U.S. March JOLTS report weaker, as is April ISM Manufacturing, but Prices Paid rise

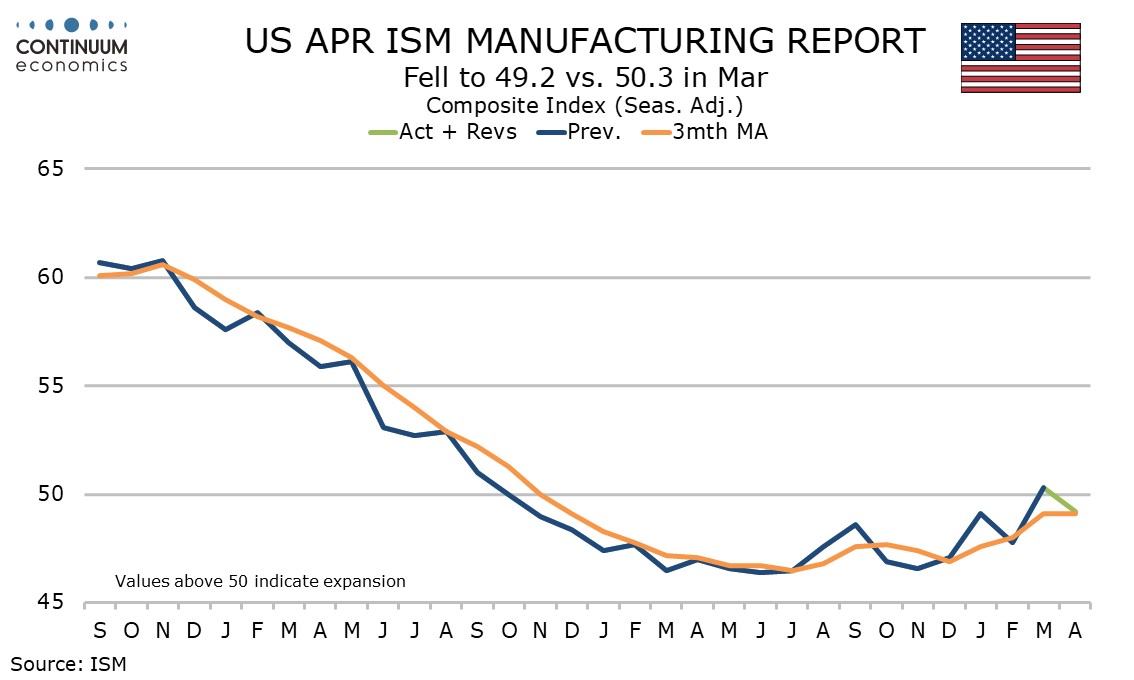

March’s JOLTS report has seen a sharp decline in job openings, to 8488k from 8813k (the latter a modest upward revision from 8756k). This with a slightly slower ISM manufacturing index if 49.2 from 50.3, hints at slowing activity in early Q2, though ISM prices paid at 60.9 from 55.8 are worryingly strong.

