Published: 2024-12-16T14:13:05.000Z

Preview: Due December 17 - U.S. November Industrial Production - Rebounding from hurricanes and Boeing strike

1

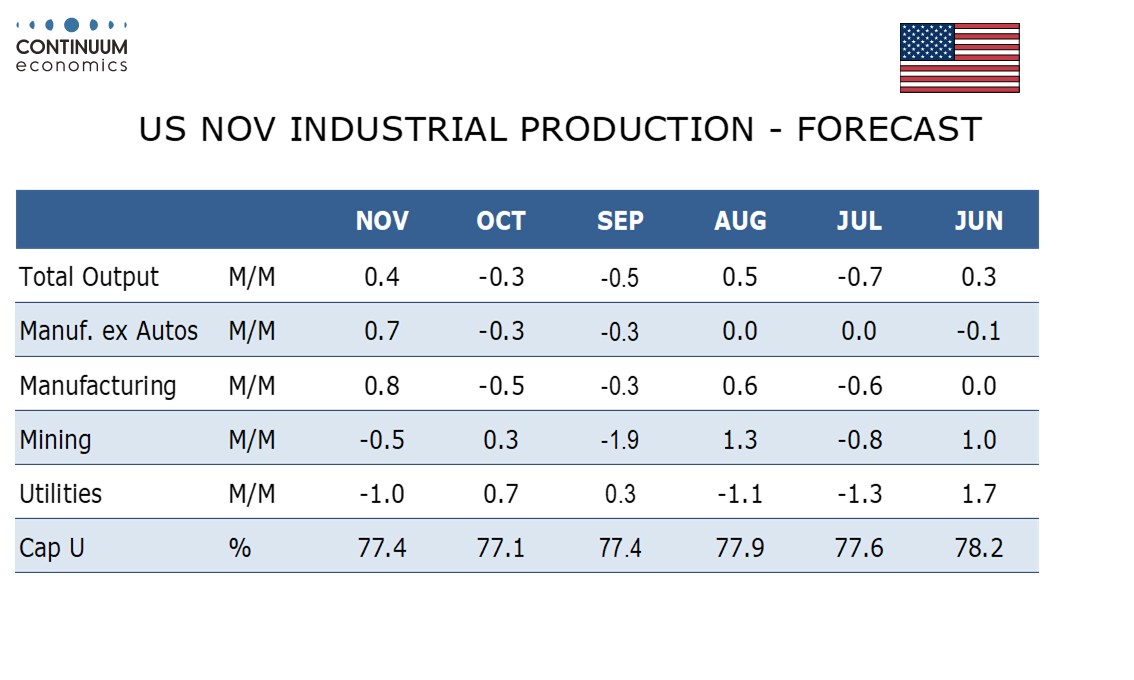

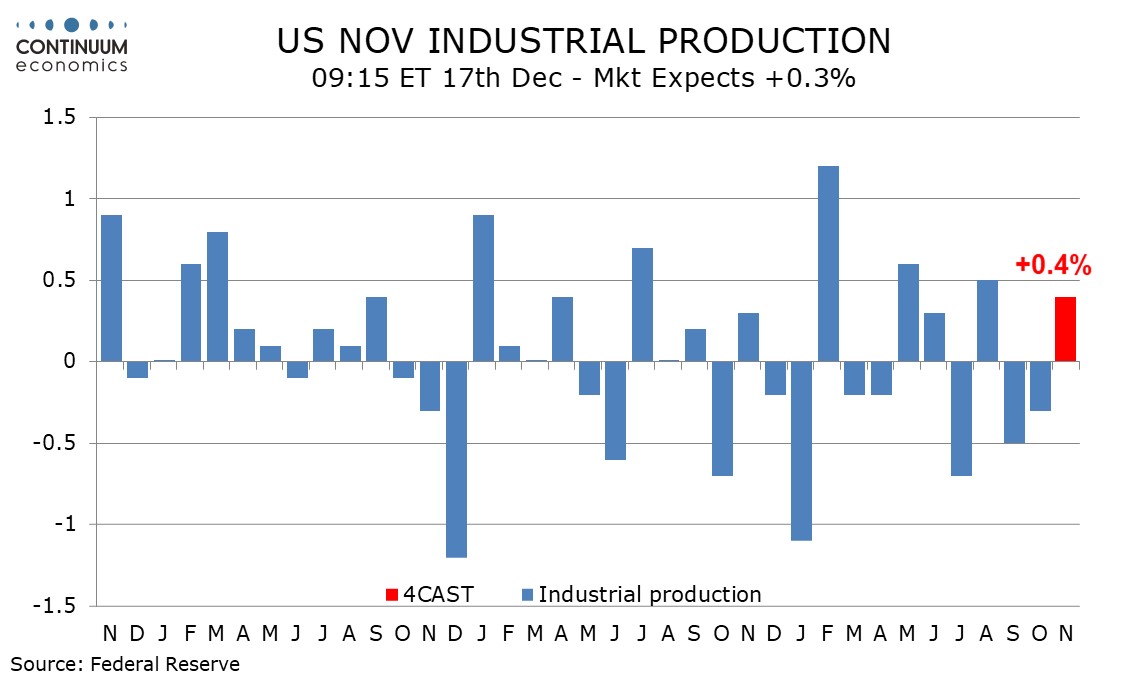

We expect a 0.4% rise in November industrial production with a 0.8% increase in manufacturing, the former partially and the latter fully reversing declines in September and October that were attributed to hurricanes and a strike at Boeing.

Hurricanes took 0.3% off output in September and a further 0.1% in October. A strike at Boeing took 0.3% off output in September and 0.2% more off in October.

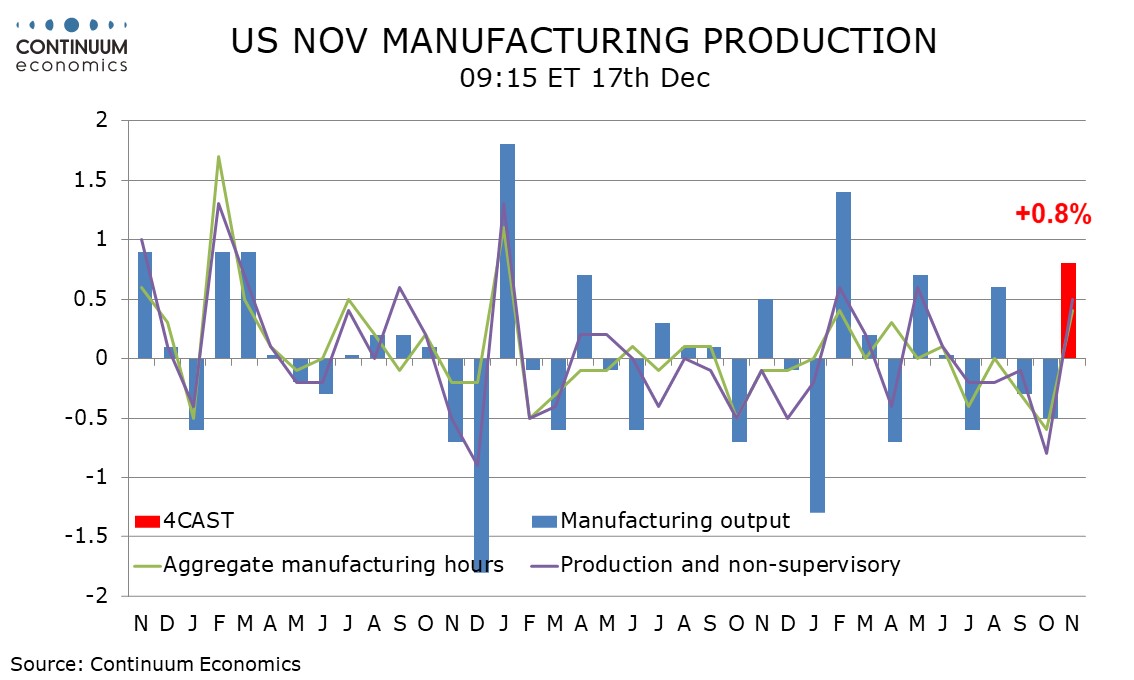

We expect quite a strong bounce in manufacturing of 0.8%, after declines of 0.5% in October and 0.3% in September, with a 0.7% rise ex autos, after declines of 0.3% in both September and October. Aggregate manufacturing hours worked bounced in October’s non-farm payroll, though employment did not fully erase its October decline.

Non-farm payroll aggregate hours data however suggests slippage in mining, while weekly electrical output data suggests slippage in utilities. We expect capacity utilization to rise to 77.4% overall from 77.1%, and to 76.7% from 76.2% in manufacturing, both reversing their October declines but remaining below August levels.