NZD, EUR flows: NZD soft after RBNZ, EUR downside preferred

NZD weaker after RBNZ rate cut as a further 50bp is seen in November. EUR/USD holding up for now but yield spreads suggest downside risks.

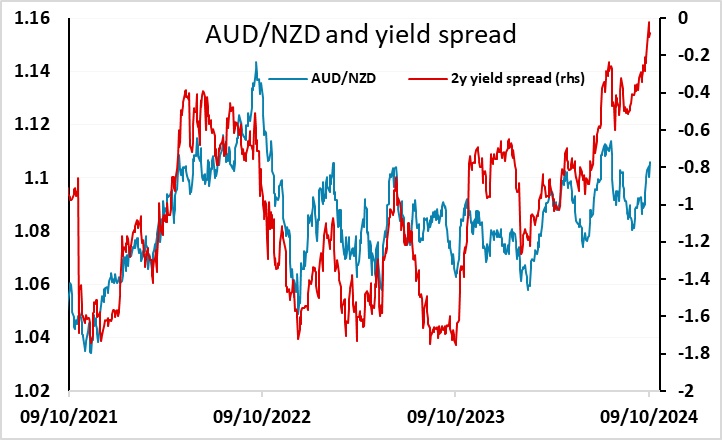

The RBNZ rate cut was the main news in the overnight session, with the RBNZ delivering the expected 50bp cut and suggesting another was on the way. The NZD fell in response, losing around 0.5%, with the market now pricing another 50bp cut in November as a 90% chance, up from 80% before the meeting. We still see plenty of upside scope for AUD/NZD, with yield spreads at their narrowest since 2019. However, the AUD is dragged down more by weakness in Chinese equities than the NZD, and Chinese equities softened again overnight. However, the losses of the last two days have only reversed the gains seen in the futures during Golden Week, and equities are still at much better levels than they were before China announced its stimulus measures. We would expect the AUD to find support above 0.67 and AUD/NZD to advance beyond 1.11.

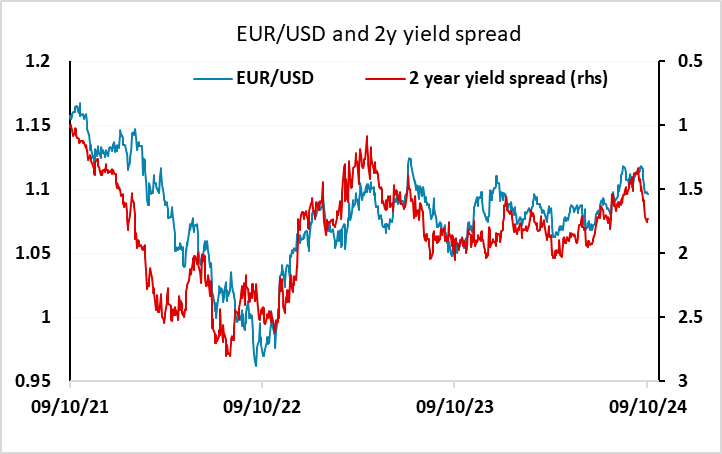

Elsewhere there isn’t much to report, and there is little on today’s calendar that is likely to move markets. We still see downside risks to EUR/USD after the rise in US front end yields since the employment report, but significant moves are now unlikely this side of the US CPI data tomorrow.