USD/JPY flows: JPY Rebound in 2026?

USD/JPY has scope to 140 by end 2026.

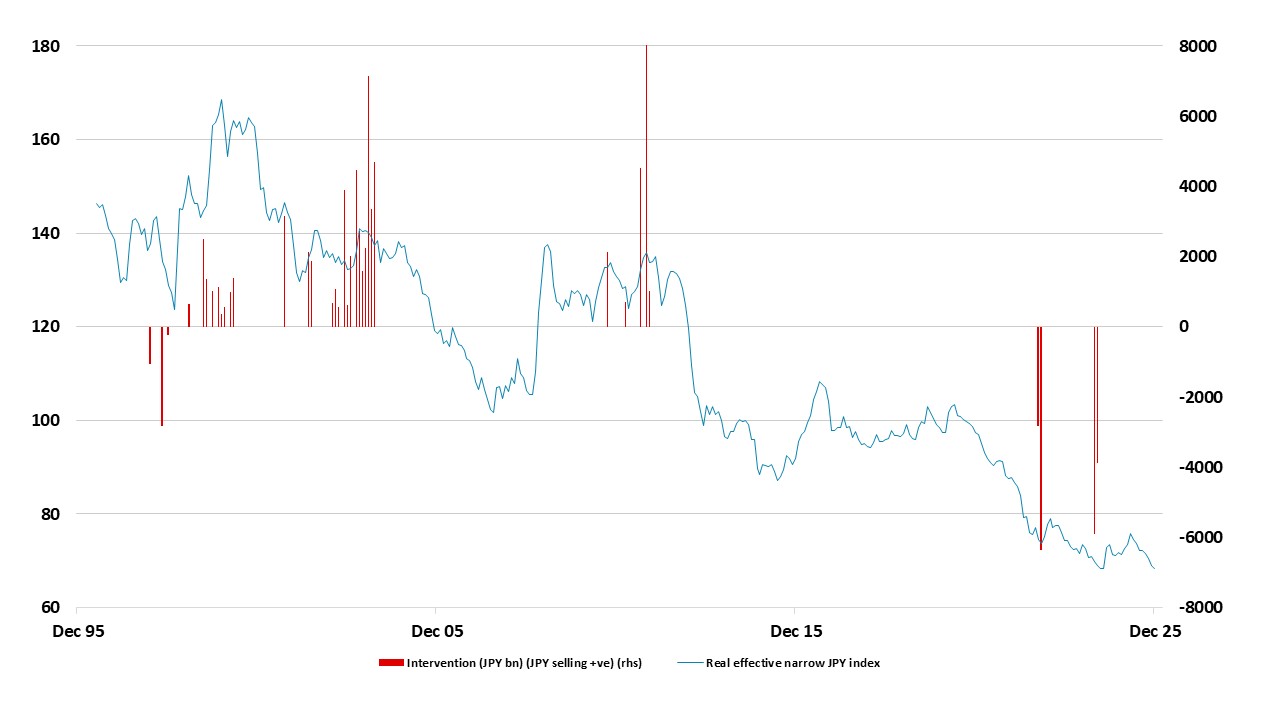

Q4 saw the JPY weaken significantly with the election of Takaichi as the LDP leader and Prime Minister being the trigger. There were some concerns expressed about the potential for Takaichi to follow “Abenomics” – involving both easier fiscal and monetary policy. However, while Takaichi has passed an expansionary budget, it is not substantially different from previous budgets, and more importantly, monetary policy and QT is still being left to the BoJ. Typically, expansionary fiscal policy is currency positive if accompanied by independent monetary policy because it will normally lead to higher yields than would otherwise have been the case, and all the indications are that the BoJ will continue on its tightening cycle provided that the economy shows the expected nominal growth. JGB yields have moved significantly higher in recent months, and the historic relationship between yield spreads and USD/JPY suggests USD/JPY should already be a lot lower (Figure 1).

Figure 1: USD/JPY and 10 year yield spread

Source: Datastream, CE

However, the relationship between USD/JPY and yield spreads appears to have broken down for now, although history and theory suggests this will not last indefinitely. There has also been a strong historic relationship between equity risk premia and the JPY, which, though less theoretically sound, has held up better in recent months. This suggests that we will need to see a turn lower in equities or, more precisely, a turn higher in equity risk premia for the JPY to turn. Bigger picture, we would expect USD/JPY to move closer to long term fair value in the next couple of years. Purchasing Power Parity for USD/JPY is below 100, but as long as real yields in the U.S. are relatively high the USD can be expected to trade well above that. Even so, with JGB yields likely to rise significantly in the coming years, we would expect to see USD/JPY close to 130 by the end of 2027. Very rapid JPY gains may be seen in the event of a sharp U.S. equity correction.