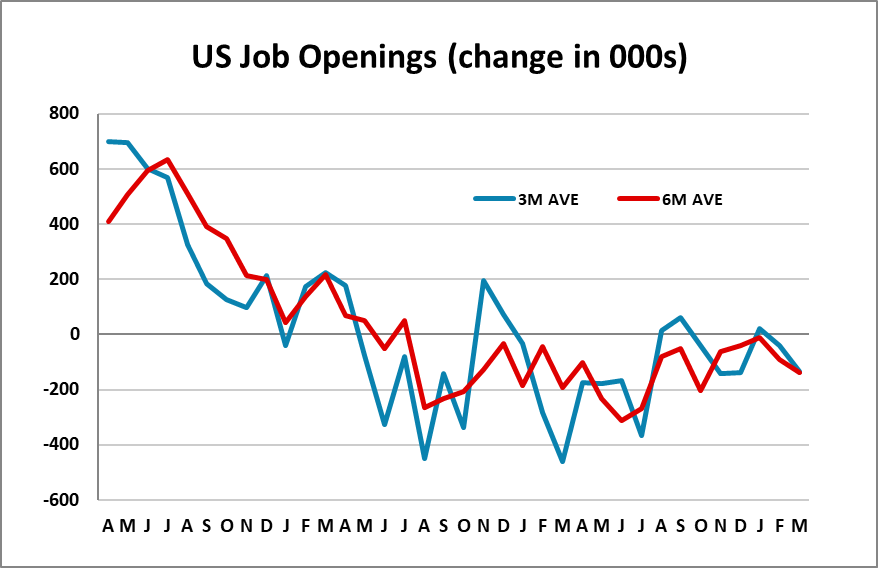

The 325k decline in March job openings corrects a revised 65k increase in February, and the average of the two is similar to a 141k decline in January, as well as the 3-month and 6-month averages of -133.7k and -136.5k respectively. The labor market appears to be losing little momentum, but not sharply.

Labor turnover generally slowed in March, with hirings down by 281k, separations down by 339k with 198k of that coming from fewer quits, all of these series more than fully reversing modest February gains. Fewer quits is a sign of decreasing confidence in the labor market.

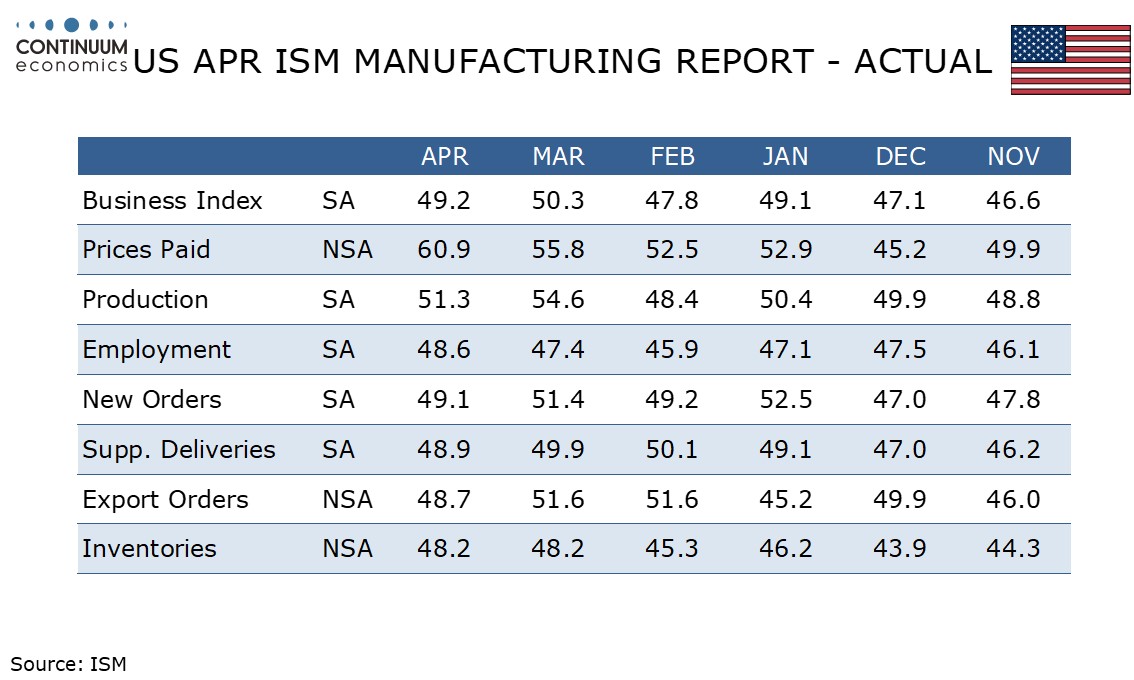

The ISM manufacturing index failed to sustain March’s move above neutral but is still stronger than any reading between November 2022 and February 2024. New orders at 49.1 from 51.4 also moved back below neutral while production slipped to 51.3 from 54.6. Deliveries at 48.9 from 49.9 also slipped but inventories were unchanged at 48.2. Employment was the only component of the composite to increase, to 48.6 from 47.4.

Prices paid do not contribute to the composite but the index in reaching its highest since June 2022 is firm enough to cause concern, and the tone of the index has changed significantly from a run of sub-50 readings running from May through December of 2023.