Canada April Employment - Trend still solid, suggesting no urgency for BoC easing

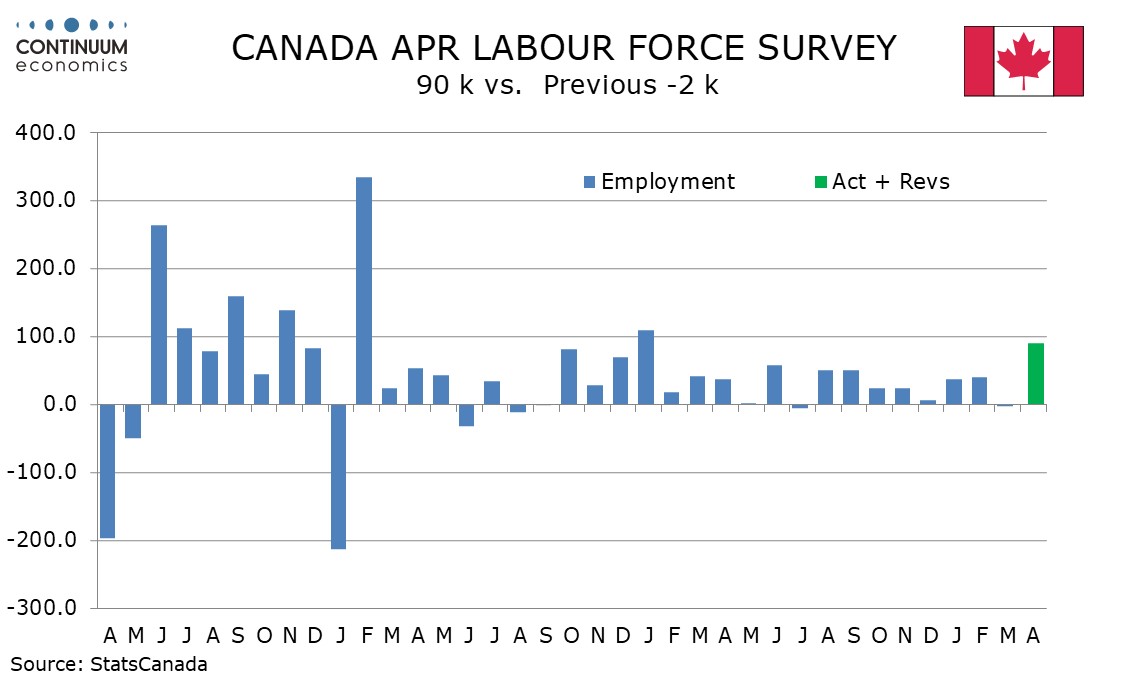

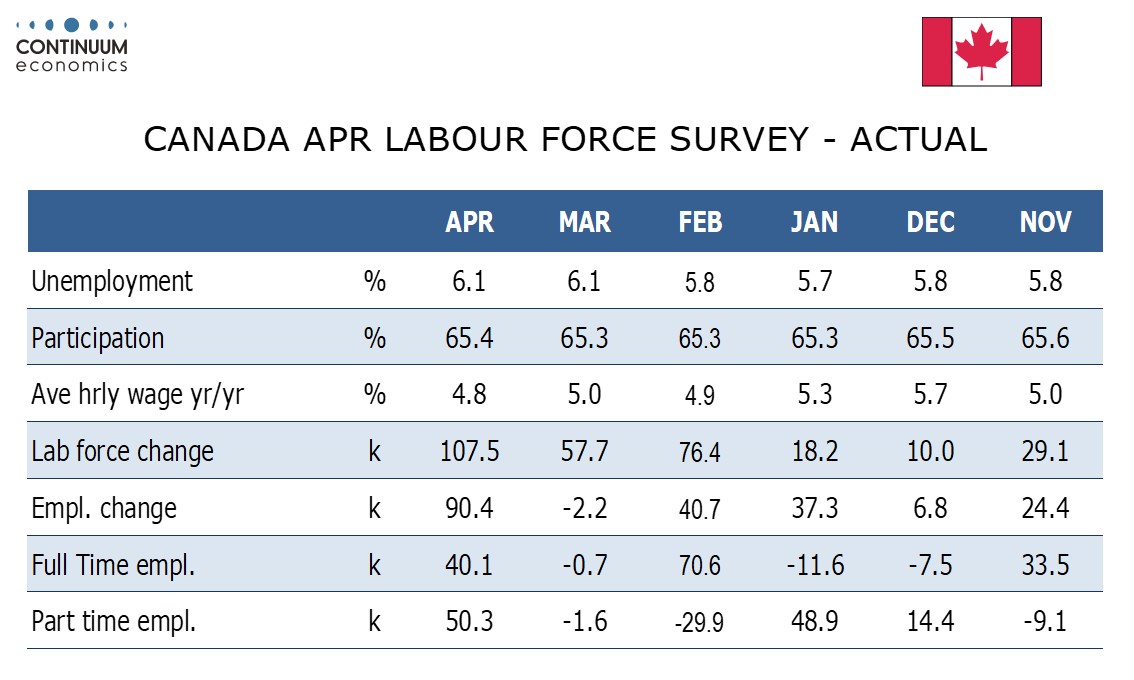

Canada’s 90.4k increase in April employment is well above expectations and raises doubt over the case for a June rate cut, this being the last employment report the Bank of Canada will see before its June 5 meeting. Unemployment was unchanged at 6.1% but wage growth (hourly wage for permanent employees) slowed to 4.8% from 5.0% yr/yr.

More than half of the job growth came in part time work at 50.3k but full time saw a strong rise of 40.1k. Private sector employment rose by 40.4k with the public sector up by 25.5k and self-employment up by 14.5k. The job growth was fully in services, up by 100.7k, with professional, scientific and technical at 25.5k and information, culture and recreation at 24.2k. There were no significant negatives in services. Goods fell by 104k on a drop of 11.1k in construction. Manufacturing rose by 3.4k.