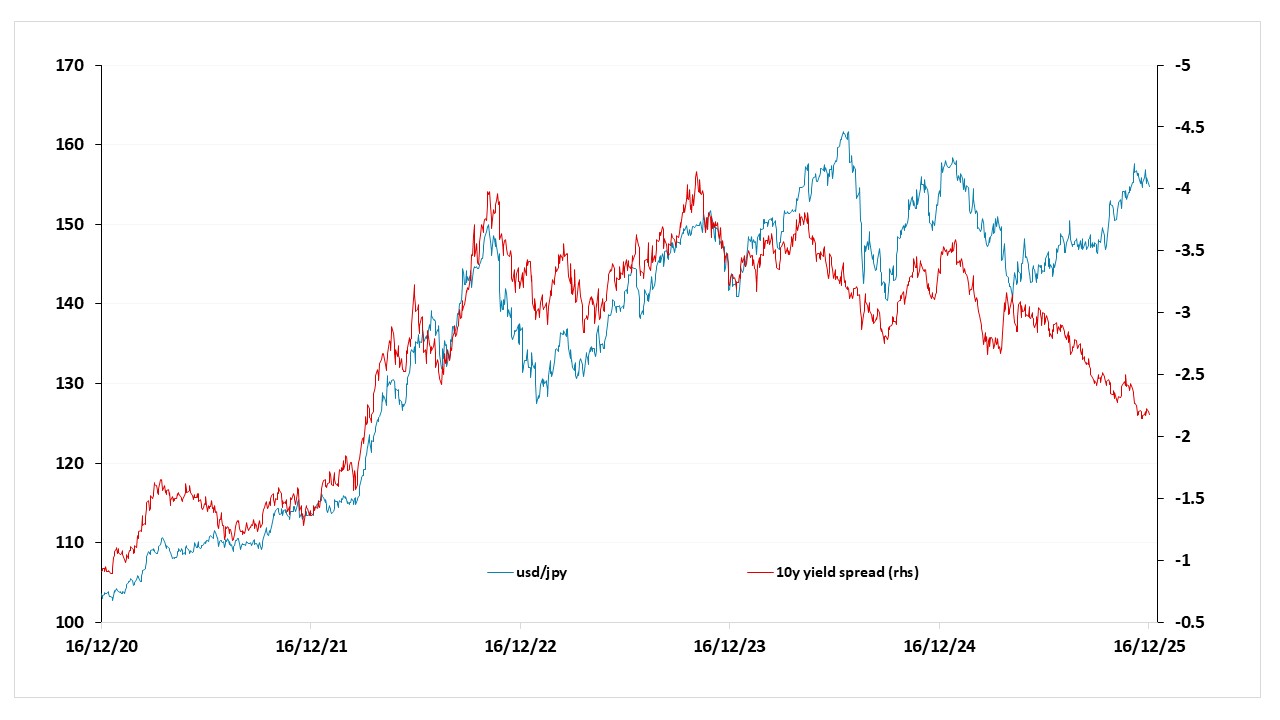

If we don’t see a significant U.S. equity correction the downward pressure on the JPY may persist near term. Trends can be powerful in the FX market, and the JPY downtrend has been persistent in the last few years. Many who have profited form the JPY’s decline will be reluctant to give up on the downtrend. However, there is an extra prop for the JPY at current levels in the form of potential FX intervention. The new Japanese government have verbally protested recent JPY weakness, and the level of the JPY is so weak that intervention to support it would be seen as acceptable. The previous government intervened close to current levels in terms of the real effective JPY, so if we see the JPY threatening new lows, we would expect to see actual FX intervention as we did in 2022 and 2024. Japanese intervention has been historically very effective in marking the long term tops and bottoms for the JPY, so with the JPY so close to all time lows in real terms and the Japanese authorities poised to intervene, it looks dangerous to position for further JPY weakness.

Figure 2: Japanese intervention and real JPY effective exchange rate

Source: Datastream, CE