USD/BRL, USD/CNY flows: Divergeing EMFX in 2026

EM currency 2026 prospects come against a backdrop of a further but slower USD depreciation against DM currencies, but inflation differentials, domestic central bank policy and politics also matter.

· We forecast the Mexican Peso (MXN) will likely be more volatile, as President Donald Trump wants to renegotiate USMCA. This will drag on throughout 2026 and a deal may only be reached in 2027 (here). In contrast the Brazilian Real (BRL) has already seen a correction and has scope to 5.20 v USD after the October 2026 presidential election.

· In Asia, the Chinese Yuan (CNY) will gain some marginal ground versus the USD, but will likely be strongly restrained by China’s authorities desire to maintain competitiveness. The Indonesian Rupiah (IDR) is undervalued and has scope for modest gains. Other EM currencies will be mixed versus the USD on a spot basis, though the Turkish Lira (TRL) will fall given the still high inflation.

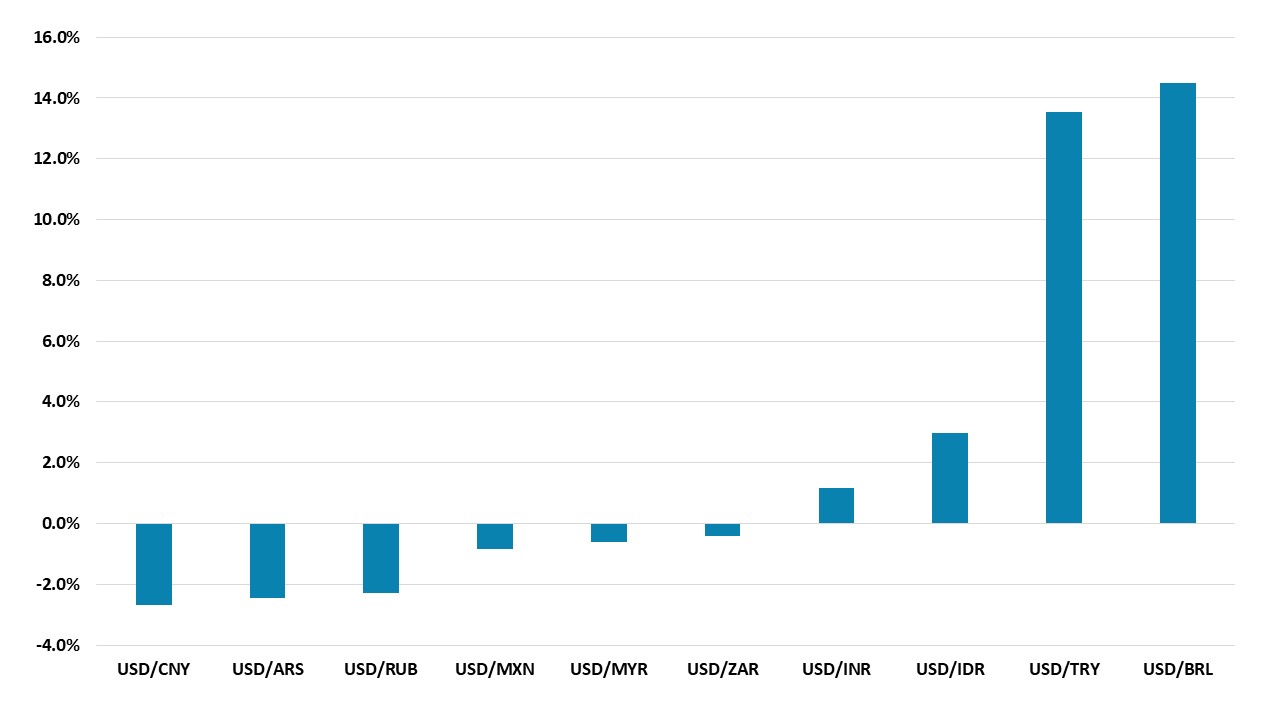

· On a total return basis over the next 12 months, BRL stands out due to the prospect of still very wide interest rate differentials. The TRL will attract carry trades also, but will likely be more volatile. The CNY will likely still see negative total returns versus the USD (Figure 1), as interest rate differentials will remain adverse.

Figure 1: 12mth Total Returns Versus the USD (%)

Source: Continuum Economics