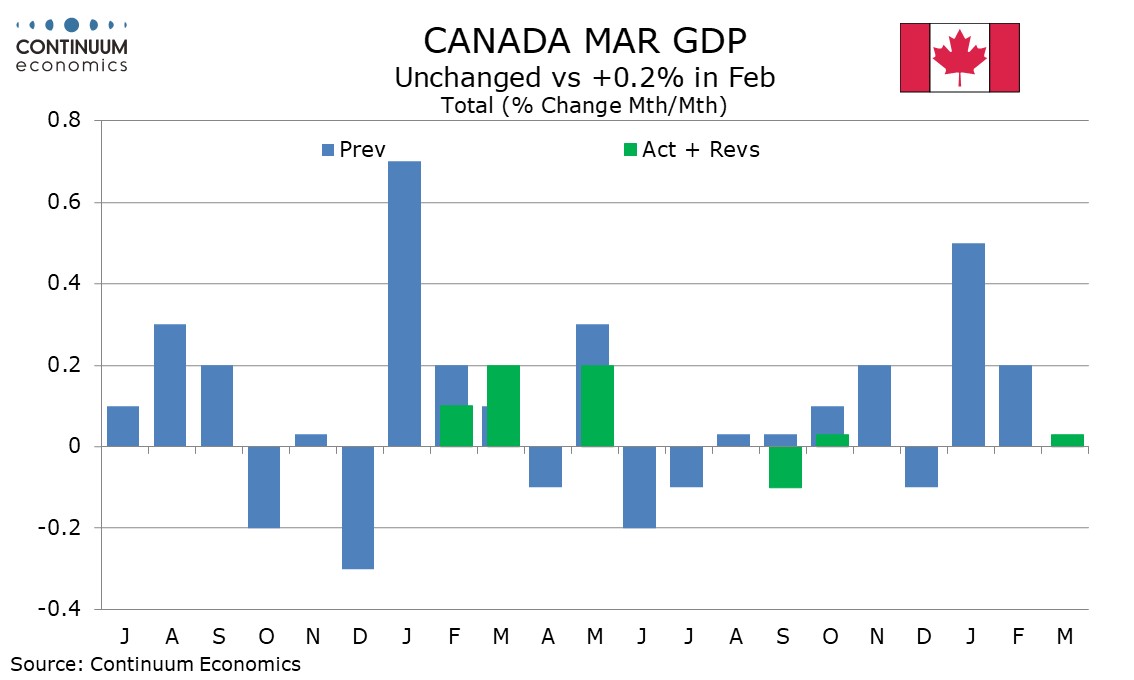

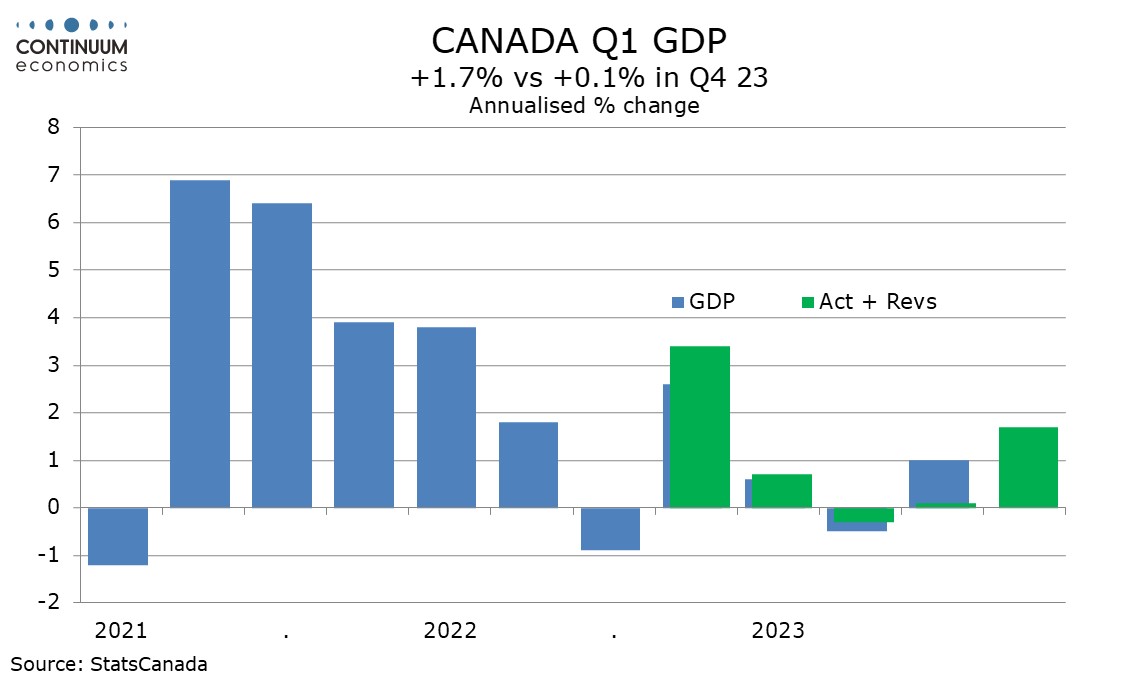

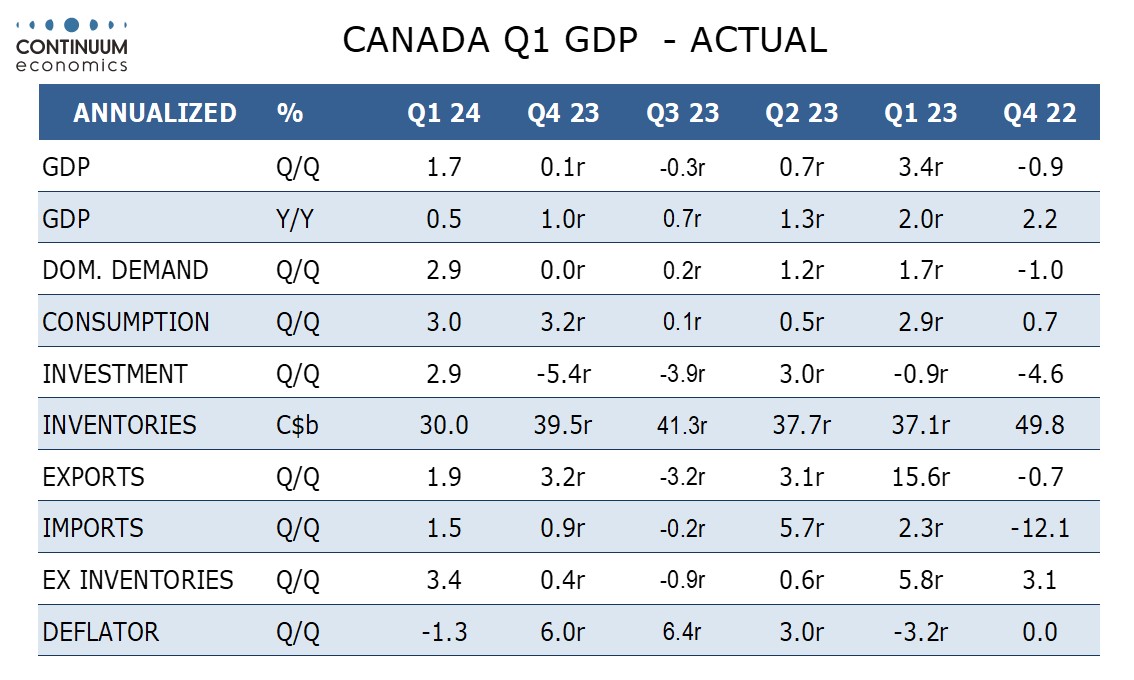

Canada’s Q1 GDP increase of 1.7% annualized is on the low side of expectations though with generally healthy details excluding weaker inventory growth. A flat outcome for March is in line with consensus though the preliminary estimate for April with a rise of 0.3% suggests some momentum entering Q2.

In addition to Q1 GDP coming in on the low side of consensus, Q4 was revised down to a 0.1% annualized increase from 1.0%. Q1 exceeded Q4 in part because public sector strikes in Quebec depressed Q4 data but were solved in January, so the underlying picture is quite subdued, as visible in a yr/yr pace of only 0.9%.

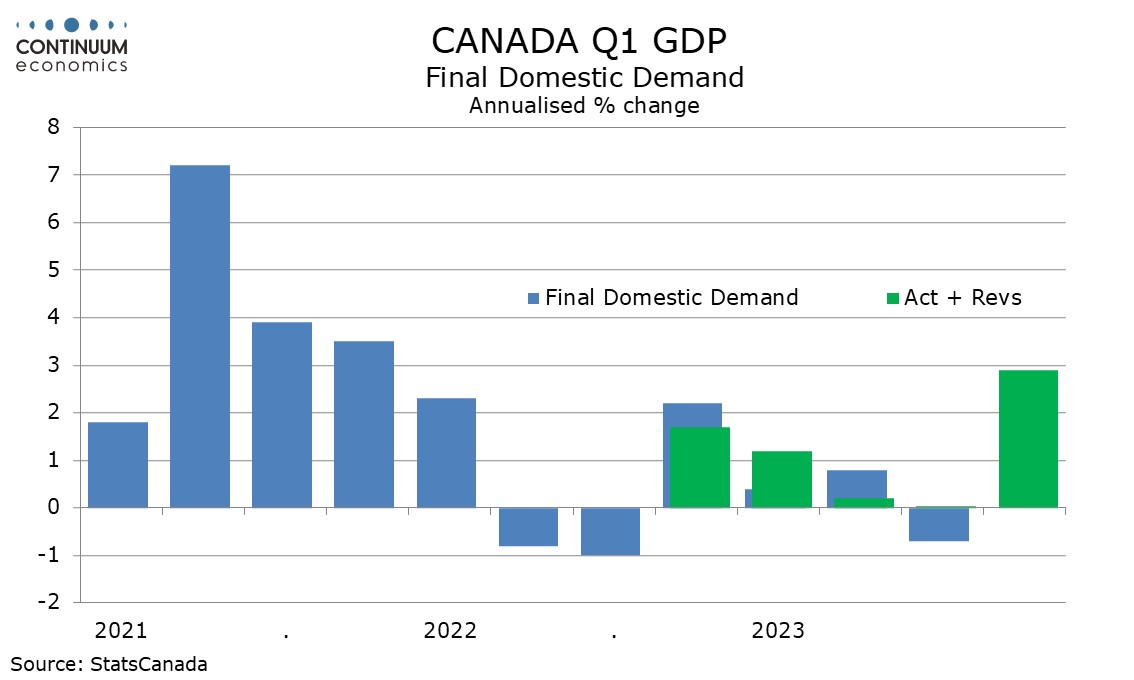

Still, Q1 saw a healthy 2.9% increase in domestic demand, with similar gains from both consumer spending and investment, while growth in exports, while modest at 1.9%, exceeded that of imports at 1.4%. The only negative in the detail was slower inventory growth.

The deflator was subdued with a 1.3% annualized decline though yr/yr growth is still quite firm at 3.5%. The report seems to provide few barriers to a BoC easing next week even if there are few recessionary signals in the data.

Monthly data showed goods and services both unchanged in March with strength in construction but weakness in manufacturing, while services were restrained by slippage in wholesale and retail. Manufacturing and wholesale are projected to rebound in April, with mining also seen firmer.