Preview: Due July 16 - Canada June CPI - Slower after May disappointment but limited progress over the two months

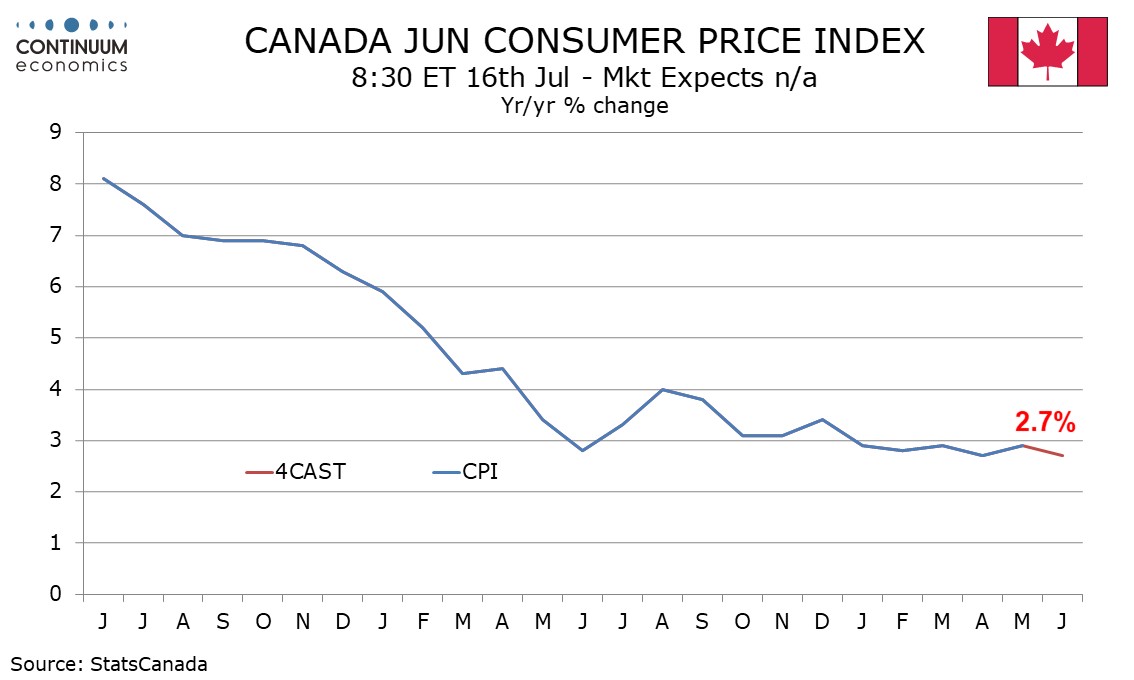

We expect June CPI to slip to 2.7% yr/yr from 2.9%, reversing a disappointing uptick seen in May, with the Bank of Canada’s core rates also likely to correct from disappointing data in May that was on balance firmer. However if the picture over two months is little changed, the BoC may decide to pause at its July 24 meeting.