The monthly rise in employment can be seen as a rebound from a 2.2k decline in March but with January and February both up by near 40k trend maintains solid momentum. Q1 GDP on May 31 is expected to show a pick-up in growth while this latest employment report suggests momentum continues entering Q2. Recessionary fears generated by weak 2023 GDP growth are fading but there has also been progress on inflation, and if April CPI on May 21 shows this continuing a rate cut could still be debated in June, even if the employment data suggests no urgency to move.

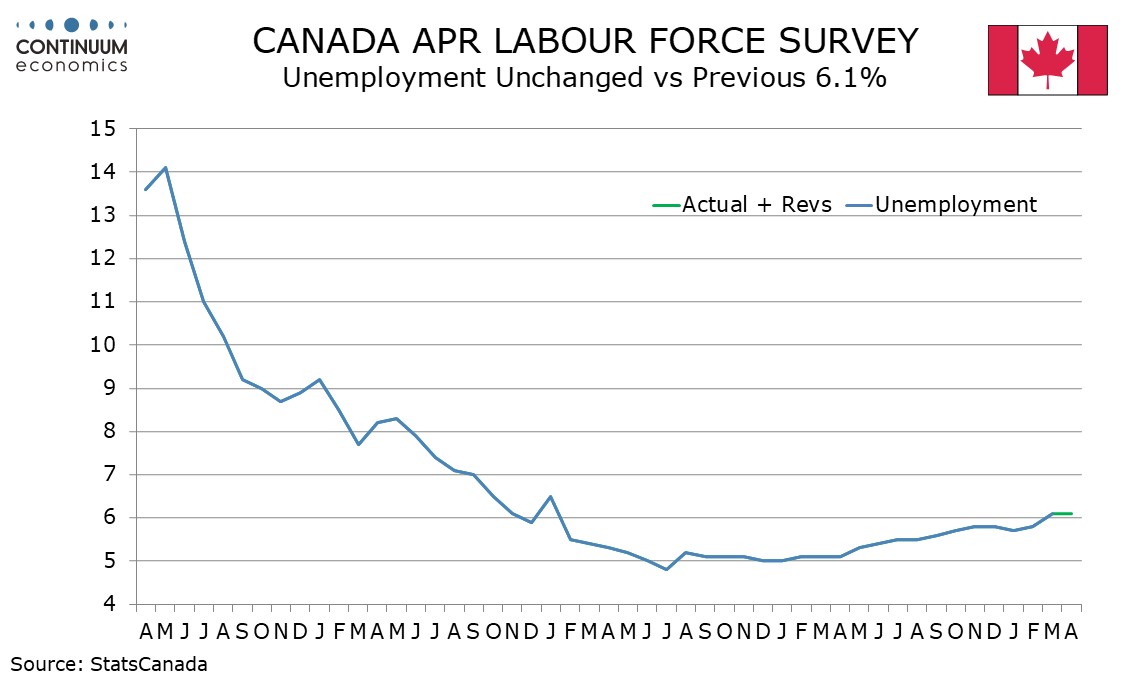

Unemployment was stable because the labor force showed a strong 107.5k increase and the rate remains well above the low of 5.0% last seen in January 2023. The latest pause in the rate follows a bounce to 6.1% in March from 5.8% in February. The 4.8% wage gain is the slowest since a June 2023 outcome of 3.9% that was well below a trend of around 5.0%, but shows that trend has slowed only modestly since then.