Published: 2024-04-16T15:00:58.000Z

Preview: Due April 24 - U.S. March Durable Goods Orders - HInts of underlying improvement

Senior Economist , North America

3

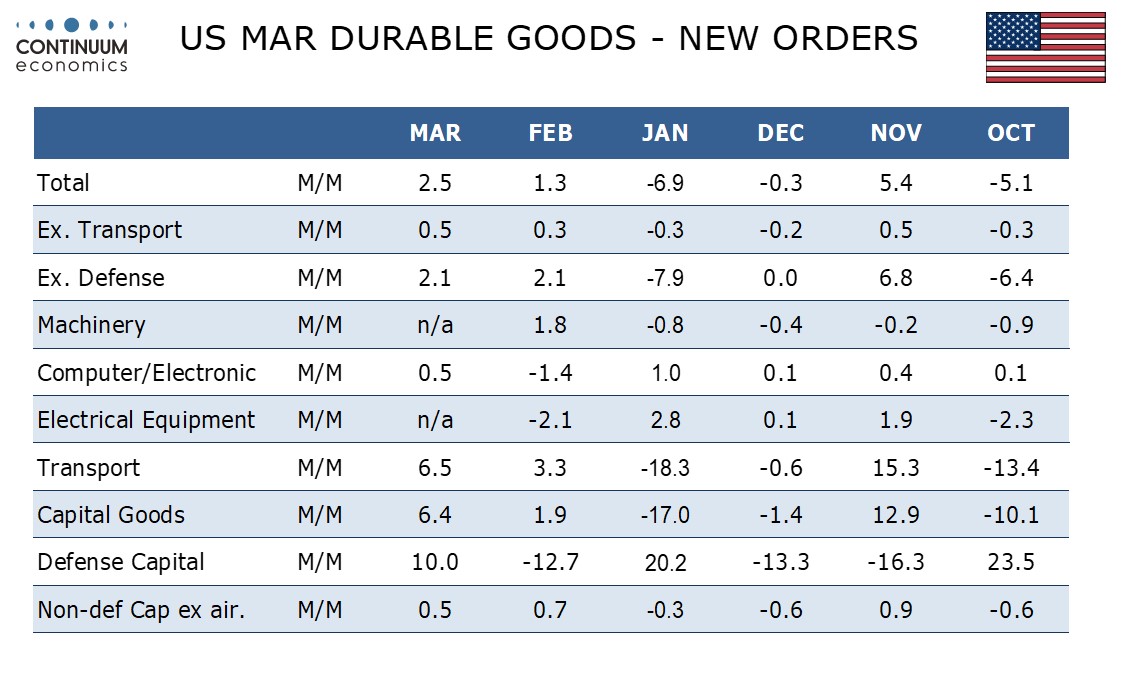

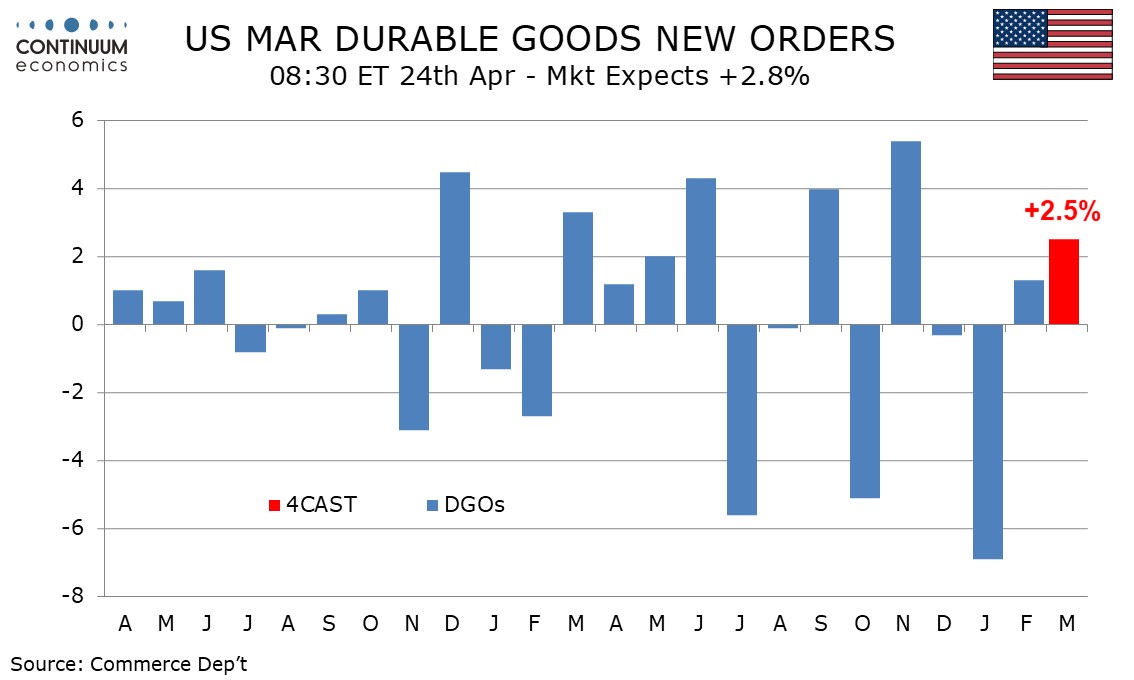

We expect March durable goods orders to rise by 2.5%, with most of the gain coming from transport, aircraft in particular, but we expect a 0.5% increase ex transport to show some hints of underlying improvement.

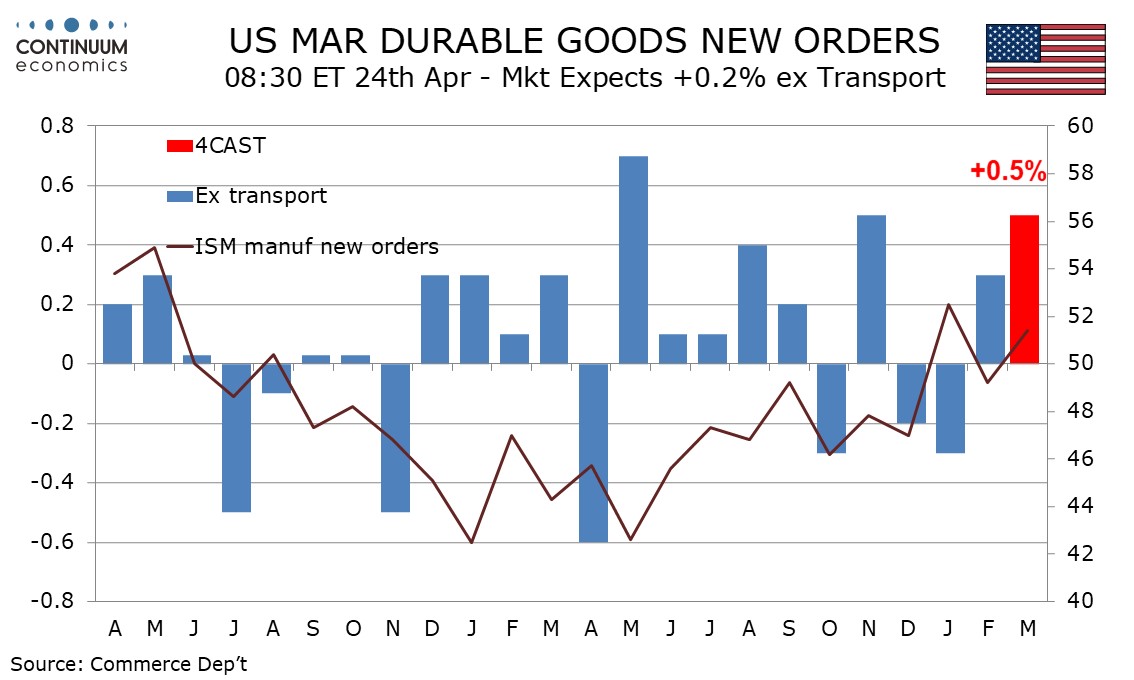

The ex transport trend has been near flat for over a year with no large out of trend moves, though signals from March’s ISM manufacturing index, which moved above the neutral 50, and a rise in March manufacturing output suggest some underlying improvement. February’s 0.3% increase ex transport simply reversed a January decline. A 0.5% rise in March would be a move a little above trend.

Transport is likely to see a lift from aircraft with Boeing orders stronger in March, with positive contributions also from autos and defense, the latter of which has a strong overlap with transport and is due for a bounce after a weaker February. Ex defense we expect orders to rise by 2.1%.

We expect non-defense capital orders ex aircraft, a key indicator of business investment, to rise by 0.5%, matching the ex-transport gain, delivering a second straight increase to more than reverse two straight declines. This series is a little more volatile than the ex transport one but trends are similar.