Preview: Due July 3 - U.S. June ADP Employment - To slow and underperform payrolls

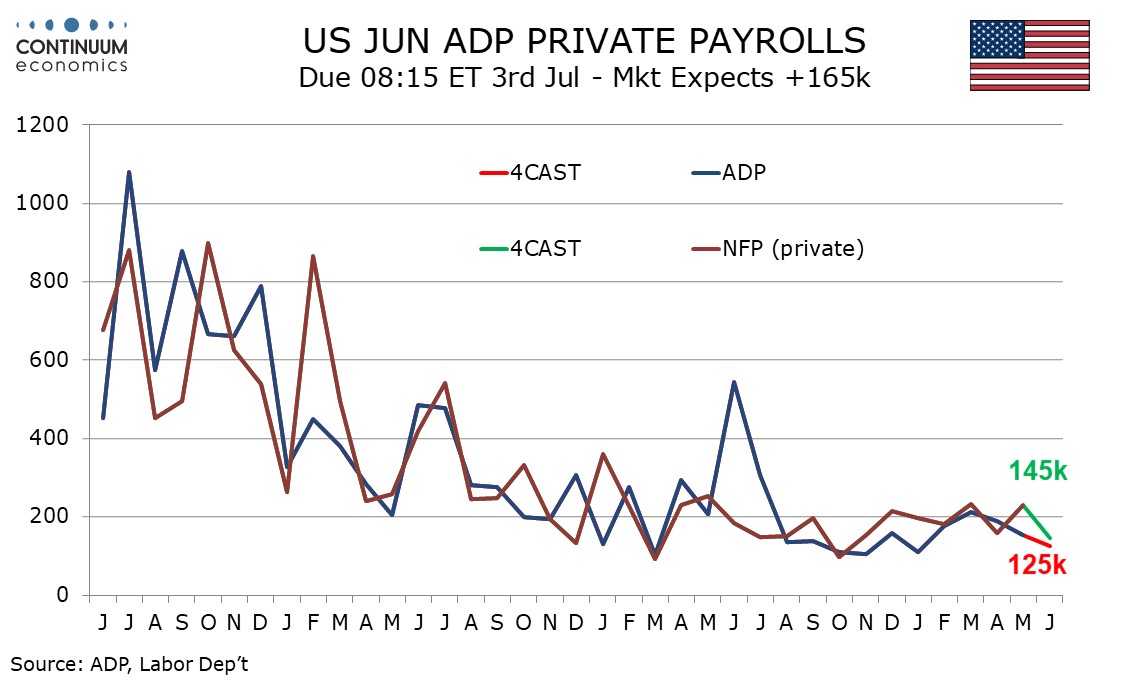

We expect a 125k increase in June’s ADP estimate for private sector employment growth, which would be the slowest since January and softer than the 145k increase we expect for private sector non-farm payrolls. We expect overall payrolls including government to rise by 185k.

