U.S. December Retail Sales - Continued Resilience

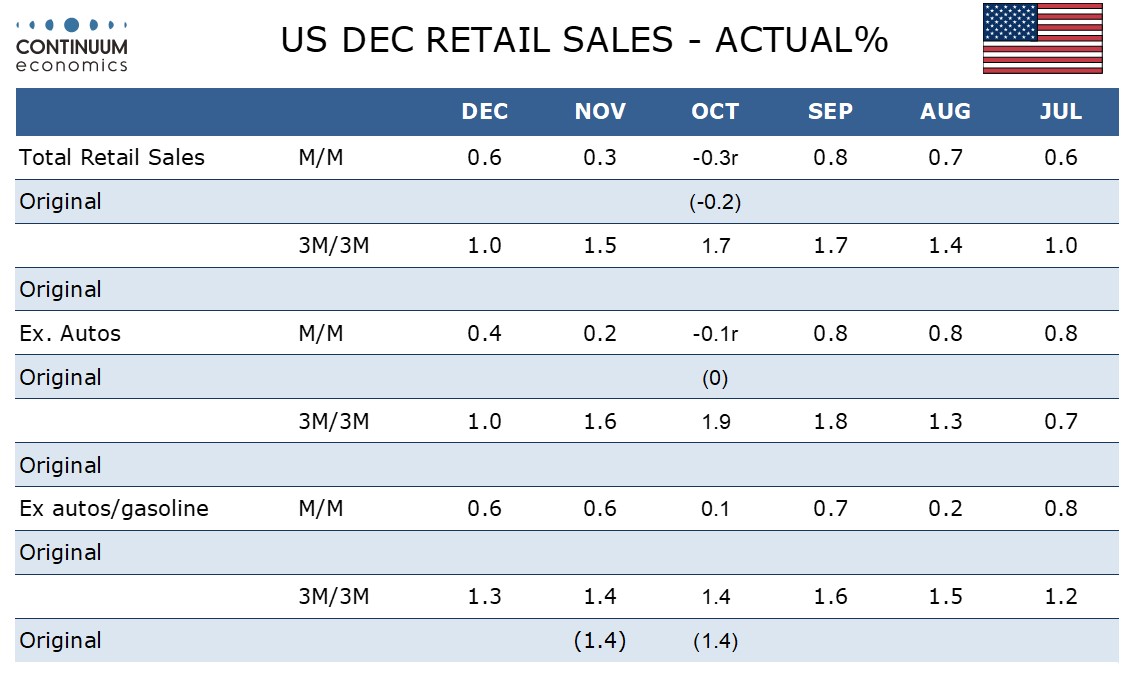

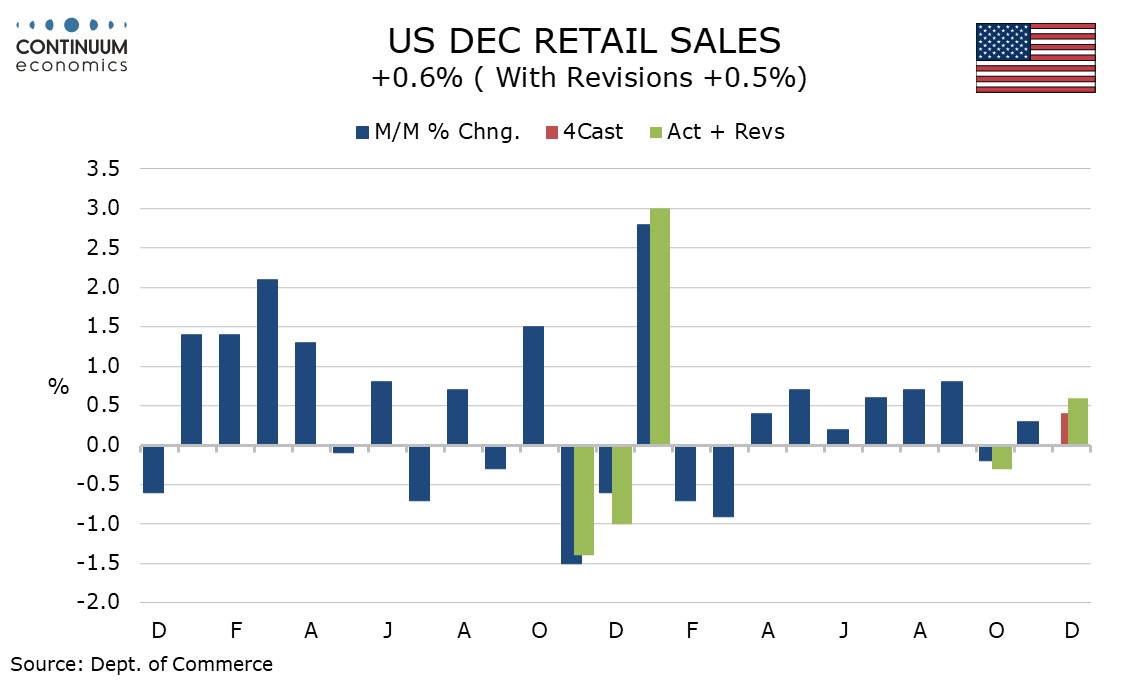

US retail sales made a solid finish to Q4, rising by a stronger than expected 0.6% with ex auto sales up by 0.4% and sales ex auto and gas up by 0.6%. Particularly impressive was a 0.8% rise in the control group, which contributes to GDP.

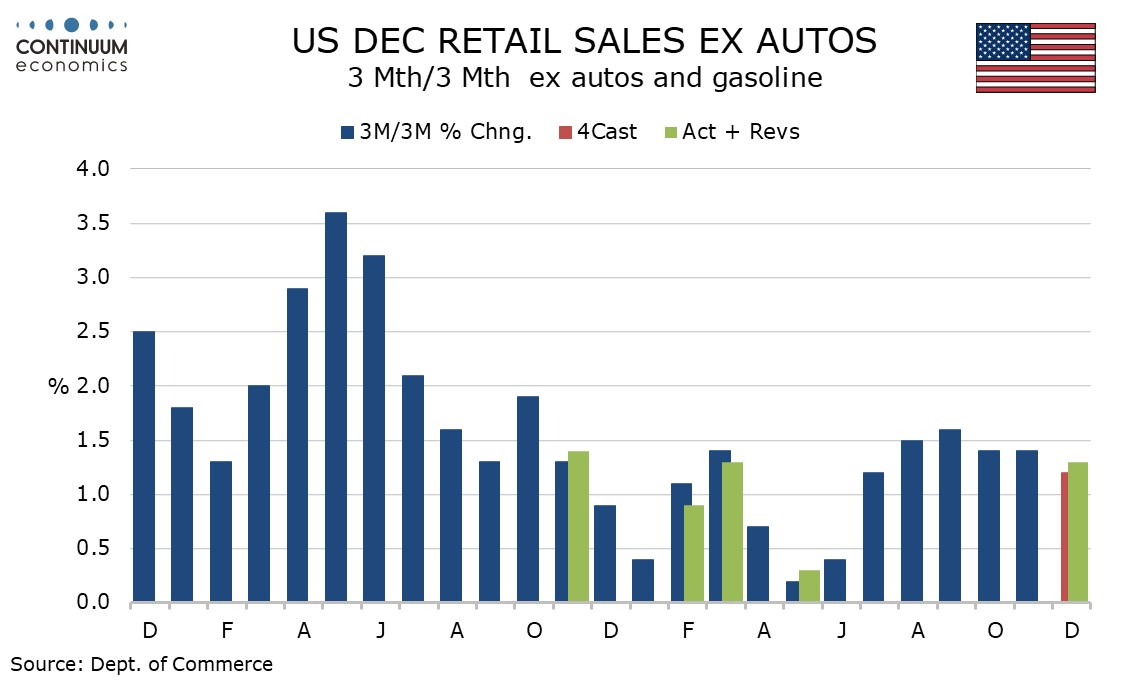

Back month revisions were minimal with October revised down to -0.3% from -0.2% and November unrevised at +0.3%. This leaves Q4 sales up by 1.0% overall and ex auto, still solid but slower than gains of 1.7% and 1.8% (not annualized) respectively in Q3. Ex autos and gasoline the slowing is marginal, to 1.3% in Q4 from 1.6% in Q3.

This leaves the consumer maintaining solid momentum, with real disposable incomes getting a boost from lower inflation, while the boost to savings during the pandemic may not yet be fully depleted. The Q3 strength of the consumer was a surprise to the Fed who will note the continued resilience in Q4.

While the data is solid overall details are mixed. Strength was seen in general merchandise, clothing as well as autos as industry data had already signaled. Weakness was however seen in furniture, health and personal care and gasoline. December’s slippage in gasoline, unlike those of October and November, appears to be on volumes rather than prices.