U.S. May Existing Home Sales - Only a modest decline

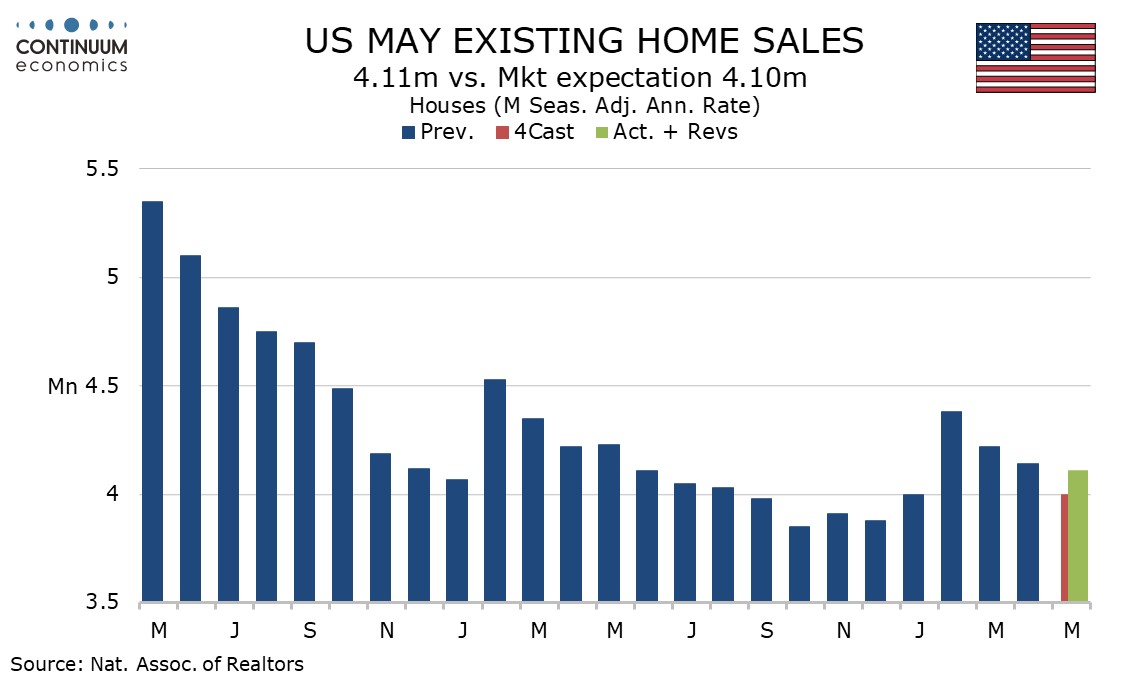

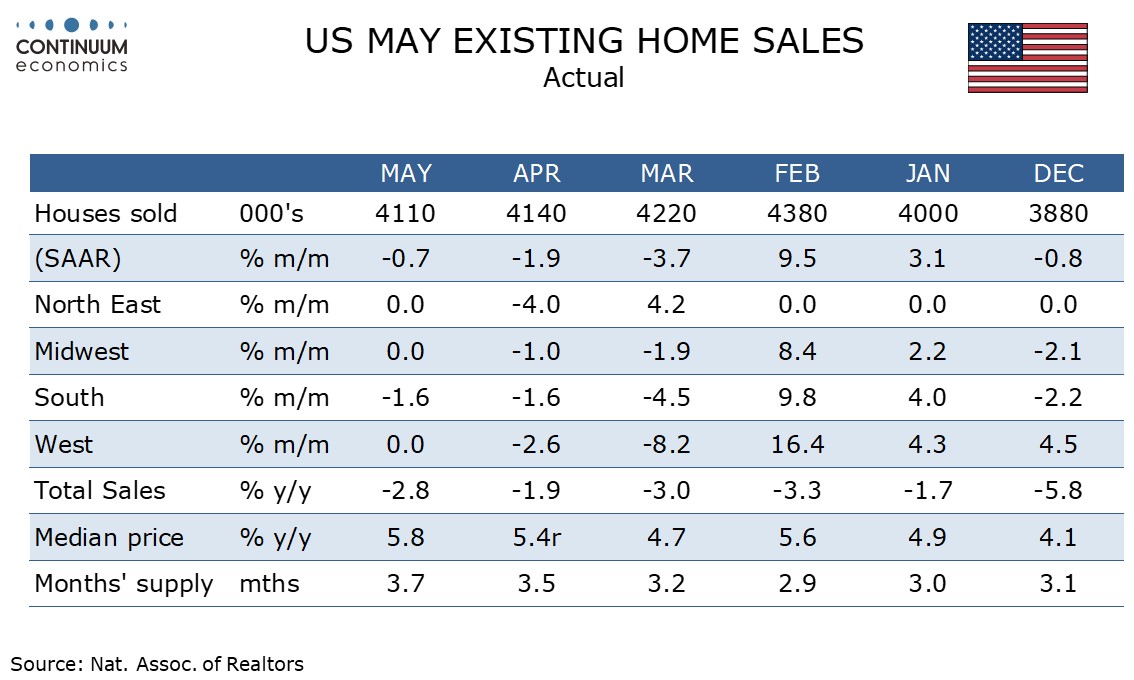

May existing home sales with a 0.7% decline to 4.11m were in line with expectations and show a third straight decline, but these declines have become increasingly modest and the sharp 9.5% increase seen in February has still not been fully reversed.

2023 also saw a sharp increase in February before a gradual downtrend in the subsequent months, with February’s gain eventually being reversed by July.

