Published: 2024-02-15T16:45:38.000Z

Preview: Due February 22 - U.S. February S&P PMIs - Correcting from improved Januarys

Senior Economist , North America

-

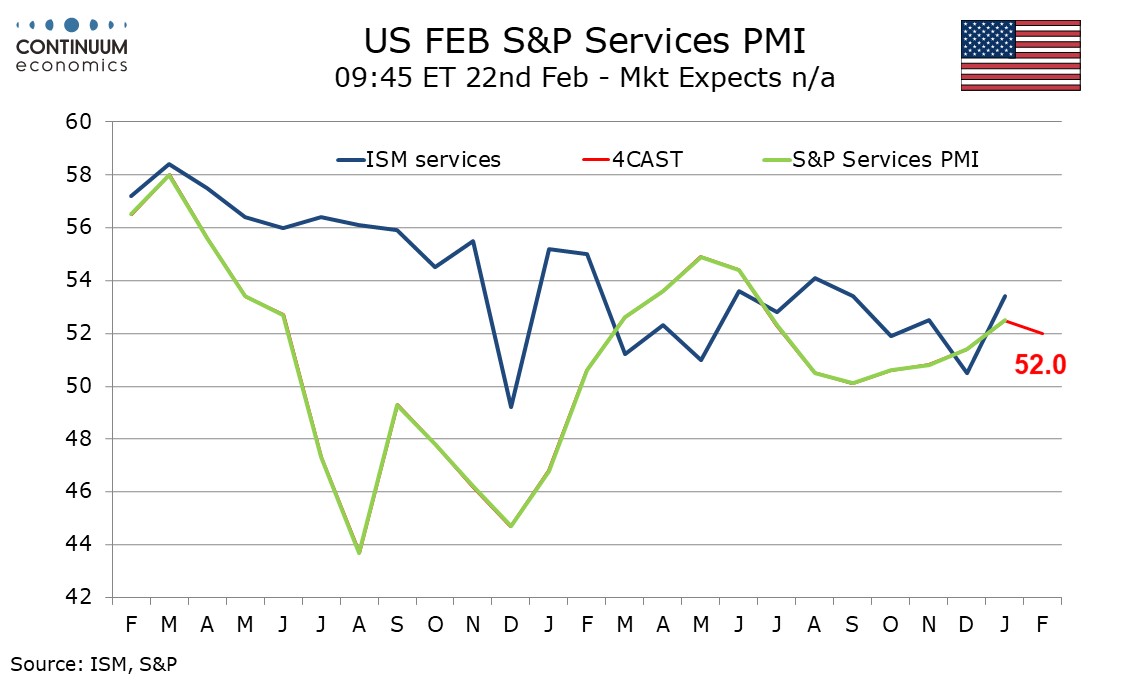

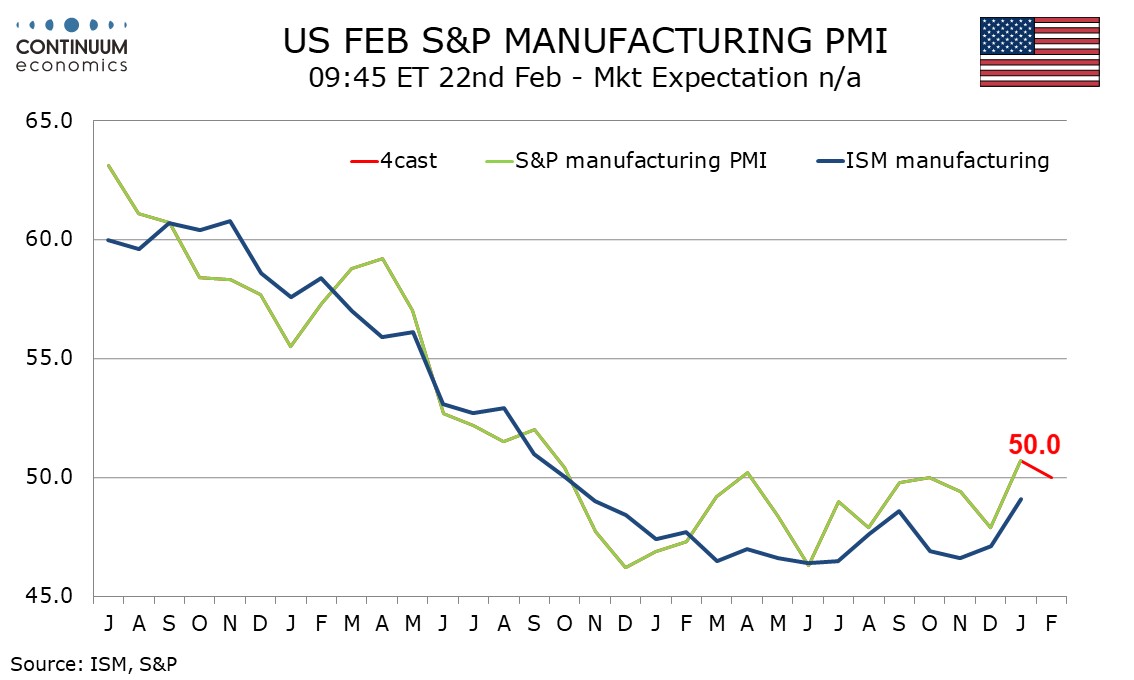

We expect marginal slippage in February’s S and P PMIs, with manufacturing moving to a neutral 50.0 from January’s 50.7 that was the highest since September 2022, and services falling to 52.0 from January’s 52.5, which would be the first decline in the index since September.

January’s improvement in the S and P manufacturing index was consistent with a stronger ISM manufacturing index though moves above 50 proved difficult to sustain on 2023. Most regional surveys remained weak in January but the Philly Fed and Empire State data improved in February. This suggests the S and P survey can avoid a move back below neutral.

The ISM and S and P services indices are less well correlated than the manufacturing indices. The S and P services survey has a reasonable correlation with bond yields, where recent gains may prevent the improvement from September’s 50.1 low extending any further.