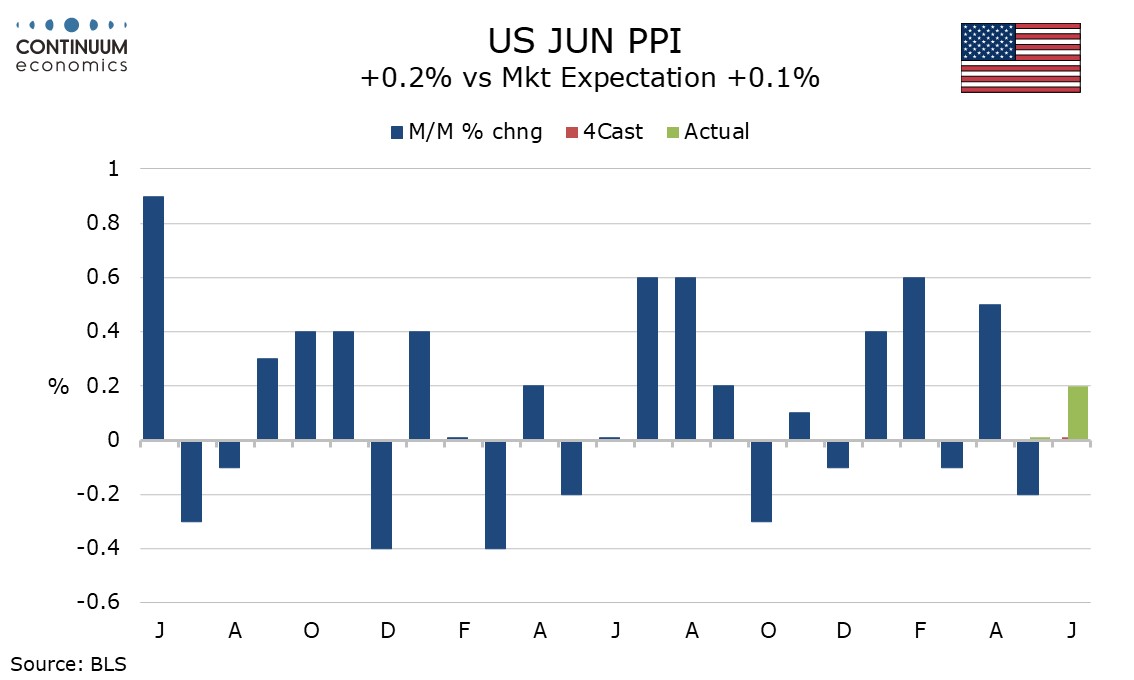

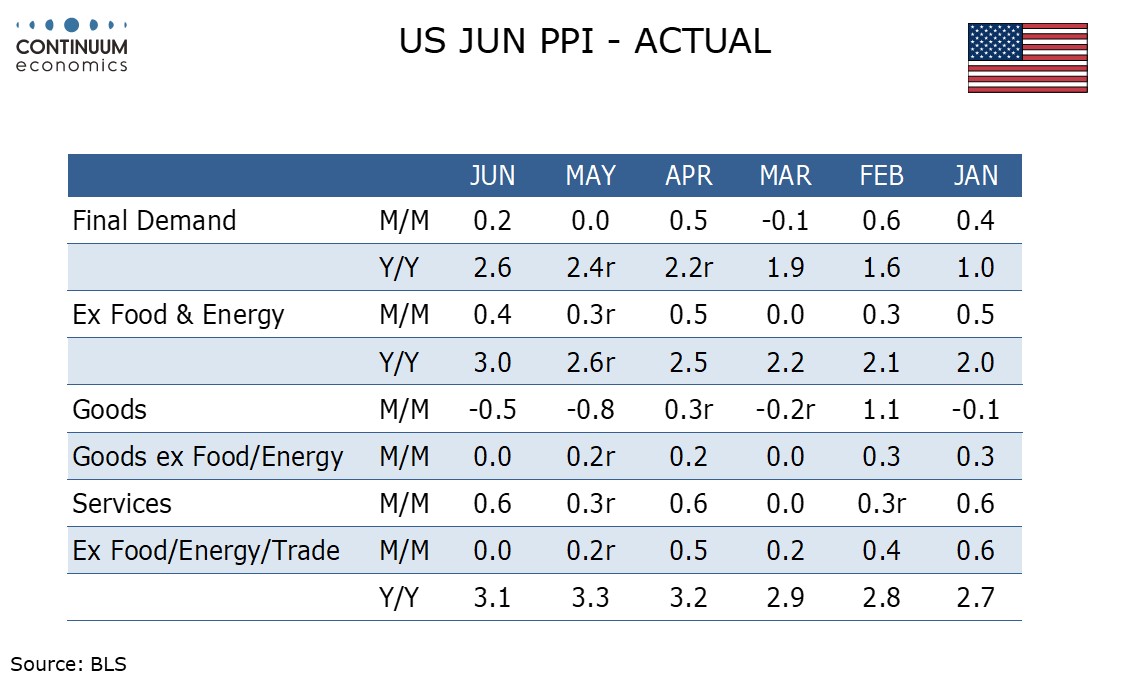

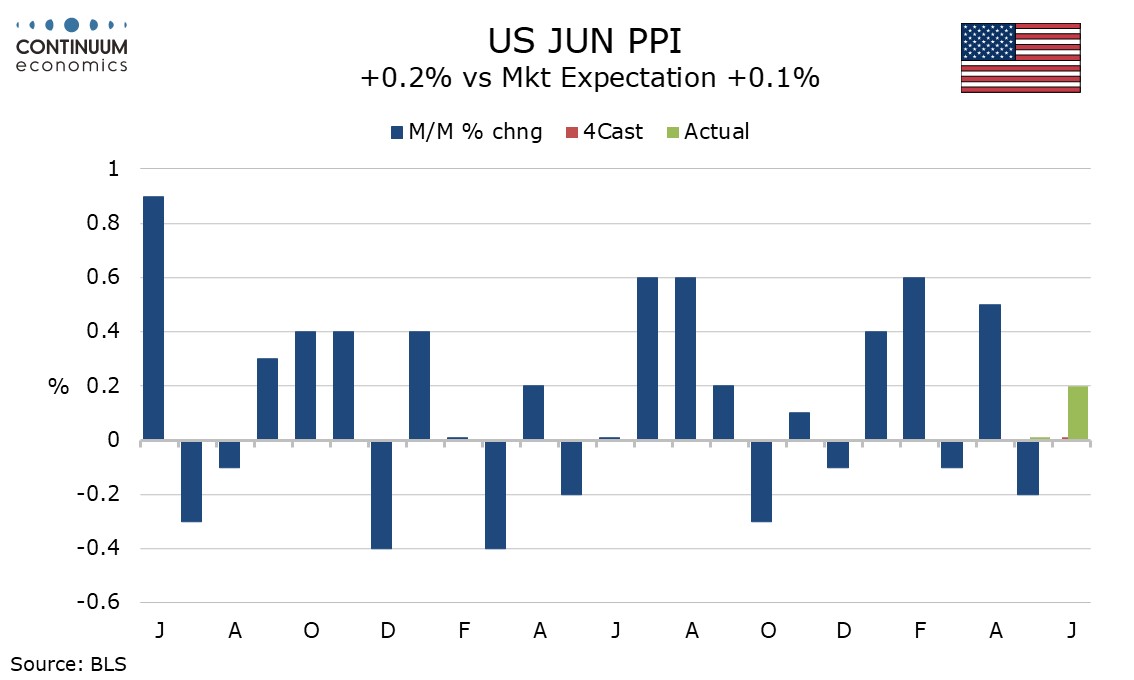

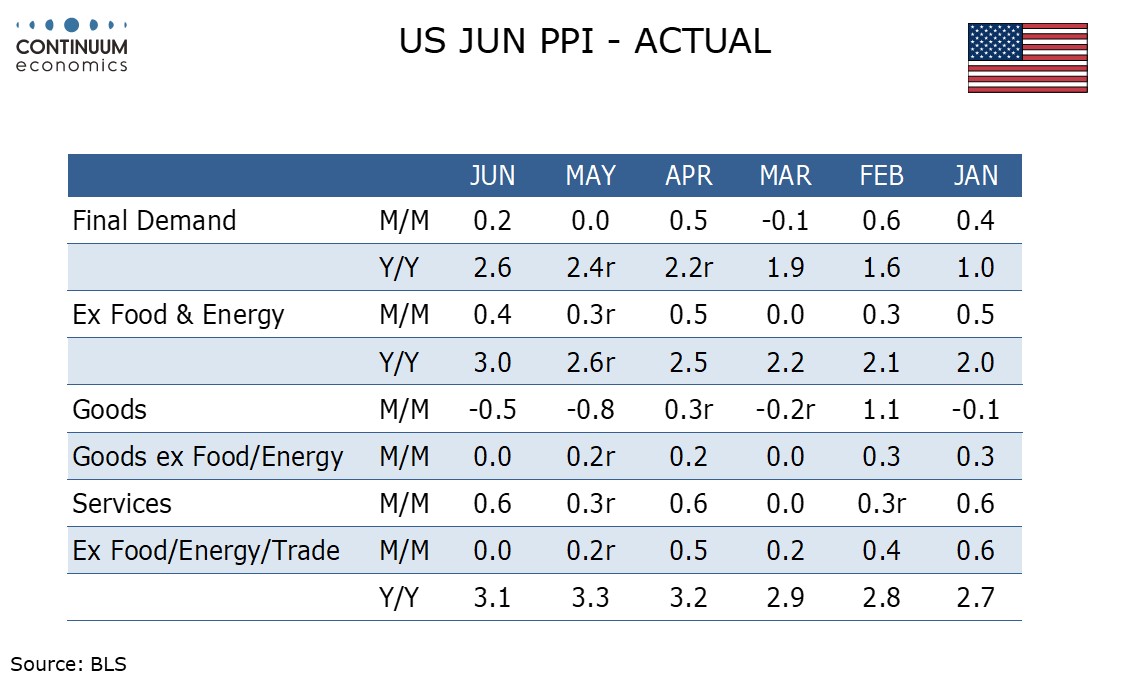

June PPI provided mixed data, with a moderate 0.2% rise overall, a strong 0.4% increase ex food and energy but a weak unchanged outcome ex food, energy and trade. Upward revisions to May, overall to unchanged from -0.2%, ex food and energy to a 0.3% increase from unchanged and ex food, energy and trade to a 0.2% increase from unchanged make the net data stronger than expected.

Energy saw a second straight decline though by 2.6% less steep than May’s 4.6% drop, while food edged lower by 0.3% after a flat May. Goods ex food and energy were unchanged after two straight 0.2% increases but services rose by 0.6%.

The service gains came largely on a 1.9% rise in trade that may reflect profit margins for retailers as energy prices slipped. Transportation and warehousing fell by 0.4% and other services rose by a modest 0.1%.

The service gains came largely on a 1.9% rise in trade that may reflect profit margins for retailers as energy prices slipped. Transportation and warehousing fell by 0.4% and other services rose by a modest 0.1%.