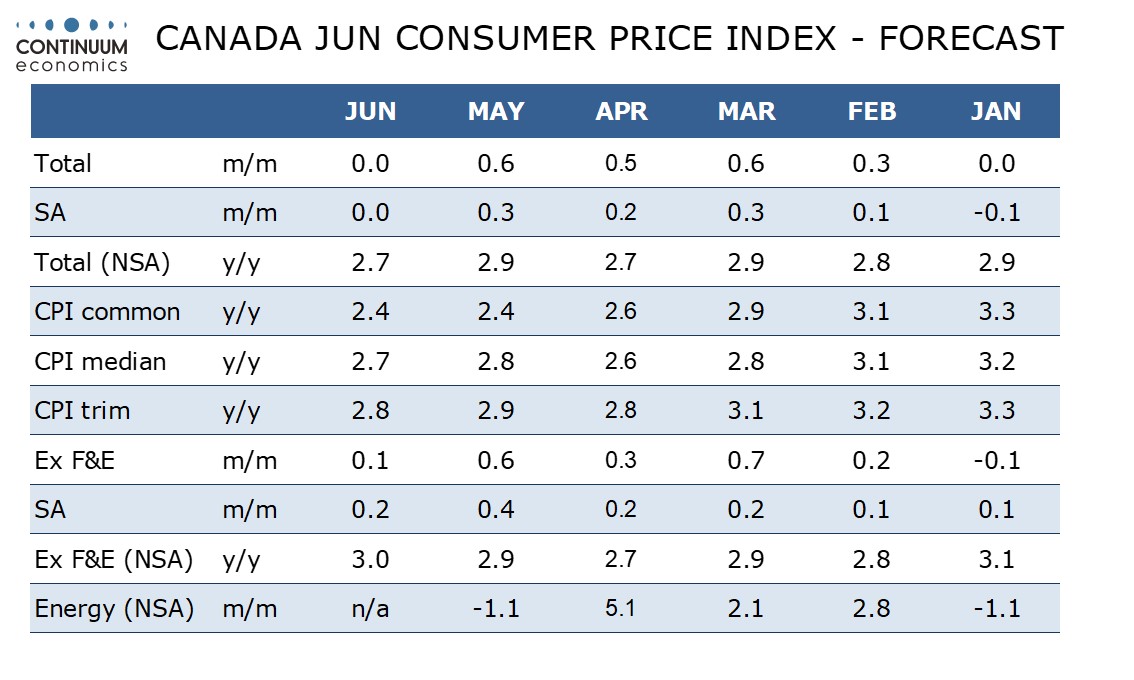

On the month we expect CPI to be unchanged both unadjusted and seasonally adjusted restrained by lower gasoline prices. We expect the ex food and energy pace to increase by 0.1% unadjusted and 0.2% seasonally adjusted. A 0.2% ex food and energy rate would slow from a 0.4% gain in May. Trend is probably near 0.2% per month as were the March and April outcomes, with May’s strong outcome compensating for weak 0.1% gains seen in January and February.

While the yr/yr headline pace under our forecast would slow to 2.7% from 2.9% this would simply reverse a May increase and there has it been much movement since the series fell below 3.0% in January. We expect the yr/yr ex food and energy pace to pick up to 3.0%, its highest since January, from 2.9% in May, as a weak June 2023 drops out.

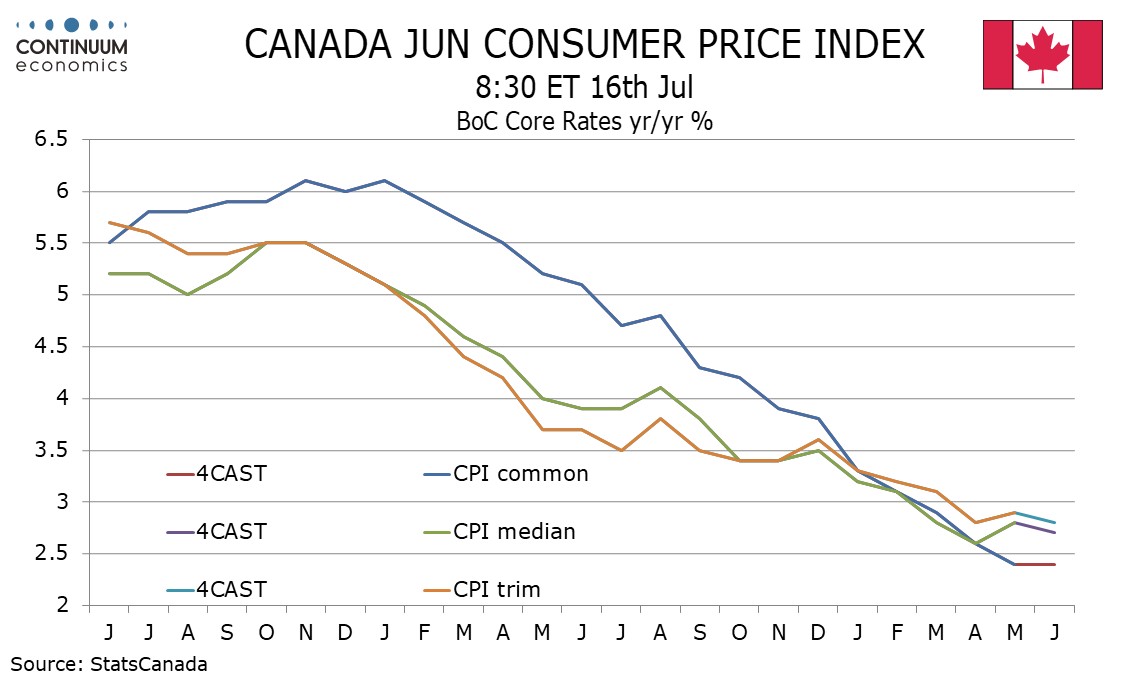

The ex food and energy rate is not one of the BoC’s core rates. Here we expect corrections lower from May increases in CPI-Median, to 2.7% from 2.8%, and CPI-Trim, to 2.8% from 2.9%, while CPI-Common, which slipped in May, remains unchanged at 2.4%. This would leave the average of the three rates at 2.63% versus 2.7% in May and 2.67% in April, meaning only limited progress towards the 2.0% target over the last two months, in data released since the BoC cut rates on June 5.