Published: 2024-06-05T12:52:42.000Z

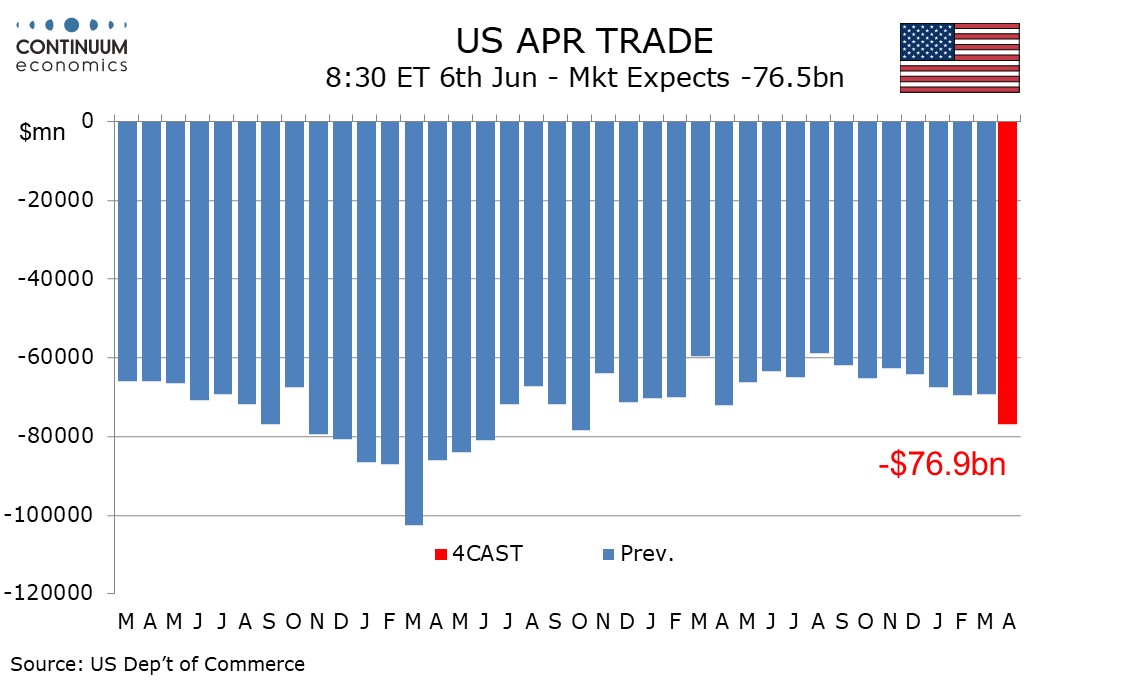

Preview: Due June 6 - U.S. April Trade Balance - Highest deficit since October 2022

3

We expect April’s trade deficit to rise to $76.9bn from $69.4bn, resuming a deteriorating trend after a pause in March and bringing the widest deficit since October 2022.

We expect goods to show exports up by 0.5% after a 2.9% March decline and imports up by 3.1% after a 1.6% March decline, consistent with advance goods data already released.

We also expect a modest deterioration in the services surplus after an increase in March, with exports rising by 0.5% after a 0.2% March decline and imports rising by 1.1% after a 1.7% March decline.

Overall we expect exports to rise by 0.9% and imports to rise by 2.7%, both series resuming growth after slippage in March corrected above trend gains exceeding 2.0% in February.