EUR flows: German data less weak than it looks

EUR/USD slightly softer after German orders and retail sales data, but underlying trends are better than headlines suggest

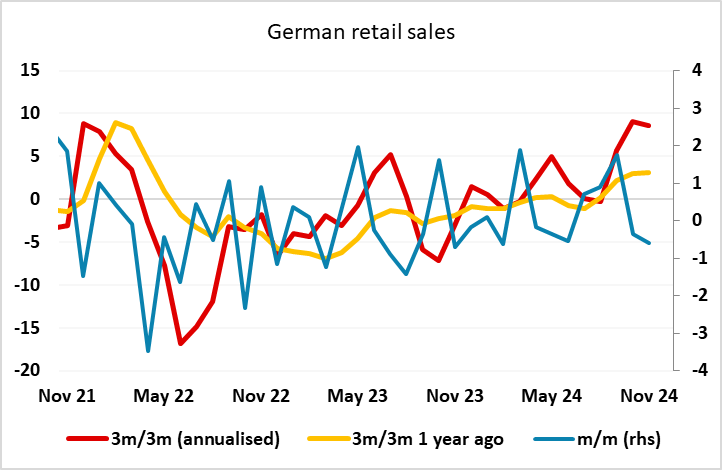

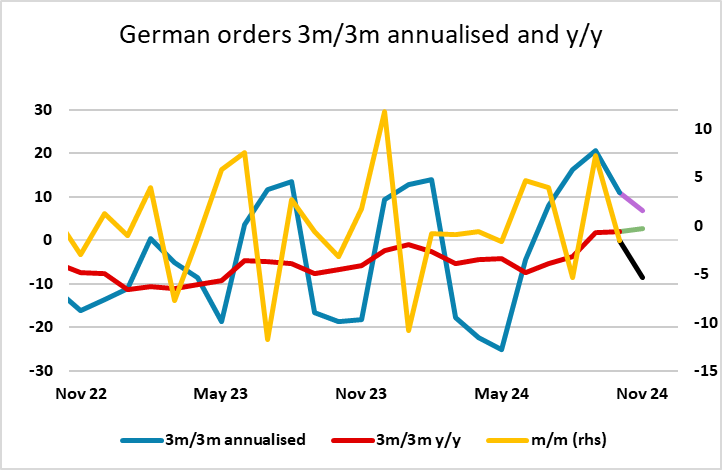

The German data out this morning is, on the face of it, on the weak side, with a big 5.4% m/m decline in factory orders and a 0.6% decline in retail sales in November. But these are very volatile series, and the underlying trends are still showing modest improvement, with revisions also helping the retail sales data.

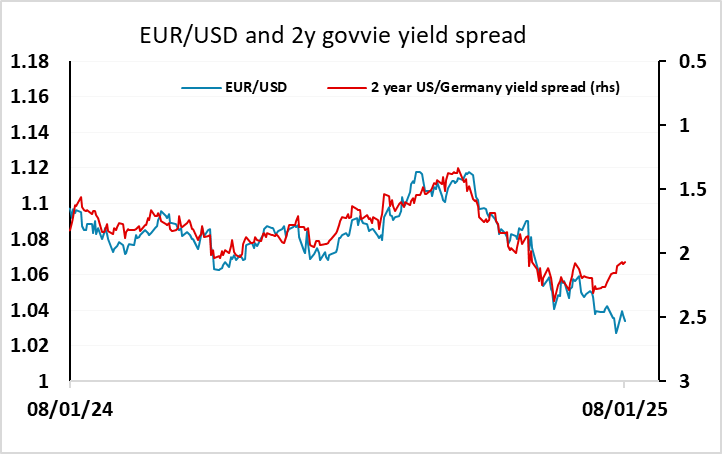

We would therefore not see the numbers as reasons to be negative on the EUR, although the headline weakness in the m/m data may mean the market takes a mildly EUR negative view this morning. We have initially seen a drop of around 10 pips in EUR/USD, but with yield spreads still looking supportive based on recent correlations, we wouldn’t see the downside below 1.03 being threatened ahead of the US ADP employment and jobless claims data later. There is also the EU Commission survey data due at 10GMT, but we doubt this will have any notable impact.