SEK, EUR flows: SEK recovering after stronger CPI, EUR supported by German production

SEK a little higher after Swedish CPI, German inductiral production suggests improving trend and could be EUR supportive

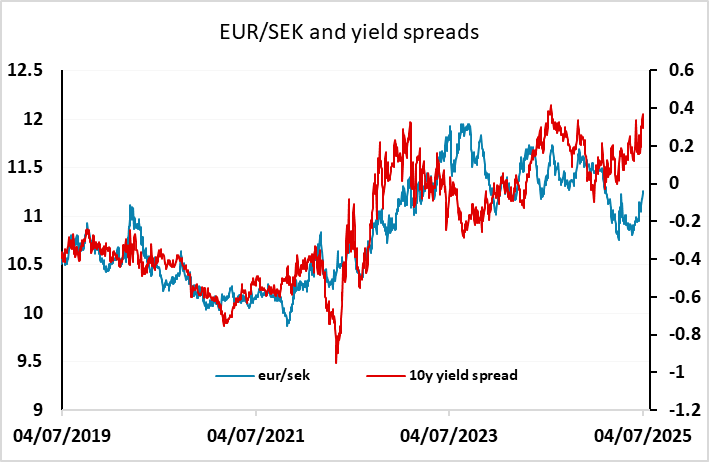

Monday opening up with stronger than expected Swedish CPI data, with the targeted CPIF measure rising to 2.9% y/y in June from 2.3% in May – well above market consensus. The Riksbank were in any case not expected to cut rates in August, but this makes it near certain that they will leave rates unchanged, although there will be one more CPI number before the August 20 meeting. EUR/SEK has been edging up in the last month as the market has taken a more dovish view of the Riksbank, and in spite of the higher CPI data, the activity numbers have been softening, so the Riksbank is still expected to cut when CPI allows. There is still scope for EUR/SEK gains based on yields spreads, but today’s data suggests we may see a pause in the 11.20-11.30 range near term.

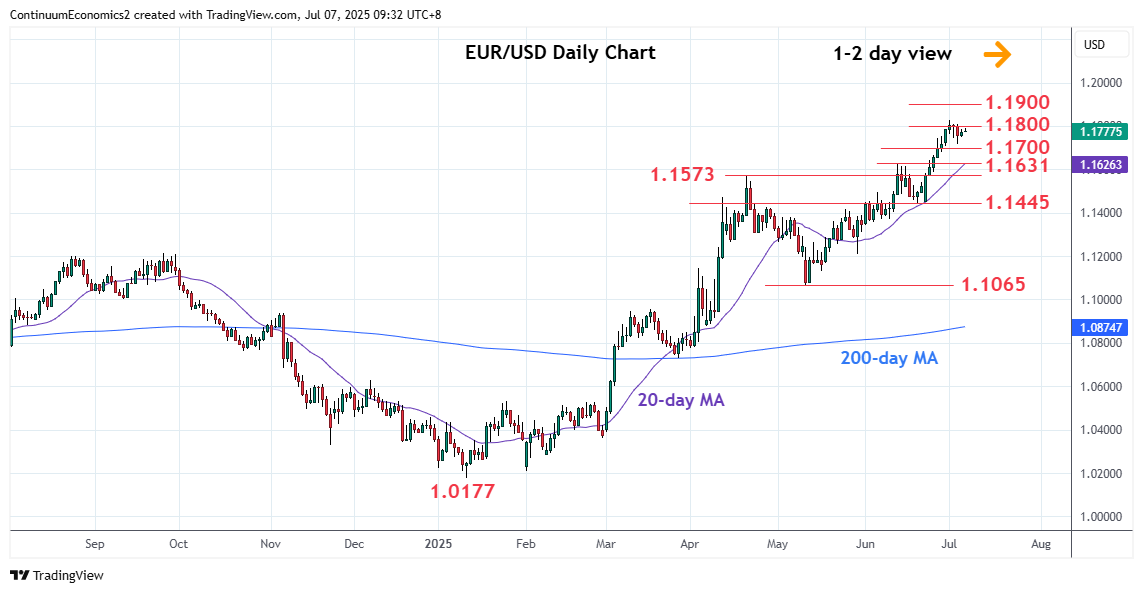

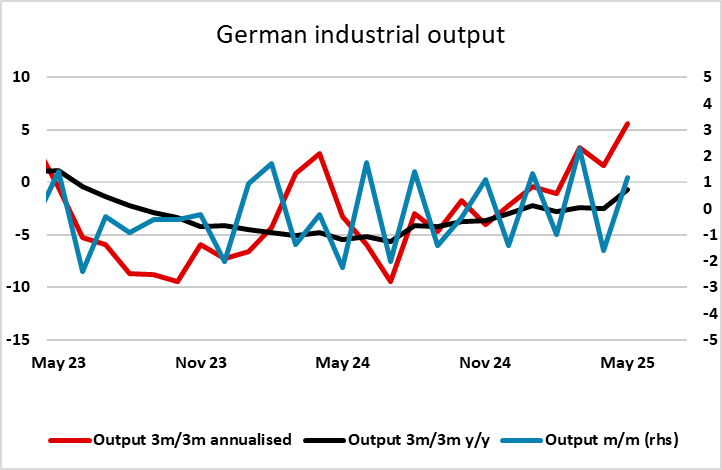

The German industrial output numbers released this morning provided a positive surprise following the weaker orders data last week. These numbers are less volatility than the orders data, and do appear to be showing some underlying improvement in the last few months. If this is a sign of resilience in the German and Eurozone economy, it could help EUR/USD hold levels above 1.17, and for today may allow some EUR outperformance, at least until the US returns from holiday this afternoon and gives its verdict on the latest Trump comments on tariffs.