Several housing sector indicators, such as the NAHB homebuilders’ index and recent starts and permits data are suggesting a loss of momentum in the housing market but the latest existing home sales data suggests that slippage will not be sharp. That recent improvements is inflation data have moved bond yields off recent highs may be providing support.

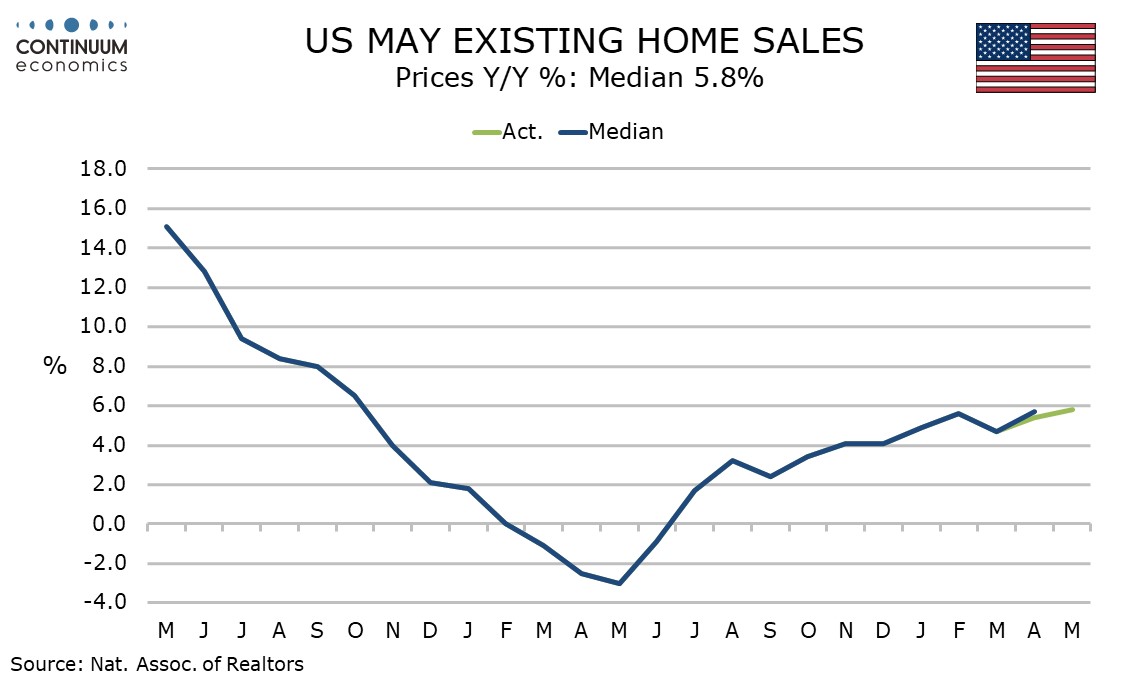

The average price rose by 3.1% on the month land while some of this rise is seasonal it lifts yr/yr growth to 5.8% from 5.4%, reaching its highest pace since October 2022.