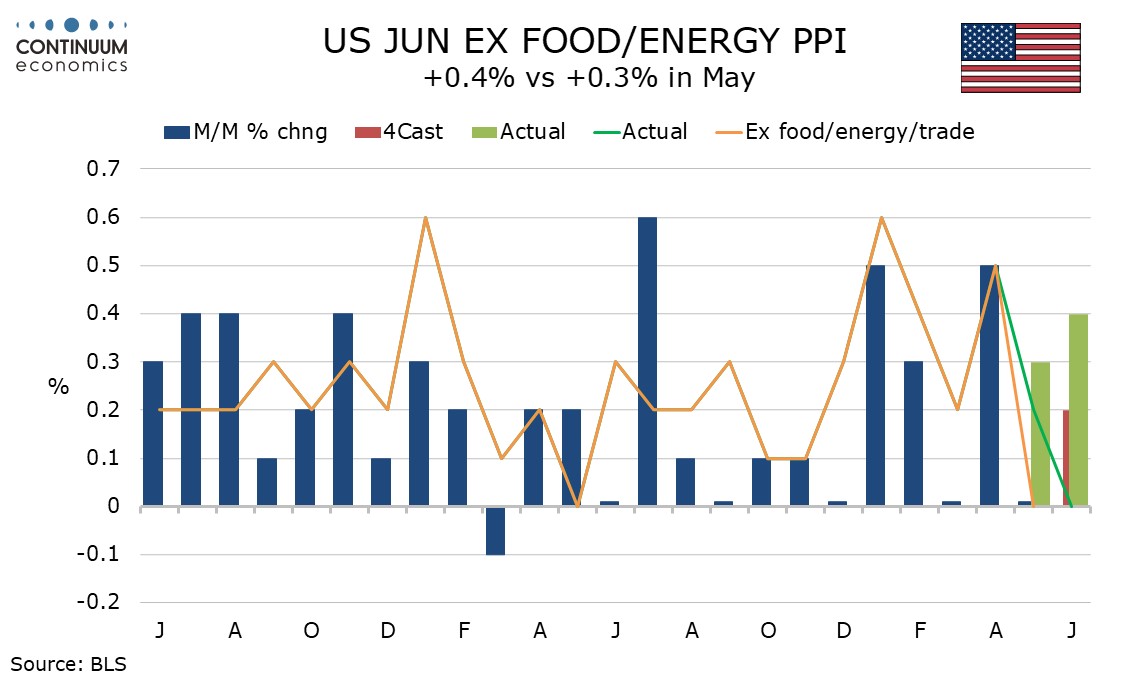

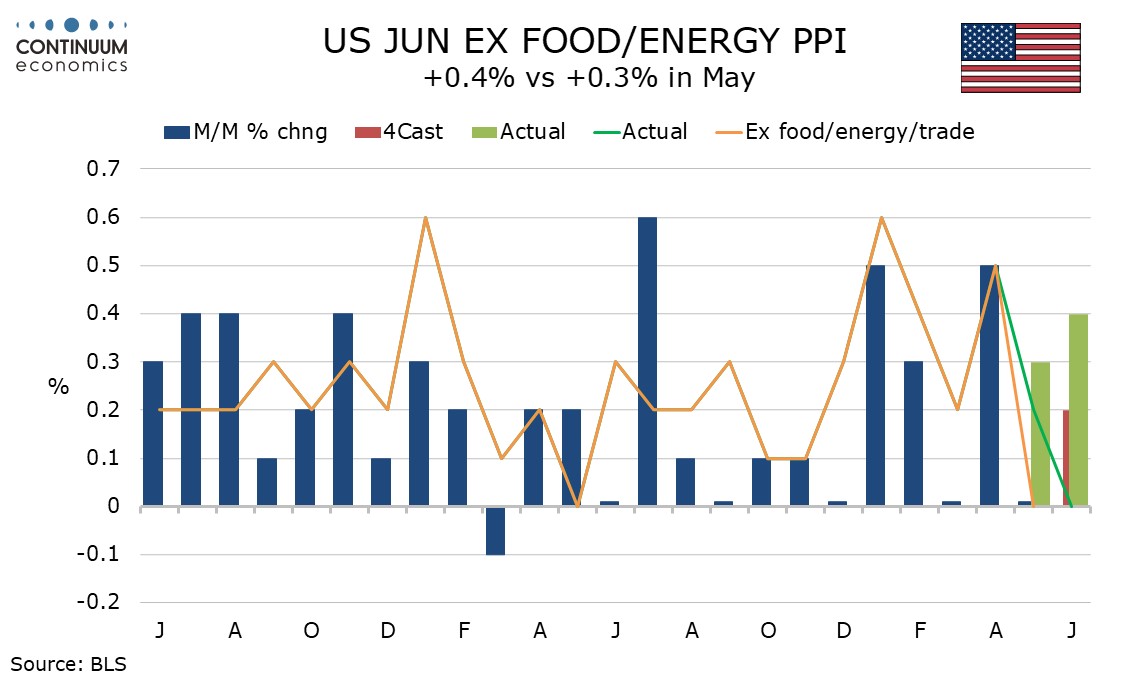

Ex food, energy and trade PPI has shown two straight subdued months with the flat June outcome the softest since May 2023 but in 2023 to date we have seen three strong months of 0.4% or more and three subdued months of 0.2% or less. For ex food and energy PPI only one month in 2023 (a flat March) has come in less than 0.3%.

Ex food, energy and trade PPI has shown two straight subdued months with the flat June outcome the softest since May 2023 but in 2023 to date we have seen three strong months of 0.4% or more and three subdued months of 0.2% or less. For ex food and energy PPI only one month in 2023 (a flat March) has come in less than 0.3%.

