U.S. January ADP Employment - Loss of momentum resumes

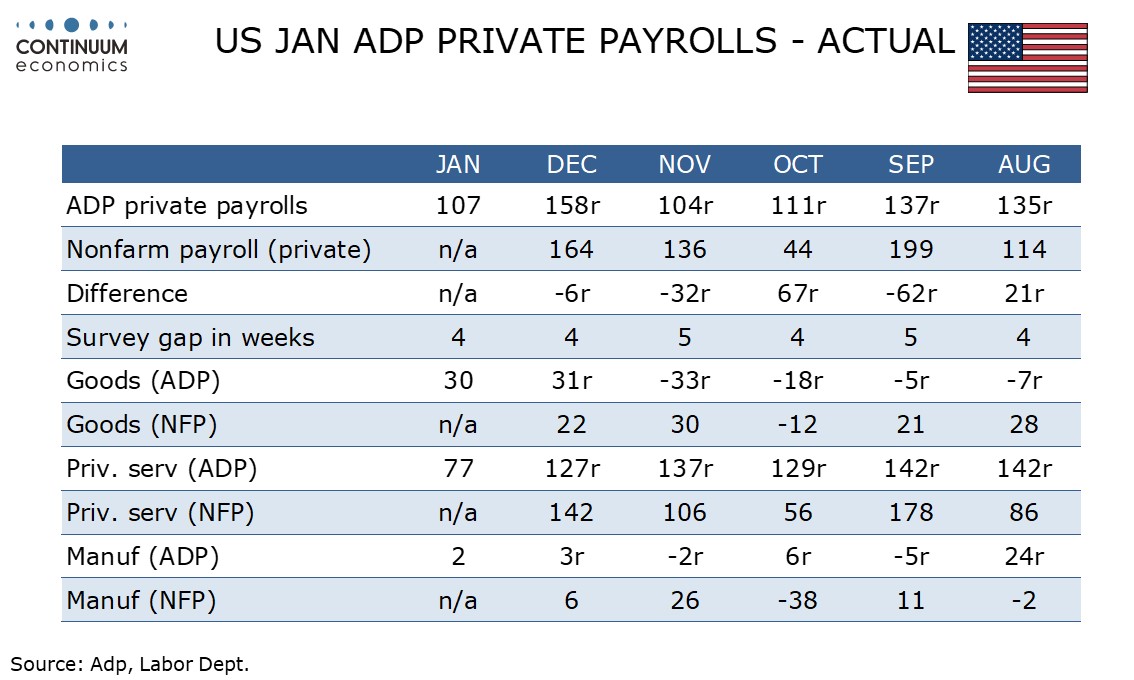

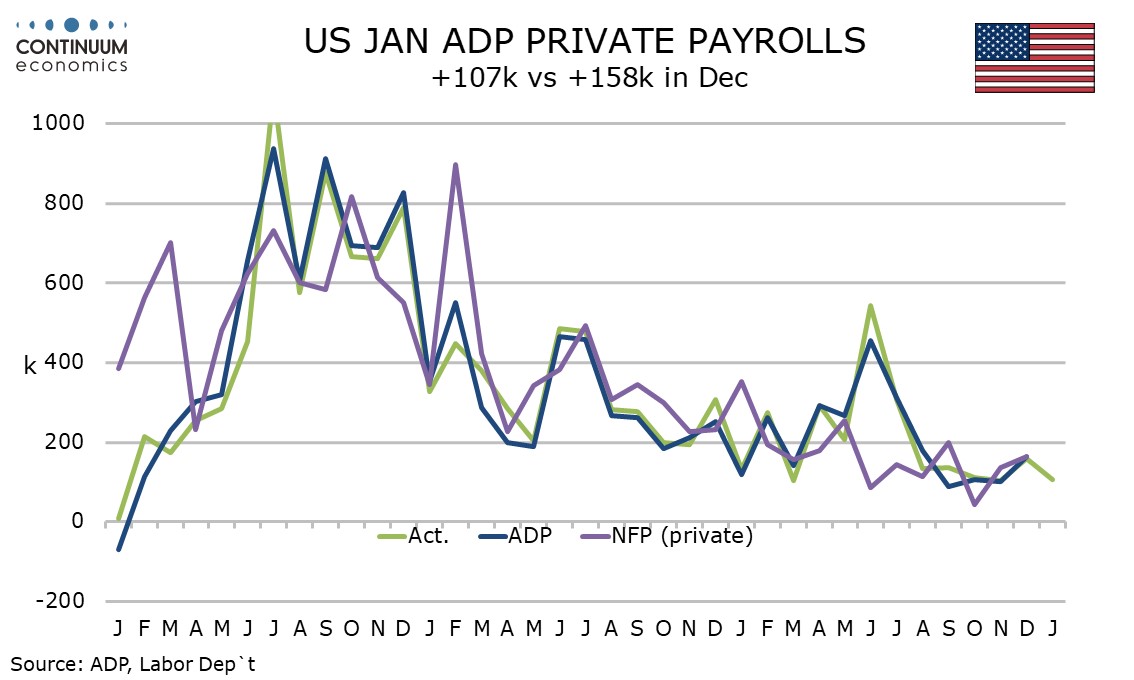

ADP’s January ADP estimate for private sector employment growth of 107k is weaker than expected and goes against some recent positive signals from the labor market, such as December’s JOLTS data and initial claims in January. The data is in line with recent ADP trend, other than December’s stronger 158k (revised from 164k).

ADP trend, which had been outperforming non-farm payrolls in early 2023, lost momentum significantly when September, October and November data all came in close to 100k, as has January’s. ADP is not a reliable guide to payrolls even if December saw ADP’s original estimate of 164k spot on the private sector non-farm payroll outcome.

January ADP details show a subdued but positive picture almost across the board, with the only significant component to decline being a 9k fall in information, while the strongest riser was a 28k increase in leisure and hospitality. Construction and trade, transport and utilities also showed gains of over 20k.