NOK flows: NOK gains on stronger CPI

Norwegian February CPI has come in much stronger than expected, and NOK has risen in response, but still has scope for further gains

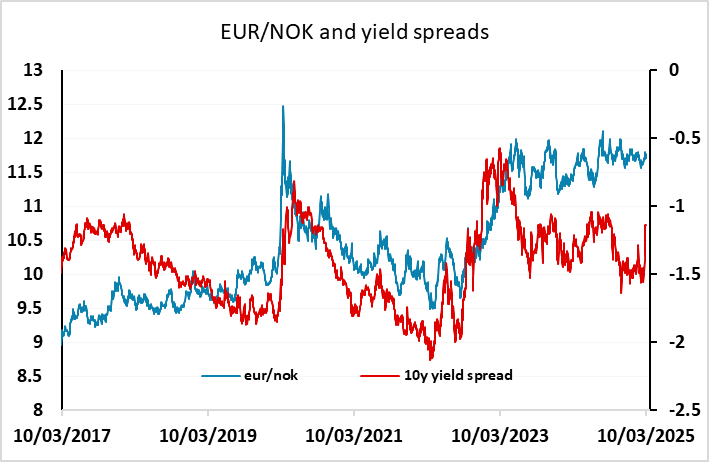

First up in Europe we have stronger than expected Norwegian CPI, which has triggered a 4 figure drop in EUR/NOK. Ahead of the data, the market consensus was for Norges Bank to cut rates 25bp at the March 27 meeting, and this still looks likely to happen, with Norges Bank having signalled a cut was likely at the last meeting. Norges Bank tend to stick with guidance in the short run and don’t tend to be derailed by one month’s data. While the CPI data was a lot stronger than expected, with the targeted core measure up to 3.4% y/y in February from 2.8% in January, and the headline up at 3.6% y/y from 2.3% in January, the upside surprise was mostly down to food prices.

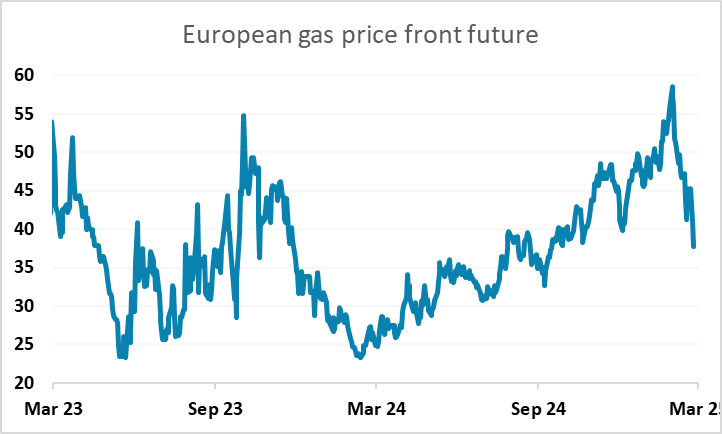

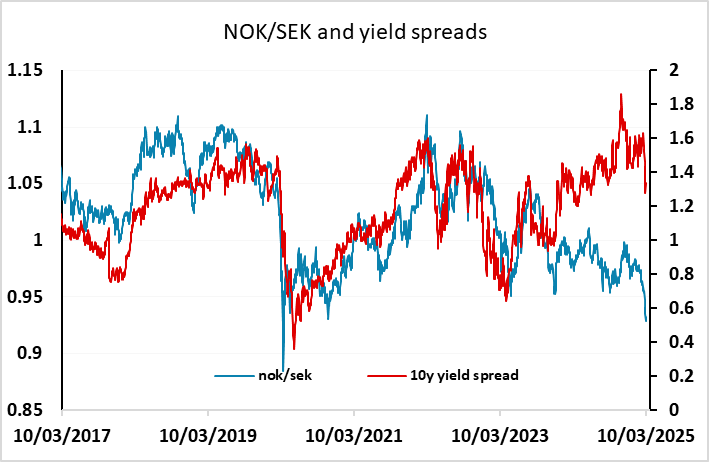

So even though the data will be a concern, we would still expect a March cut, although then prospect of further cuts may well be played down. But EUR/NOK continues to look too high given current yield spreads and NOK/SEK looks even more clearly too low, approaching the all time lows. NOK weakness to some extent reflects the hopes for peace in Ukraine, which could mean lower gas prices and tends to favour the SEK which can act as a barometer for European equity sentiment. Higher yields in the Eurozone and Sweden on the back of expectations of increased defence and infrastructure spending have also led to EUR and SEK gains against the NOK. But gas prices are still high by historic standards, and higher spending will also impact Norway, so it looks hard to justify the current lo level of the NOK,