CAD flows: CAD softer after weaker CPI

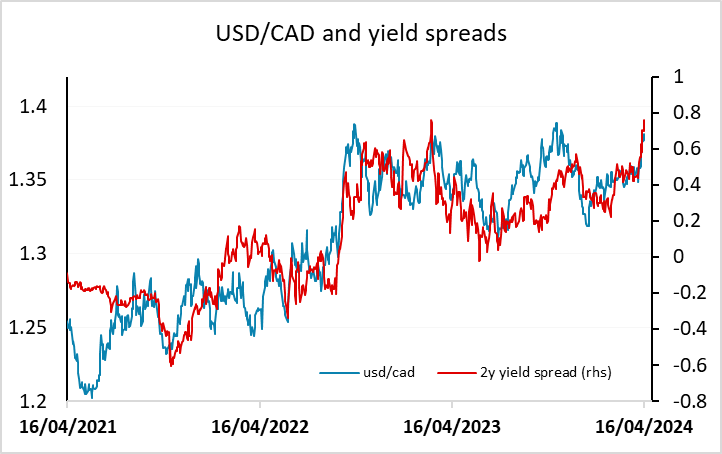

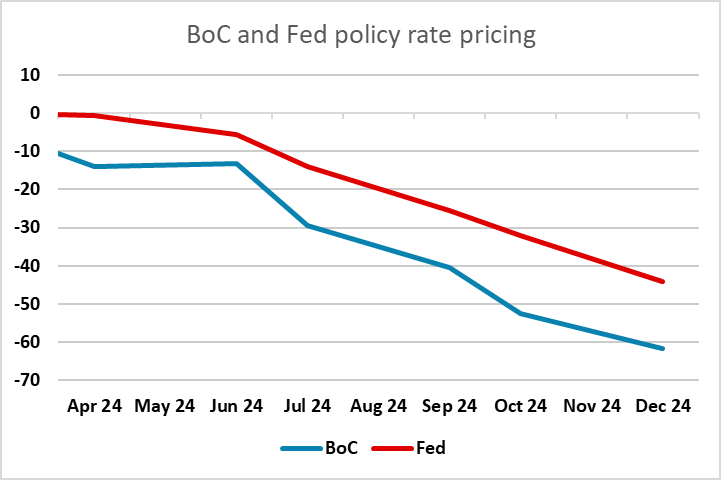

All CPI measures below expectations, widening spreads with the US and suggesting USD/CAD scope above 1.38

Canadian March CPI was weaker than expected in all the categories, including the headline and the three core measures watched by the Bank of Canada, coming in 0.1-0.2% below expectations. At the last meeting, the Bank of Canada made no policy changes with rates left at 5.0% and Quantitative Tightening continuing as expected. However the tone of the statement was significantly more optimistic on inflation, focusing more on this than recent signs of stronger activity. The BoC still needed to see progress on inflation sustained before easing, but today’s data supports that more dovish tone, and suggests a June cut is possible. Canadian yields have dropped after the data and now price a June cut at slightly better than a 50-50 chance. This prospective widening of the spread with the US suggest scope for USD/CAD to extend gains above 1.38