Canada August GDP - Weak but Q3 looking in line with BoC forecast

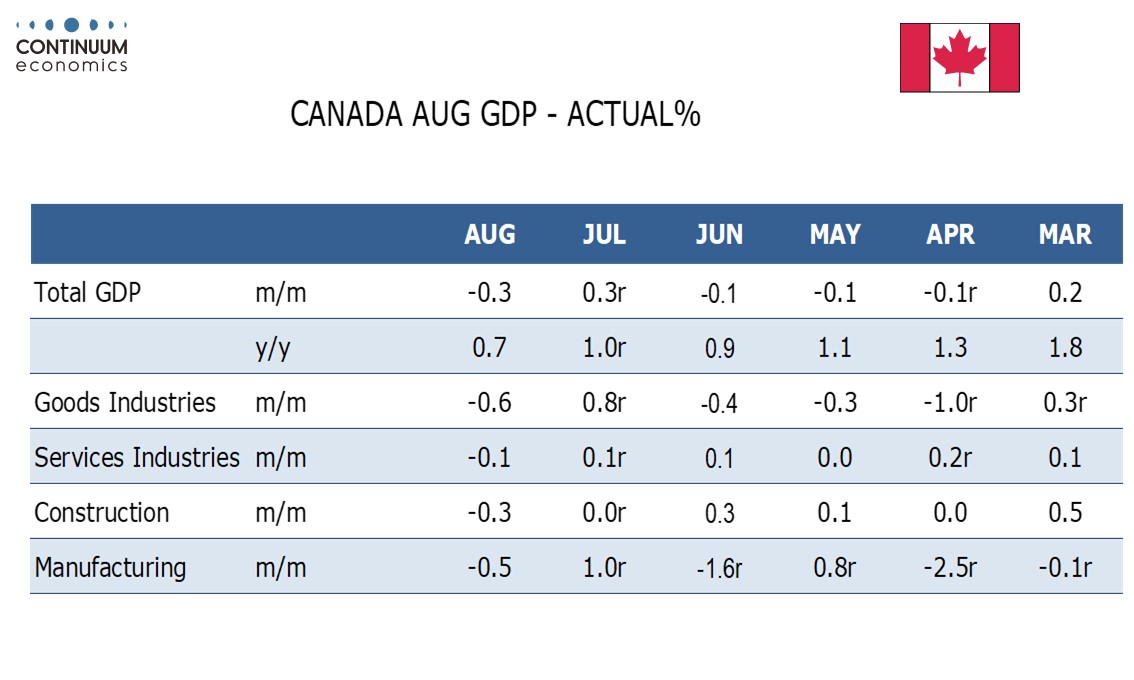

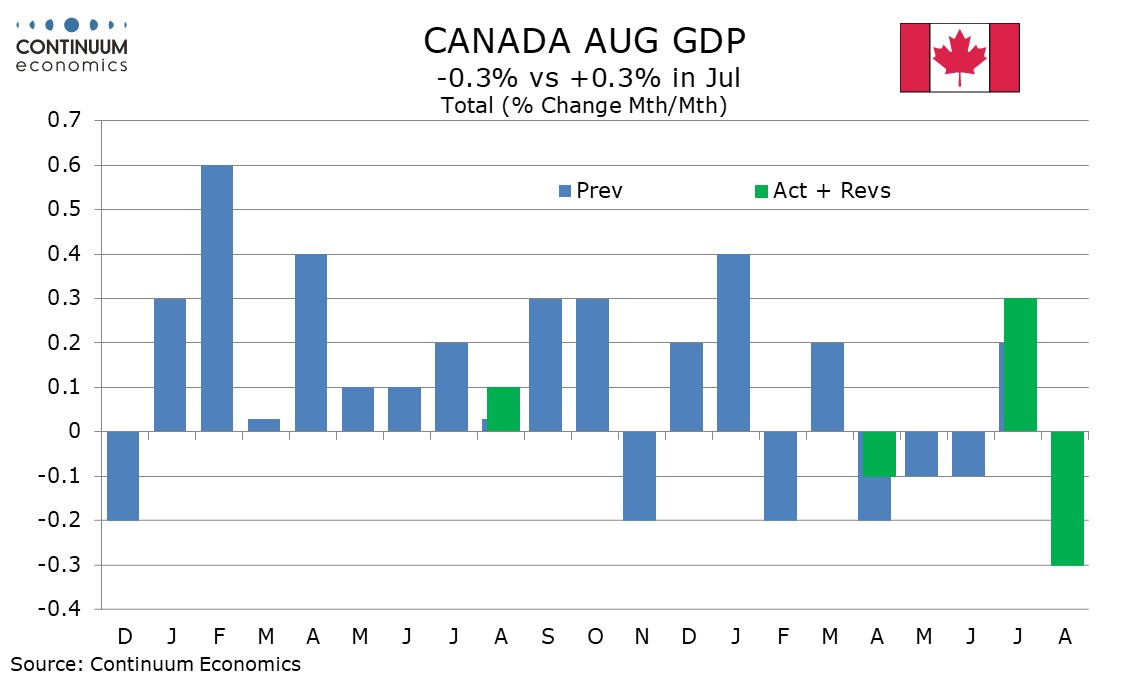

August Canadian GDP with a 0.3% decline is an unusually large miss from the preliminary estimate for unchanged, though July was revised up to a 0.3% increase from 0.2%. September’s preliminary estimate is for a rise of 0.1%, only partially correcting August’s decline.

If the September forecast is accurate this would leave Q3 GDP up by 0.4% annualized, close to a 0.5% estimate made by the Bank of Canada in its recent Monetary Policy Report. The BoC has suggested that data will have to fall short of expectations to put further easing on the agenda.

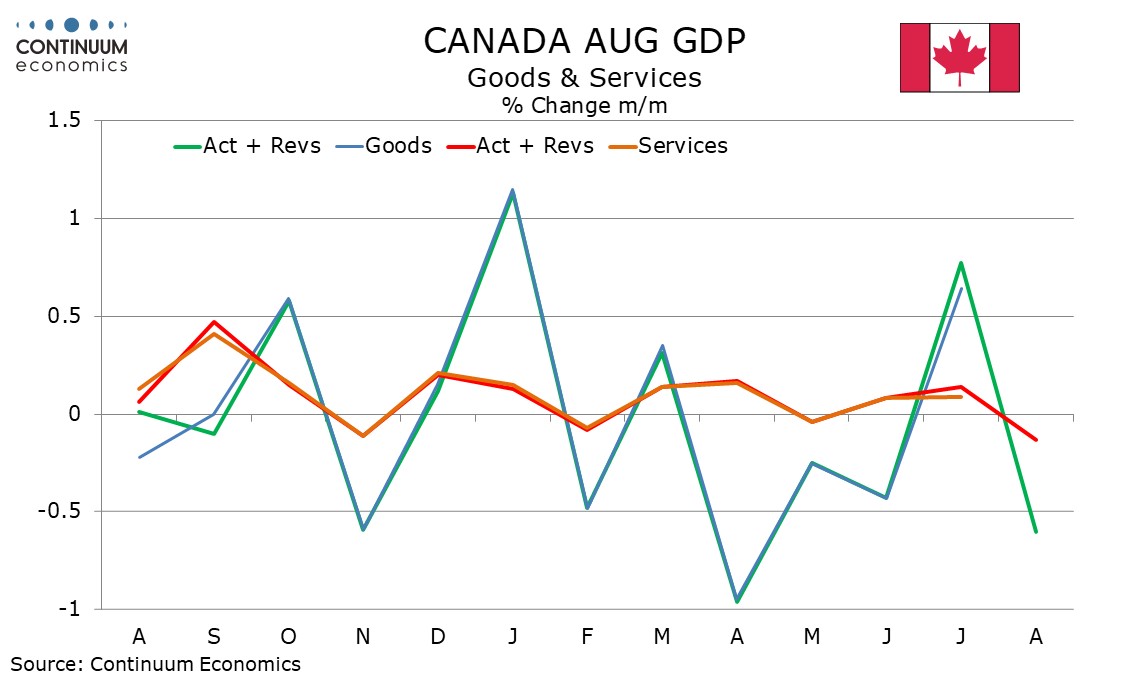

There was a special factor restraining August data, a strike by Air Canada flight attendants which led a 1.7% decline in transportation and warehousing, contributing to a 0.1% decline in services, its first decline since February. Elsewhere in services retail rose by 0.9% but wholesale fell by 1.2%, as signaled by sales data. Goods output fell by 0.6% after a 0.8% increase in July with mining and manufacturing partially reversing July increases and utilities more than reversing a rise in July.

Yr/yr GDP growth slowed to 0.7% from 1.0% to its slowest pace since a pandemic-induced decline in February 2021. In January 2025 yr/yr GDP was healthy at 2.3% supported by BoC easing. The slowdown seen since then is largely a consequence of US tariffs.