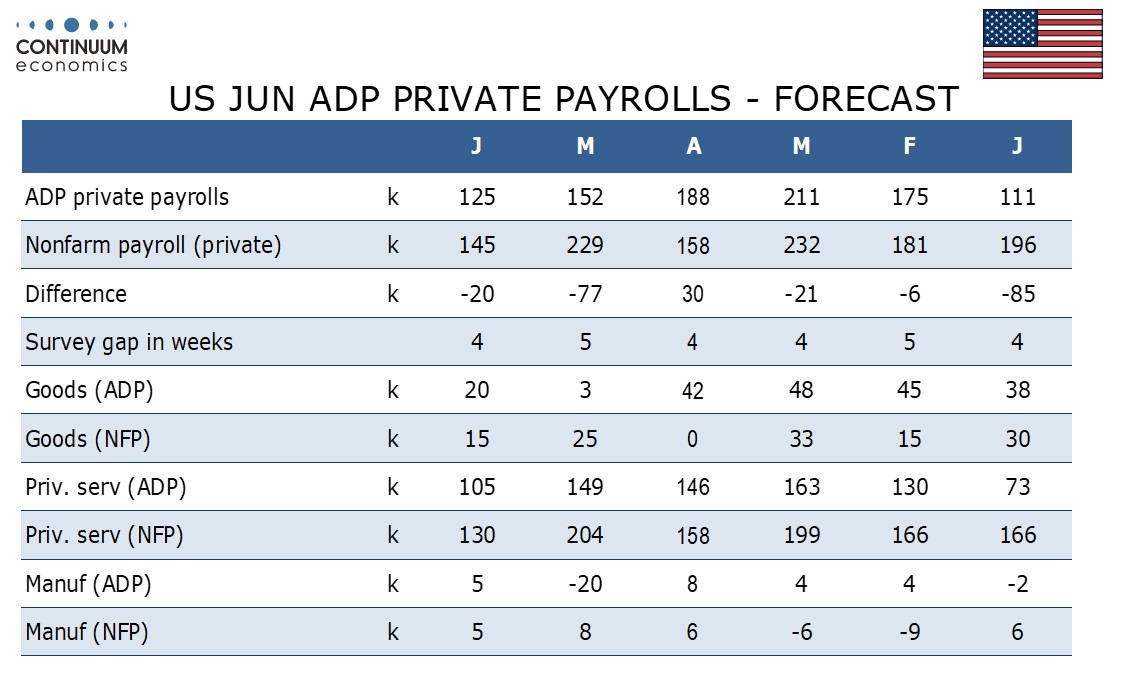

Most recent months have seen ADP data underperform the non-farm payroll, though April was a rare exception outperforming by 30k, corrected by an underperformance of 77k in May. The 20k underperformance we expect in June would be in line with recent trend.

Higher initial claims suggest that the labor market lost some momentum and we expect both ADP and non-farm payroll data to see some slowing from recent trend, with ADP’s 6-month average slowing to 160k from 166k, which would be the first slowing since January. We expect non-farm payrolls to see the first slowing in the 6-month average since November 2023.

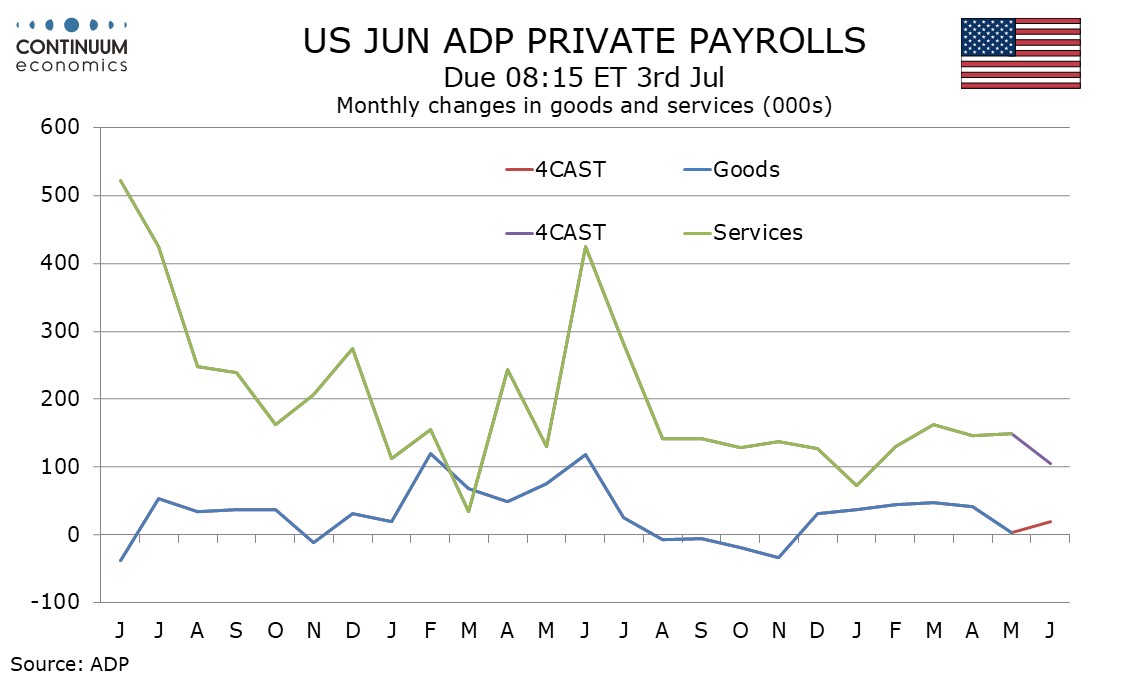

We expect ADP’s data to see a June correction in manufacturing from a 20k May decline that was well below trend and inconsistent with non-farm payroll manufacturing data. However elsewhere we expect the ADP data to show a fairly broad based loss of momentum.