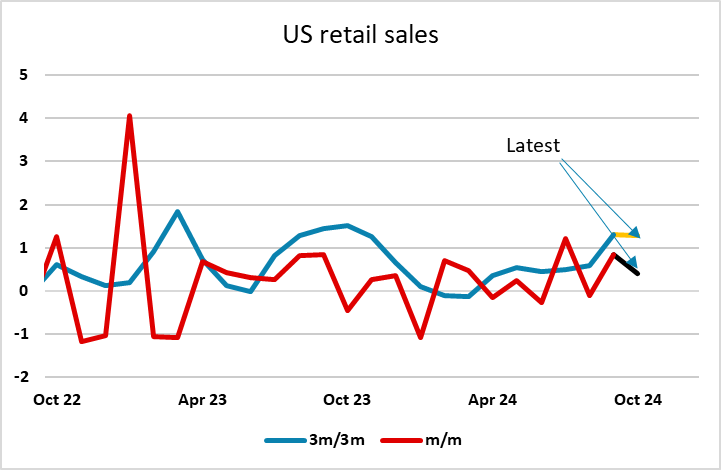

USD, JPY flows: USD gains support after solid retail sales

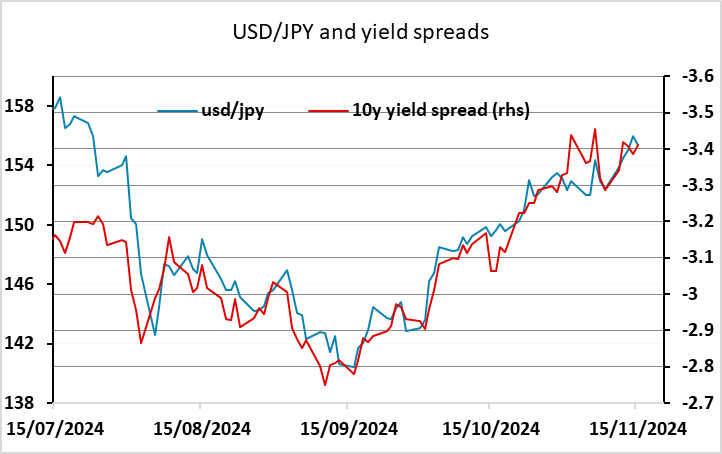

USD better bid after strong retail sales but JPY holds its own as market increases BoJ rate hike expectations

While the October numbers were a little weaker than expected, the revisions to September mean that the underlying trend in US retail sales remains strong, and the data support the recent USD gains. The USD has generally gained a little ground after the data, although the JPY has held its own. There isn’t a great deal on the calendar for next week, and the initial focus may be on the Ueda speech on Monday. The market has priced in a better than 50% chance of a 25bp BoJ rate hike in December in the wake of the recent JPY decline, and will be looking to Ueda to guide on this. In the absence of a clear signal the JPY may lose the ground gained today. Bigger picture,, the JPY is very cheap, but unless equity risk premia start to rise it will be hard for it to make a significant recovery.