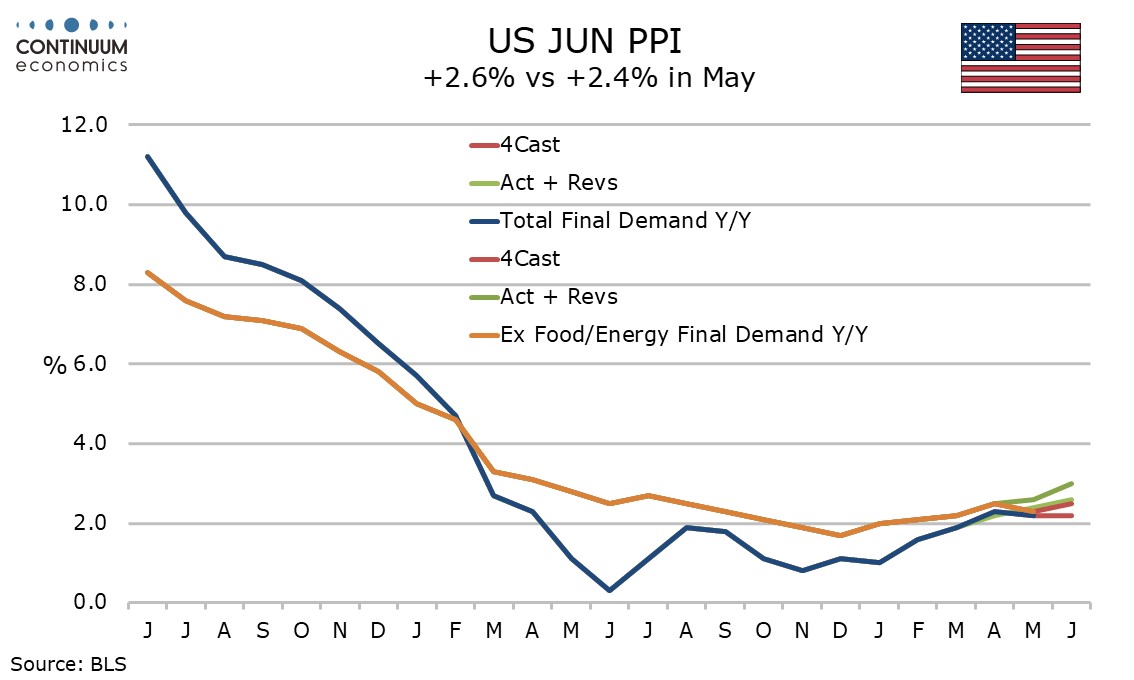

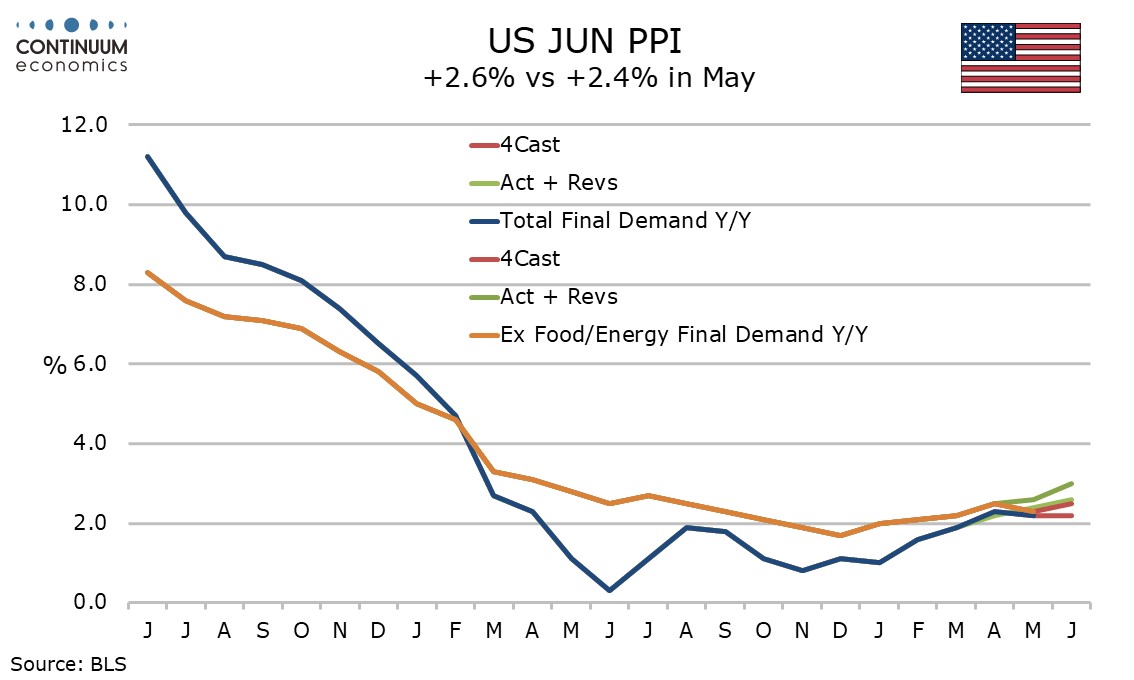

The data in the year to date is not giving a clear picture of subdued underlying inflation. Yr/yr growth accelerated overall to 2.6% from 2.4% and the ex food and energy yr/yr pace of 3.0% from 2.6% is the highest since April 2023. The ex food, energy and trade yr/yr pace slipped to 3.1% from 3.3%, but remains above the ex food and energy pace.

The data in the year to date is not giving a clear picture of subdued underlying inflation. Yr/yr growth accelerated overall to 2.6% from 2.4% and the ex food and energy yr/yr pace of 3.0% from 2.6% is the highest since April 2023. The ex food, energy and trade yr/yr pace slipped to 3.1% from 3.3%, but remains above the ex food and energy pace.

Intermediate data was on balance subdued, processed goods at -0.2% and -0.1% ex food and energy. And while unprocessed goods rose by 1.4% on energy ex food and energy a 0.4% decline was seen. Intermediate services rose by a modest 0.2%.

Intermediate data was on balance subdued, processed goods at -0.2% and -0.1% ex food and energy. And while unprocessed goods rose by 1.4% on energy ex food and energy a 0.4% decline was seen. Intermediate services rose by a modest 0.2%.