CAD flows: CAD dips as BoC loses tightening bias

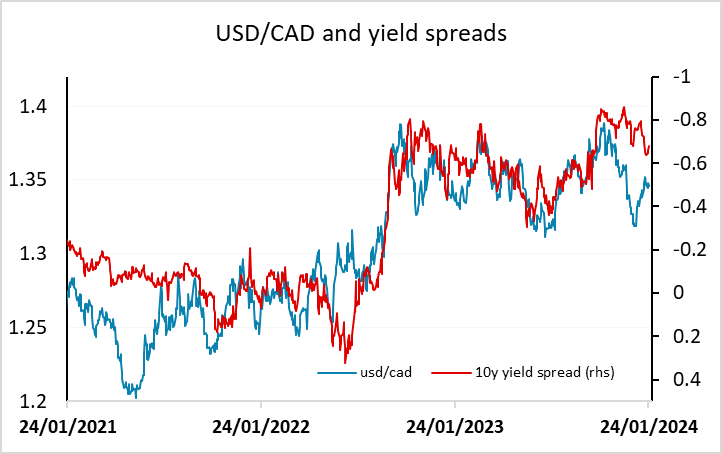

Less hawkish BoC justifies some CAD losses with CAD already a little stretched based on current yield spreads

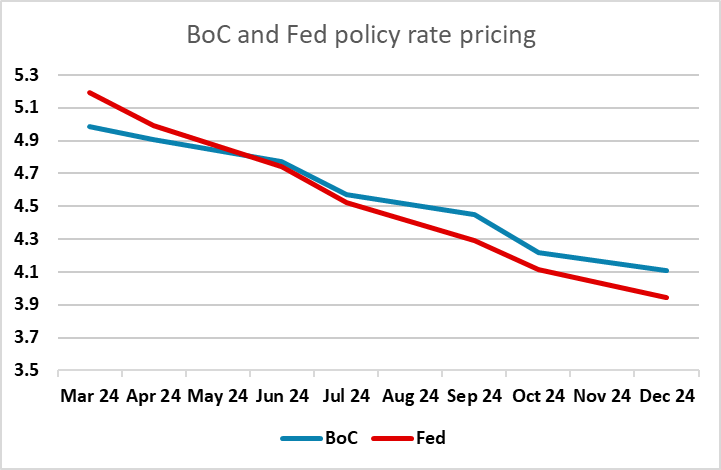

The removal of the BoC’s tightening bias is not entirely unexpected, but nevertheless justifies a modest CAD decline. Even though yields haven’t reacted a great deal, which isn’t surprising since they weren’t pricing in any sort of tightening bias, USD/CAD is trading a little below where you would expect given current yield spreads. USD/CAD has so far just reversed the dip seen ahead of the meeting, and yield spreads still suggest scope for further USD/CAD gains. However, this is unlikely to come while equities are firm and the USD is under general pressure. As it stands, the market is still pricing in a steeper decline in US rate than BoC rates, which may make some sense based on the recent inflation trajectories, but risks are that the BoC cuts at a similar pace to the Fed, which also suggests some CAD downside risk.